What Is the Best Strategy for Paying Off Credit Card Debt?

"Millions of people get financial advice from non-economists."

—James J. Choi1

Consumers use credit cards all the time. It's very common to pay for large and small items using credit. According to one survey, approximately 83% of adults in the United States have at least one credit card.2

Because credit card debt is considered an unsecured loan, a loan not backed by collateral, the interest rate charged on unpaid credit card balances is very high. In 2022, the average credit card had an interest rate, or annual percentage rate (APR), of more than 18%!3 So, if you had $10,000 in credit card debt at an 18% interest rate and paid $200 toward the balance every month, you'd take more than seven years to pay it off, and you'd pay more than $8,000 in interest alone!

Consumers are wary to accrue credit card debt because the interest penalty is so high. In fact, in one survey, 75% of Americans said they would not make a major purchase on their credit card unless they could pay it off immediately.4

Even though most consumers say they try to avoid carrying a balance on a credit card, they commonly do carry a balance. The Federal Reserve Bank of Boston estimates that 65% of cardholders carry a balance on their credit cards.5 And a large subset of these borrowers have credit card debt on two or more credit cards with balances. The figure shows the average amount of outstanding consumer loans held by American households.

Inflation-Adjusted Dollar Amount of Credit Card Consumer Loans per Household

SOURCE: Board of Governors of the Federal Reserve System, Bureau of Labor Statistics, and U.S. Census via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=XCoe, accessed December 13, 2022.

Credit Card Debt Happens: How Do I Pay it Off?

Even though many people say they try to avoid credit card debt, they nevertheless end up having it. So what's the best strategy for paying it off? People tend to disagree on the best way to chip away at that debt. For simplicity, we can divide the recommended strategies for paying off debt into two camps: one that economic theory recommends and one that personal finance gurus recommend.6

Let's explore the costs and benefits of these different strategies using the following concrete example:

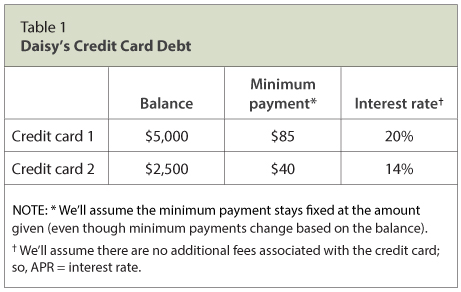

Daisy has two credit cards with details listed in Table 1.

Let's say Daisy wants to pay off this credit card debt and she's adjusted her budget so that she'll have $200 per month to apply to her debt. What's the best way to pay off these balances? The following are three options:

• Option 1: Pay off the credit card with the smaller balance first and then tackle the credit card with the larger balance.

In this scenario, Daisy would pay her credit card minimum payment, $85, toward card 1 each month and pay $115 toward card 2, the one with the smaller balance. Once Daisy has paid off everything owed on card 2, she would switch to using all $200 to pay off the remaining balance of card 1.

• Option 2: Pay off the credit card with the higher interest rate first and then tackle the credit card with the lower interest rate.

In this scenario, Daisy would pay the minimum payment, $40, toward card 2 each month and pay $160 toward card 1, the one with the higher interest rate. Once she has paid off everything owed on card 1, she would switch to using all $200 to pay off the remaining balance on card 2.

• Option 3: Split the allotted budget of $200 proportionally between the two cards according to the amount of debt on each card.

In this scenario, Daisy would pay roughly $133 toward card 1, the card with the bigger balance, and pay $67 toward card 2, the one with the smaller balance, each month until one of them is paid off. Then Daisy would pay the full $200 to the remaining card until that card is also paid off.

Take a minute to think about which option seems appealing to you and why.

Evaluating the Options

Which Option Does Economic Theory Recommend?

Economists tend to recommend Option 2: Pay off the credit card with the higher interest rate first.

Why? This strategy leads you to pay off all the debt faster and save money (compared with the other options). By tackling the card with the highest interest rate first, you'll pay off that card as quickly as possible and therefore pay less interest overall.

Table 2 shows that Option 2 results in the least amount of interest paid and helps Daisy become debt free anywhere from one to three months earlier.

Which Option Do Personal Finance Gurus Recommend?

Personal finance gurus tend to recommend Option 1: Pay off the credit card with the smaller balance first.

James Choi, an economist at Yale, reviewed the top 50 personal finance books in the country to see what type of advice they offered on this topic.7 Of the subset of books that covered this topic, roughly half recommended targeting resources toward the credit card with the smaller balance.

Why? This strategy is thought to help build motivation. It's sometimes called the snowball method, and the selling point here is people's perception of progress, which aligns with other research on achieving "quick wins" to keep people motivated.8 By tackling and paying off the smaller balance first, the person in debt will have a sense of accomplishment, or victory, early on. So personal finance gurus think that tackling smaller credit card balances helps build momentum toward the final goal of paying off all the debt.

What Do Most Borrowers with Credit Card Debt Choose?

Perhaps surprisingly, most borrowers choose Option 3: Repay both credit cards at rates roughly equal to the amount of debt on the card.9 In this example, Option 3 saves the borrower more money than Option 1.

Table 2 shows how much time and money all three approaches end up costing using the dollar amounts from the above example.

Conclusion

Who is right? This is where behavioral economics or psychology can come into play. Economic theory can tell us what the quickest, cheapest option is—targeting high-interest debt first regardless of the size of the balance, as you would pay less interest overall. But it's only the best solution if people stick to it. Personal finance gurus think that many people are more likely to succeed in paying off all their debt if they get rid of one credit card debt quickly, even if it means they don't perfectly optimize their choices. Ultimately, the best strategy is the one that helps someone pay off the total debt balance.

Notes

1 Choi, J. "Popular Personal Financial Advice versus the Professors." Journal of Economic Perspectives, 2022, 36(4), pp. 167-92; American Economic Association (aeaweb.org).

2 Economic Well-Being of U.S. Households in 2020 - May 2021 - Banking and Credit, via Board of Governors of the Federal Reserve System (federalreserve.gov).

3 Commercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest (TERMCBCCINTNS), via FRED®, Federal Reserve Bank of St. Louis (stlouisfed.org).

4 Sethi, R. I Will Teach You to Be Rich: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works. Workman Publishing Company, 2019, p. 58.

5 Fulford, S. and Schuh, S. "Consumer Revolving Credit and Debt over the Life Cycle and Business Cycle." Federal Reserve Bank of Boston, Research Department Working Papers, 2015 Series, No. 15-17.

6 Based on the James J. Choi article summarizing personal finance advice given by economic theory versus the most popular personal finance books. (Choi, J. [2022]. See footnote 1.)

7 Choi, J. (2022). See footnote 1.

8 Trudel, R. "Research: The Best Strategy for Paying Off Credit Card Debt." Harvard Business Review, Financing and Investing, 2016.

9 Gathergood, J.; Mahoney, N.; Stewart, N. and Weber, J. "How Do Individuals Repay Their Debt? The Balance-Matching Heuristic." American Economic Review, 2019, 109(3), pp. 844-75.

© 2023, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Annual percentage rate (APR): The percentage cost of credit on an annual basis and the total cost of credit to the consumer. APR combines the interest paid over the life of the loan and all fees that are paid up front.

Behavioral economics: A field in economics that uses insights from psychology and other behavioral sciences to learn how individuals make economic decisions.

Borrower: An individual or business that borrows money from a lender with the expectation that they will pay the money back.

Collateral: Property required by a lender and offered by a borrower as a guarantee of payment on a loan. Also, a borrower's savings, investments, or the value of the asset purchased that can be seized if the borrower fails to repay a debt.

Consumers: People who buy goods and services to satisfy their wants.

Credit: The granting of money or something else of value in exchange for a promise of future repayment.

Credit card: Cards that represent an agreement between a lender (the institution issuing the card) and the cardholder. Credit cards may be used repeatedly to buy products or services or to borrow money on credit. Credit cards are issued by banks, savings and loan associations, retail stores, and other businesses.

Credit card balance: The amount of outstanding debt on a credit card.

Credit card minimum payment: The least amount of money a credit cardholder must pay toward a credit card balance each month to avoid being considered delinquent on their credit card debt. The minimum payment varies by the size of the credit card balance and the interest rate.

Debt: Money owed in exchange for loans or for goods or services purchased with credit.

Interest rate: The percentage of the amount of a loan that is charged for a loan. Also, the percentage paid on a savings account.

Unsecured loan: A loan not backed with collateral.

follow @stlouisfed

follow @stlouisfed