Credit Cards: The Trillion-Dollar Debt

"Money often costs too much."

—Ralph Waldo Emerson

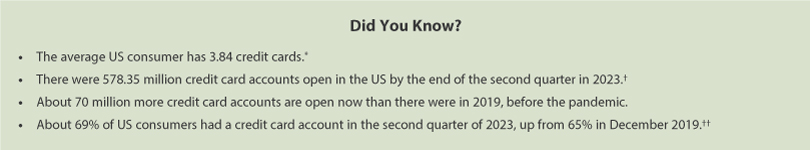

"Highest Credit Card Debt in History" was US headline news in early August 2023. This is quite a change from credit card debt during the pandemic, when reduced consumer spending led to a large drop in average credit card balances.1 After reaching an all-time high and exceeding $1 trillion in the second quarter of 2023, credit card debt and usage moved into the spotlight.

What's behind this rise in credit card debt to a trillion dollars? Everyone knows that debt is money owed in exchange for loans or for goods or services purchased with credit. But understanding credit card debt requires some knowledge of the history, purpose, and function of credit cards.

The Evolution of Credit Cards

The Diners Club card was invented by businessmen in 1950 and was the first modern-day credit card. It allowed people to charge meals in local restaurants and then pay the full balance due at the end of a month. This evolved into banks issuing cards with revolving credit: In 1958, Bank of America launched its first credit card, which became Visa in 1976.2

Today there are four major companies that issue credit cards—Visa, Mastercard, American Express, and Discover—as well as countless smaller issuers. Many consumers consider credit cards a necessity! They are a convenient way to purchase goods and services without carrying cash or writing a check, and sometimes you're required to use one. For example, car rentals may not rent a vehicle without a credit card.

SOURCE: *Lembo-Stolba, Stefan. "What Is the Average Number of Credit Cards per US Consumer?" Experian, April 8, 2021; https://www.experian.com/blogs/ask-experian/average-number-of-credit-cards-a-person-has/. †Federal Reserve Bank of New York. "Total Household Debt Reaches $17.06 Trillion in Q2 2023; Credit Card Debt Exceeds $1 Trillion." Press Release, August 08, 2023; https://www.newyorkfed.org/newsevents/news/research/2023/20230808. ††Haughwout, Andrew; Lee, Donghoon; Mangrum, Daniel; Scally, Joelle and van der Klaauw, Wilbert. "Credit Card Markets Head Back to Normal after Pandemic Pause." Federal Reserve Bank of New York Liberty Street Economics, August 8, 2023; https://libertystreeteconomics.newyorkfed.org/2023/08/credit-card-markets-head-back-to-normal-after-pandemic-pause/.

How Typical Credit Cards Work

Credit card issuers use information from credit reports—and the credit scores they generate—to make most decisions about issuing credit cards and setting interest rates on accounts. A credit report includes a consumer's credit history, and a credit score is calculated based on information in the credit report.

A credit card is an unsecured loan and does not require collateral. From a card issuer's perspective, an unsecured loan is quite risky and has a high possibility of not being repaid. Therefore, interest rates on credit cards are often high overall. Generally, credit card applicants with higher credit scores are more likely to get a lower interest rate or annual percentage rate (APR), while applicants with lower credit scores will get higher interest rates because of the higher risk in lending them money.

A credit card offers revolving credit, usually designed for repeated use, with a preapproved credit limit. A card issuer determines the credit limit for an account using an applicant's credit report information and income. The amount of available credit decreases and increases as consumers borrow and then repay funds, oftentimes with interest.

Credit cardholders receive monthly statements from a credit card issuer. A statement includes a list of purchases made during that monthly billing cycle, the balance owed, the due date, and the minimum payment required—the lowest amount due each billing cycle. The card issuer calculates a minimum payment as a percentage of an account's total balance and any past due amounts owed.

When a credit cardholder carries a balance, paying only the minimum amount by a due date, the card issuer will charge interest on the remaining balance. Making minimum payments means a cardholder will take longer to pay off the balance and will be charged more interest in the long run.

If a cardholder does not make a payment by a due date, the card issuer will charge a late fee and add it to the balance on the card. If a cardholder pays less than the minimum amount due, the card issuer will treat it as a missed payment and report it to credit bureaus. Missing payments will negatively affect a cardholder's credit history and credit score.

Credit card issuers will not charge interest or late fees if a cardholder pays the statement's full balance each billing cycle by the due date. Paying a balance in full each month positively affects a cardholder's credit history and credit score.

The Lowdown on Credit Card Debt

With credit card balances having reached a record high in 2023 (Figure 1), a question arises: What are some contributing factors for this upward trend? A survey in early 2023 showed that 41% of cardholders owed credit card debt during 2022, and 72% of this group had added debt during 2022. Of those who added debt, 48% identified inflation and inflation rates (Figure 2) as the cause, while 34% blamed higher interest rates (Figure 3). The remaining 24% stated income as the primary reason.3 The combination of these components increases the possibility that consumers will have difficulty paying balances due and accumulate more debt.

Figure 1

Credit Card Balances

SOURCE: Federal Reserve Bank of Philadelphia via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1b5Db, accessed October 11, 2023.

Figure 2

US Inflation Rates

SOURCE: World Bank via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1b5Do, accessed October 11, 2023.

Figure 3

Interest Rates on Credit Card Accounts

SOURCE: Board of Governors of the Federal Reserve System via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1b5DI, accessed October 11, 2023.

Interest or Annual Percentage Rates

Most credit card issuers don't offer just one interest rate, or APR, to everyone. Issuers offer a range of possible rates based on an applicant's credit risk and credit score. Those with higher credit scores tend to be offered lower interest rates, but this is not guaranteed when opening a new credit card account. At the end of the third quarter in 2023, the average APR for all accounts was 21.19%, but the average APR for new credit card accounts was 24.45%.4

There are also different interest rates for different categories in a credit card account, which include the following:

- An introductory APR may be offered to new applicants. This is an incentive that card issuers offer; it may be a very low or 0% APR for a certain amount of time.

- A purchase APR is the interest on purchases made with the card.

- A cash advance APR may be charged when the card is used at an ATM.

- A balance transfer APR is charged on balances transferred from another card and is usually lower for a certain amount of time.

- A penalty APR is applied when a consumer misses a credit card payment.

Regardless of which APR applies, it will affect the amount of credit card debt. And APR rates tend to be variable, which means they can change over time. When consumers use credit cards to pay expenses and pay off their balances in full each month, the APR is not an issue: They do not pay any interest at all. For consumers who don't pay the full balance or pay just the minimum amount, the APR is very significant. And it is very costly when consumers miss their payments, as it adds to the national credit card debt: From a low in the second quarter of 2021, the share of all credit card accounts 30 or more days past due has trended upward (Figure 4).

Figure 4

Share of All Credit Card Accounts 30+ Days Past Due

SOURCE: Federal Reserve Bank of Philadelphia via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1b5C3, accessed October 11, 2023.

Rights and Responsibilities of Cardholders

Over the years, credit card laws have given consumers some protection. For example:

- The Fair Credit Reporting Act of 1970 governs how credit information is used and gives consumers the right to know what's in their credit reports.5

- The Equal Credit Opportunity Act of 1974 made it illegal for credit card companies to discriminate based on race and gender.

- The Fair Credit Billing Act, also passed in 1974, allows consumers to dispute unauthorized charges on their bills.

- The FICO score was introduced by the Fair Isaac Corporation in 1989 as a tool to help assess whether card applicants were creditworthy.6

- The Credit Card Accountability Responsibility and Disclosure Act (Credit CARD Act) of 2009 was introduced in response to the high fees and penalties that credit card issuers charged cardholders. This law protects cardholders from deception by card issuers.

These and other consumer protection laws are helpful to credit cardholders. But it is the responsibility of consumers to understand the way credit cards work and the conditions and terms of their credit card account. For example, according to a Forbes Advisor survey from February 2023, 47% of US cardholders reported that they don't know or are unsure about the interest rate on their credit card.7 This oversight can be costly; it's important to read the fine print and information on a monthly statement to manage an account wisely.

Conclusion

The record-high US $1 trillion credit card debt is a result of several factors, including an increasing number of credit card accounts, inflation, increased interest rates, and credit card account management. While most of these factors are out of the control of consumers, credit card account management can be addressed on an individual level: Consumers can choose the types and number of cards they want, how much to spend on each card, and how to manage each of their accounts. Credit card laws add protections, but a consumer has the responsibility to know what's involved in using this type of unsecured loan. It means you must pay a bill every month for all the things you purchased. And it's important to remember that if you don't pay for all the things you bought by the due date on a statement, those things end up costing much more than their original price because of interest and fees.

Notes

1 Dashiell, Steve. "US Credit Card Debt Reaches All-Time High, Exceeds $1 Trillion." Bankrate.com, August 09, 2023; https://www.bankrate.com/finance/credit-cards/credit-card-debt-reaches-all-time-high/.

2 Capital One. "When Were Credit Cards Invented?" August 23, 2023; https://www.capitalone.com/learn-grow/money-management/when-were-credit-cards-invented/.

3 Thangavelu, Poonkulali. "Poll: 72% of Those with Credit Card Debt Have Added To it in the Last Year." CreditCards.com, January 23, 2023; https://www.creditcards.com/statistics/credit-card-debt-increase-poll/.

4 Schulz, Matt. "Average Credit Card Interest Rate in America Today." LendingTree.com, October 6, 2023; https://www.lendingtree.com/credit-cards/average-credit-card-interest-rate-in-america/.

5 Johnston, Joey. "Fair Credit Reporting Act: Common Violations and Your Rights." InCharge Debt Solutions, May 19, 2022; https://www.incharge.org/debt-relief/credit-counseling/credit-score-and-credit-report/fair-credit-reporting-act/.

6 Capital One. "When Were Credit Cards Invented?" August 23, 2023; https://www.capitalone.com/learn-grow/money-management/when-were-credit-cards-invented/.

7 Pokora, Becky. "Credit Card Statistics and Trends 2023." Forbes, March 9, 2023; https://www.forbes.com/advisor/credit-cards/credit-card-statistics/.

© 2023, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Annual percentage rate (APR): The percentage cost of credit on an annual basis and the total cost of credit to the consumer. APR combines the interest paid over the life of the loan and all fees that are paid up front.

Collateral: Property required by a lender and offered by a borrower as a guarantee of payment on a loan. Also, a borrower's savings, investments, or the value of the asset purchased that can be seized if the borrower fails to repay a debt.

Credit: The granting of money or something else of value in exchange for a promise of future repayment

Credit card: Cards that represent an agreement between a lender (the institution issuing the card) and the cardholder. Credit cards may be used repeatedly to buy products or services or to borrow money on credit. Credit cards are issued by banks, savings and loan associations, retail stores, and other businesses.

Credit card balance: The amount of outstanding debt on a credit card.

Inflation: A general, sustained upward movement of prices for goods and services in an economy.

Inflation rate: The percentage increase in the average price level of goods and services over a period of time.

Interest: The price of using someone else's money. When people place their money in a bank, the bank uses the money to make loans to others. In return, the bank pays interest to the account holder. Those who borrow from banks or other organizations pay interest for the use of the money borrowed.

Interest rate: The percentage of the amount of a loan that is charged for a loan.

Revolving credit: A line of available credit that is usually designed to be used repeatedly, with a preapproved credit limit. The amount of available credit decreases and increases as funds are borrowed and then repaid with interest.

Unsecured loan: A loan not backed with collateral.

follow @stlouisfed

follow @stlouisfed