The Role of Credit Scores in the Recent Rise in Credit Card Delinquency

Borrowers who fail to make regular monthly payments on their credit cards become delinquent. And companies routinely use credit scores to predict a borrower's likelihood of delinquency or default. American borrowers maintained unusually low default rates throughout the COVID-19 recession and subsequent recovery likely because of several factors, including forbearance programs, limited spending during lockdowns, and substantial government subsidies. As a result, credit scores increased considerably in 2020 and 2021. Credit card delinquencies, on the other hand, began to rise at the end of 2021. This essay sheds light on the relationship between rising credit scores and subsequent increases in credit card delinquencies.

We use data from the Federal Reserve Bank of New York/Equifax Consumer Credit Panel to compute, for every quarter, the share of the US population 20 to 64 years of age whose credit score was below 600 three years ago but was above 600 one year ago. We refer to this group as "people who have recently improved their credit score." We focus on this group because it allows us to investigate, for example, the delinquency status in 2022 of individuals who improved their credit scores between 2019 and 2021. We next use information from Athreya, Mather, Mustre-del-Río, and Sánchez (2019) to categorize US zip codes based on how frequently households experience financial distress.1 The 20% of the population living in US zip codes with the greatest percentage of credit card delinquency is the group we refer to as the "most financially distressed zip codes." We focus on this sample of zip codes because the authors found that residents in regions of greater financial distress are more adversely affected by economic downturns and react more by reducing their consumption.

Figure 1 shows that the most significant increase in the share of people who have recently improved their credit score occurs between the second quarter of 2021 and the fourth quarter of 2022. Because we're comparing scores from three years ago with those from one year ago, this rise corresponds to people who achieved a score of 600 or higher between the second quarter of 2020 and the fourth quarter of 2021, at the height of the COVID-19 pandemic. Increases occurred during this time period both in the aggregate of all zip codes (blue line) and in zip codes with a greater incidence of financial distress (red line). Figure 1 also shows that this proportion returned to their pre-COVID credit score levels by the second quarter of 2023.

There was a slower but somehow similar increase in the share of people improving their credit after the 2007-09 Great Recession. However, there was no sharp decline after the Great Recession, which may signal that the rise in credit scores then was less exceptional than the rise after the pandemic because of the improvements in labor markets during the recovery from the Great Recession.

Are these two large swings in consumers' credit scores equal? Our hypothesis is that the fast improvement in credit scores during the COVID-19 pandemic was due to exceptional factors (large government interventions and shifts in consumption behavior) and, consequently, individuals with high credit scores in the post-COVID period are not as financially stable as those with the same pattern in credit scores in other periods, including those with improved credit scores after the Great Recession. To test this hypothesis, we compute a measure of credit card delinquency among those who have improved their credit scores and compare it with an aggregate credit card delinquency rate.2 We believe that a clear difference in recent patterns of delinquency rates between these two groups would support our hypothesis.

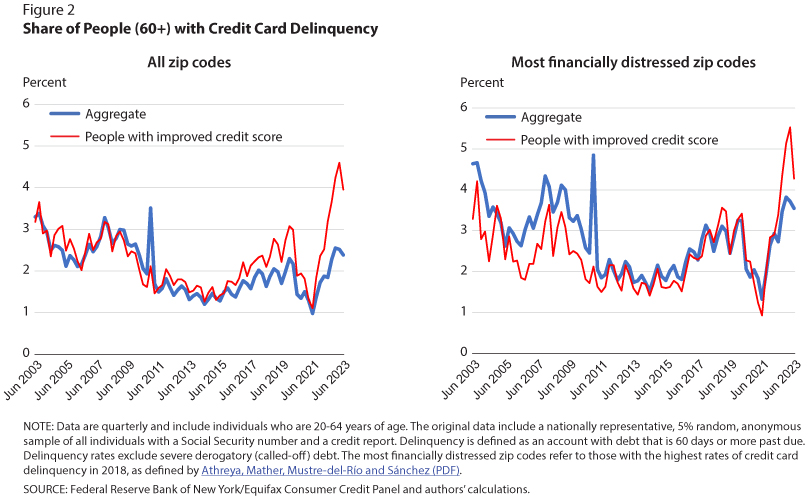

Figure 2 displays the aggregate credit card delinquency rates (blue lines) and delinquency rates for people with improved credit scores (red lines) for all zip codes (left panel) and for zip codes with the highest incidence of financial distress (right panel). Before the COVID-19 pandemic, the patterns for the red and blue lines in both panels are quite similar. However, since the COVID-19 surge, the difference between the two groups has widened and has stayed significantly wider than in the past.

This difference between the two groups, including the high rate of credit card delinquency among those with improved credit scores provides suggestive evidence in favor of our hypothesis that individuals who improved their credit scores during the pandemic are financially different from those who improved their credit scores in the past.

Notes

1 As in their study, we employ the terms financial distress and credit card delinquency interchangeably. See Athreya, Kartik; Mather, Ryan; Mustre-del-Río, José and Sánchez, Juan M. "The Effects of Macroeconomic Shocks: Household Financial Distress Matters." Federal Reserve Bank of St. Louis Working Paper No. 2019-025F, revised September 2022.

2 Our measure of delinquency considers individuals who have debt 60 days or more past due, except for high derogatory debt (more than 120 days past due).

© 2023, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed