Banking Basics

"If you would be wealthy, think of saving as well as getting."

—Benjamin Franklin

"It is thrifty to prepare today for the wants of tomorrow."

—Aesop

Why Do You Need a Bank Account?

Do you have some extra cash you're saving? Where are you keeping it? Some savers stash their cash in shoe boxes, in "piggy banks," or in special secret places. In any case, the same problem arises. Sooner or later, you have to make a decision: Should I spend the money or continue to save? And if I continue to save, should I open a bank account or just find another place to stash the cash? Maybe you've had to face such a decision yourself. If you decide to keep your money at home, it will just sit there and won't earn any extra money for you. You also run the risk that a burglar, a fire, or some other disaster will wipe out your savings in the blink of an eye.

Opening an account with a traditional bank or credit union or with an online-only bank is a big step because you are putting your money in someone else's hands. You're counting on someone else to handle your money responsibly. Before you do that, it might be a good idea to learn a bit more about these institutions and the types of services they offer.

What Are Banks, Credit Unions, and Online Banks?

There are a number of institutions that offer deposit accounts, including banks and credit unions. Banks and credit unions are safe places to keep your money, and they make it easy for you to do the daily business of life. Depending on the type of account you have, you can use an automated teller machine (ATM) for account access, use a debit card for transactions, make electronic payments for bills, or go old-school and write checks. So, you can easily pay bills, buy goods and services, and save for the future. If your bank debit card is either lost or stolen, and you report it to your bank immediately (within two business days), your loss is limited to $50. Depending on the financial institution and the type of account, you could also earn some interest on the balance in your account. Banks, credit unions, and online-only banks are all financial institutions that offer savings accounts, checking accounts, certificates of deposit, credit cards, and other financial services. These institutions also make loans.

A bank is a business. But unlike some businesses, banks don't manufacture products, sell food, or extract natural resources from the earth. Banks sell financial services such as car loans, home mortgage loans, business loans, checking accounts, credit card services, certificates of deposit, and individual retirement accounts. Some people go to banks in search of a safe place to keep their money and perhaps receive some interest on the money in their accounts. Others seek to borrow money to buy a house or a car, start or expand a business, pay for college, or do other things that require borrowing money.

When you open an account at a credit union, you become an owner-member of the credit union. Credit unions are mutual associations rather than corporations. This means that the members of the credit union own and control it.

Credit unions offer services that are similar to those offered by banks. However, their interest rates, fees, and services are generally very responsive to the needs of their members. As a result, credit unions often offer higher interest rates on accounts, lower interest rates on loans, and reduced fees.

Both banks and credit unions allow their customers to do online banking. That is, customers can use an electronic payment system through the bank's or credit union's website or app to make payments and accept deposits.

Online financial institutions are banks and credit unions that operate without actual buildings. Because of this, they have lower operating costs, and they have a reputation for offering higher interest rates on deposits and for keeping fees low relative to traditional banks and credit unions. They often offer user-friendly apps and tools that make it easier for you to manage your money. The trade-off is that you can't just walk into an online bank for customer services, and many online banks don't offer traditional bank services such as safe deposit boxes.

You aren't limited to choosing one option—you can have several accounts at a variety of institutions. You can have an account at an online bank or credit union while maintaining an account at a local institution. Regardless of which option you choose, make certain that your bank is a member of the Federal Deposit Insurance Corporation (FDIC). The FDIC insures accounts up to $250,000 per depositor, per insured bank, and per each account category. Likewise, if you choose a credit union, be sure that it is a member of the National Credit Union Association (NCUA). The NCUA insures accounts up to $250,000 per depositor, per insured bank, and per each account category. If the institution is insured by the FDIC or NCUA, your money is safe, even if the bank or credit union goes out of business.

What Type of Account Do You Want?

People use banks, credit unions, and online banks for different purposes. Some want to save; others need to borrow. Some need to manage household finances; others need to manage business finances. Banks help their customers meet those needs by offering a variety of accounts.

Savings accounts are for people who want to keep their money in a safe place and earn some interest at the same time. You don't need a lot of money to open a savings account, and you can withdraw your money easily.

Certificates of deposit (CDs) are savings deposits that require you to keep a certain amount of money in the bank for a fixed period of time (e.g., $1,000 for two years). As a rule, you earn a higher rate of interest if you agree to keep your money on deposit longer, and there is usually a penalty if you withdraw your money early.

Individual retirement accounts (IRAs) are savings deposits that offer an excellent way to save for your later years. With a traditional IRA, you don't have to pay tax on the money you deposit in your IRA until you withdraw it. But there is often a significant penalty if you withdraw your funds before you reach a specified age (usually 59 or older). With a Roth IRA, you pay tax on the money you deposit in the account, but when you retire the withdrawals are tax free.

Checking accounts are deposit accounts held at financial institutions. You can easily deposit and withdraw money from a checking account. You can access the money in your account by doing the following: setting up automatic bill payment, using a debit card, using an ATM, using a peer-to-peer payment app, or even writing a check or visiting a brick-and-mortar facility. You can track your deposits, withdrawals, and payments online; or if you want to go old-school, you might be able to get a paper record mailed to you on a monthly basis. You may be able to have a no-fee checking account and earn interest if you keep a certain amount of money in an account—a minimum balance.

Money market accounts are savings accounts with some checking account features. They often have a high minimum balance requirement. They usually come with a debit card and some checks. And, they allow a limited number of transactions each month. In the past they offered higher interest rates than regular savings accounts, but now the rates are very similar.

What Are Important Criteria to Consider?

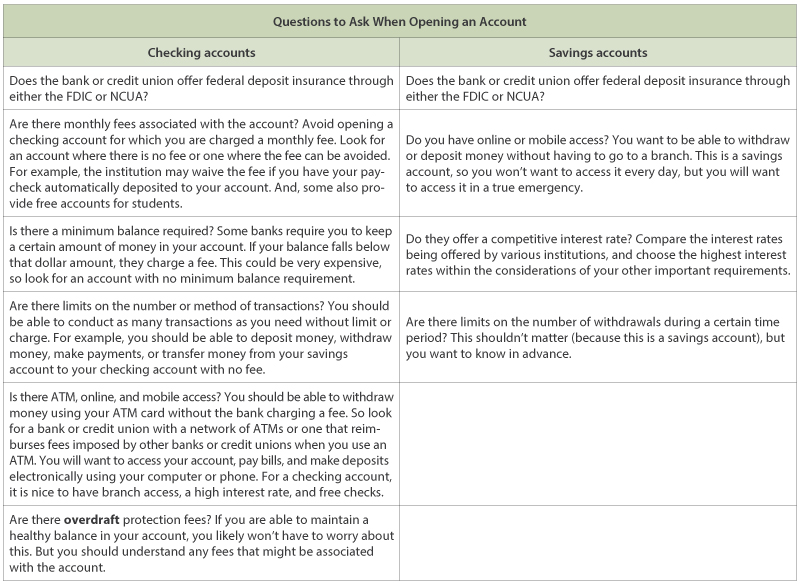

With all of these options, it seems like a good idea to compare the requirements, fees, and features of each type of account before deciding on the type of account to open and where to open it. The box "Questions to Ask When Opening an Account" identifies some things to consider.

What Documents Do You Need to Open an Account?

To open an account in person, you will need two forms of identification, such as your Social Security card, a state-issued driver's license or state identification card, your passport, or your birth certificate. If you are not a U.S. citizen you may be able to use identification issued by your country, such as your passport. You should also bring a utility bill or lease agreement with your name and address on it. You will have to complete an application and signature card. You'll also need the initial deposit. This could be cash, a money order, a check from another account, a transfer using routing and account numbers from another account, or a direct deposit from your employer.

If you are opening an online account, you will be asked for an email address, an address that can be verified as a legitimate postal address by the online system, your Social Security number, and your driver's license or state identification number. You'll also be asked to agree to certain rules or terms for the account by clicking on an "I agree" button. Some institutions may allow you to sign forms electronically; others will require that you print, sign, and mail documents to them. And, as with opening an account face-to-face, you will need an initial deposit. This could be provided using debit card information or routing and account numbers from another bank account you own. It might also be direct deposit information from an employer.

Whether face-to-face or online, if you are opening a joint account—that is, an account with someone else—you will need the same documentation and information for that individual.

Why Should You Manage Your Account?

Once you have opened your savings or checking account, watch the mail for your debit or ATM card and possibly checks, depending on the type of account. And, once your account is opened, you have to keep track of deposits (credits), withdrawals, and payments (debits) from the account. You can do this online. It isn't enough to simply check your balance once in a while. You need to check to be sure that correct amounts are being deposited to your accounts and that any withdrawals or payments from your account are accurate. This is important so that you i) avoid paying overdraft fees, ii) know where your money is going, and iii) make certain the records and account balance are correct.

Conclusion

There are many reasons to keep your money in a bank or credit union. For example, banks and credit unions are safe places to keep your money; money in a bank or credit union account may earn interest, depending on the type of account; there are low or no fees for cashing checks; you'll have a record of your transactions; and you'll likely have 24-hour access to your money through use of a debit or an ATM card.

Choose the best option for you—bank, credit union, or online bank. When making your choice, consider whether a minimum balance is required, what fees are charged for use of an ATM or for overdraft protection, and the interest rate paid on the money in your account. Once you've made your choice, be sure you have all of the identification and information you need to open the account. And, once you have an account, be sure to carefully track your withdrawals, deposits, and expenses so that you aren't charged any fees and will know the records are accurate and your balance is correct.

Sources

Consumer Financial Protection Bureau. "Bank Accounts and Services"; https://www.consumerfinance.gov/consumer-tools/bank-accounts/.

Federal Reserve Bank of Boston. "Banking Basics"; https://www.bostonfed.org/publications/economic-education/banking-basics.aspx.

WalletHub. "How to Open a Checking Account: Step-by-Step Guide, Tips & More"; https://wallethub.com/edu/ca/how-to-open-a-checking-account/10299/.

© 2020, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Banks: Businesses that accept deposits and make loans.

Checking account: An account held at a financial institution in which account owners deposit funds. Account owners are able to write checks on their accounts and use ATM cards or debit cards to access funds.

Credits: Additions or deposits to an account. Credits are added to the balance.

Credit union: A nonprofit financial institution that is owned by its members.

Debit card: A card that allows an account owner to withdraw money or make payments directly from an account.

Debits: Charges to or withdrawals from an account. Debits are subtracted from the balance.

Direct deposit: Money deposited electronically directly into an account from another account.

Fees: Money charged for services. There are fees associated with checking and savings accounts, such as if an overdraft occurs and the account owner has requested that the bank cover overdrafts.

Online(-only) bank: A bank customers access only through the internet or web—there are no physical branches.

Online banking: An electronic payment system that allows customers of a bank or credit union to conduct a wide variety of financial transactions through the bank or credit union website or app.

Overdraft: Occurs when an account holder authorizes a withdrawal through a check, ATM withdrawal, debit card purchase, or electronic payment when the account does not have enough money to cover the amount of the transaction.

Savings account: An account at a bank, credit union, or other financial institution in which account owners deposit funds. Account owners are paid interest on the amount deposited in their accounts. Account owners have the ability to withdraw funds but do not write checks on these accounts.

Withdrawal: A sum of money taken out of an account.

follow @stlouisfed

follow @stlouisfed