Is College Still Worth the High Price? Weighing Costs and Benefits of Investing in Human Capital

"An investment in knowledge pays the best interest."

—Benjamin Franklin

Students have several options for life after high school, including enrolling in college, pursing a technical training program, starting a career, or enlisting for military service. While college has been a popular choice, college enrollment for recent high school graduates has dropped from its peak of 70% in 2009 to 61% in 2021.1 In fact, some people are challenging the notion that college is the best route for the majority of students. A March 2023 survey found that only 42% of Americans believe college is worth the cost because it leads to better job opportunities and higher income, while 56% believe that earning a college degree is not worth the cost. That has changed a lot in 10 years: A 2013 study found that 53% believed college was a good decision, while 40% believed it wasn't.2

Of course, attending college is an individual decision, as each person must weigh the costs and benefits of their options. While some costs of college are immediate (your tuition payments), the benefits are spread over an entire career. This article looks at the costs and benefits of a college education and explains the rate of return of going to college, viewing higher education as an investment. Economists often use the word investment to refer to spending on capital, but that does not mean just physical capital (tools and equipment); it can mean investment in human capital (education and training) too.

Costs and Benefits of Attending College

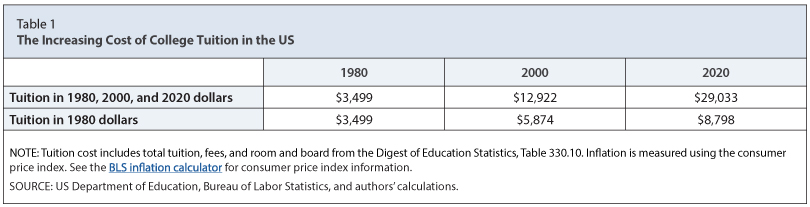

It's true that the cost of going to college has risen significantly in recent decades. The first row of Table 1 shows the average annual tuition for colleges and universities in 1980, 2000, and 2020. The last row of the table shows how much college tuition costs in terms of 1980 dollars, showing that in real (inflation adjusted) terms, attending college cost over twice as much in 2020 as it did in 1980.

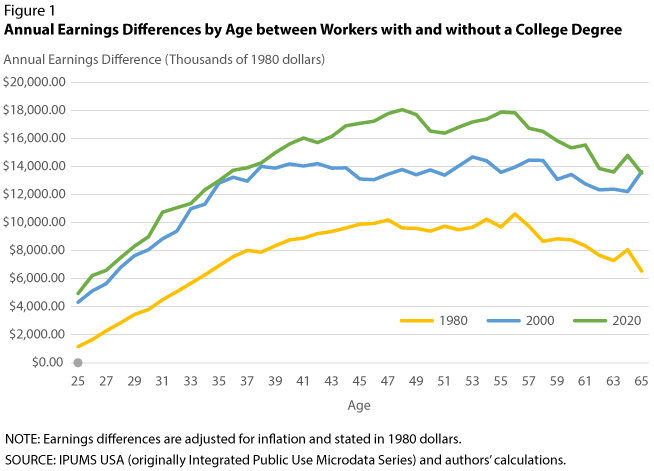

Now, let's examine the financial benefits of going to college, which include how much more money a person with a college degree earns than someone without one; this is sometimes called the college wage premium. Figure 1 shows the annual earnings differences, adjusted for inflation, between workers with a college degree and workers with no more than a high school education.

More specifically, each line in the graph represents how much more money workers with a college degree earn in a year than those with only a high school diploma, for 1980, 2000, and 2020. For each set of data, the college wage premium starts relatively small, but it increases as workers age and acquire skills and experience. For example, in 1980 (yellow line), new college graduates earned about $1,000 more than those with only a high school diploma; but, by mid-career, college-educated workers earned about $10,000 more than high school-educated workers. In 2000 and 2020, however, you can see that the differences in income between education groups were much larger. In 2020 (green line), those with a college degree earned nearly $5,000 more after graduation; but, by mid-career, college-educated workers earned $18,000 more than high school-educated workers. Note that these numbers are adjusted for inflation (stated in 1980 dollars).

What Is the Return on Investing in a College Education?

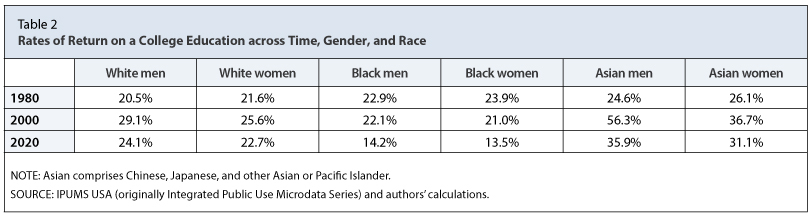

Let's again consider the costs of a college degree. In 1980, the price paid for a college education, on average, was $13,996 (4 x $3,499). If you add up the extra income these workers received each year after graduation, the rate of return on the college tuition they initially paid is very large. For example, a White woman who invested in a college education in 1980 could expect to make back in annual income the cost of her college education plus 21.6%—all of this in addition to the income she would have made without a college degree. By 2020, this rate had risen to 22.7%. Table 2 shows the rates of return on a college education for several demographic groups in 1980, 2000, and 2020.

Of course, there are other ways to invest money besides a college education. For example, instead of paying for four or more years of college, a person could invest money in a financial asset and go straight into the workforce. In this case, the person might have a lower wage, but invested funds and capital gains would add to their income. Although the rates of return on a college education vary greatly across time, gender, and race, they are still considered higher than the returns on financial assets, such as stocks and bonds. For example, investing in the stock market has returned about 10% per year since 19573; in 2020, returns on a college education varied from 13.5% to 35.9%. By this measure, a college degree is an excellent investment.

What Is This Calculation Missing?

Calculating the rate of return on a college education is imperfect because it is not a tangible asset. A numerical calculation excludes certain intangible aspects that may affect the estimated rates of return on a college education. These include a person's inherent skills, employment status, and career satisfaction.

The Skill Sets Behind Higher Earnings

The rates of return shown in Table 2 were calculated from data collected on the earnings of college-educated workers. However, it is possible that college-educated workers have skills—ones they had even before attending college—that make them simultaneously better at earning high incomes and more likely to pursue a degree. The question here is are people more highly skilled because they went to college or are highly skilled people simply more likely to go to college?4 It's difficult to tell the difference, so this may cause the rate of return on a college degree to be overestimated.

Unemployment

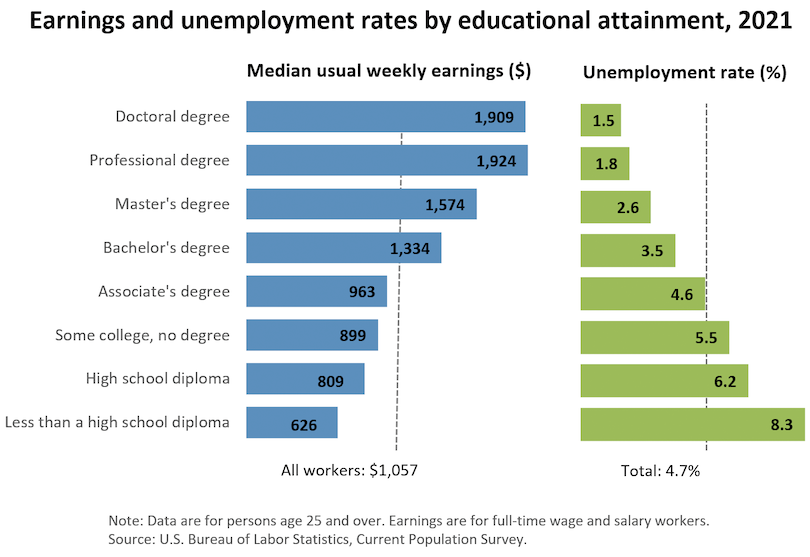

You can only collect income data from someone who has a job, meaning everyone accounted for in this calculation is employed. This information does not account for the fact that high school-educated workers tend to experience higher rates of unemployment. That is, if you have only a high school diploma, you are more likely to be unemployed than someone with a college education. This concept is depicted in Figure 2, which shows the unemployment rates for varying levels of education. You can see that the more educated a person is, the more likely they are to have a job. This issue could cause the rates of return on a college degree to be underestimated.

Figure 2

Career Satisfaction and Non-Financial Benefits

As previously stated, people attend college (or don't) for many different reasons. This article did not include any factors aside from financial ones. For example, high school-educated and college-educated workers may work different hours, work in different conditions, or face different stressors. This calculation does not account for career satisfaction, or lack thereof, that one might get from a specific type of job.

Conclusion

Students have many options for life after high school. One of the most popular options is college. Even though college enrollment has dropped and people have a more dismal outlook on the returns on investing in a college education, the data suggest it is still one of the best investments a person can make. In fact, the advice former Federal Reserve Chair Ben Bernanke gave in 2007 still seems to ring true: "When I travel around the country, meeting with students, businesspeople, and others interested in the economy, I am occasionally asked for investment advice…. I know the answer to the question, and I will share it with you today: Education is the best investment."5

Notes

1 The Economics Daily, US Bureau of Labor Statistics, May 23, 2022; https://www.bls.gov/opub/ted/2022/61-8-percent-of-recent-high-school-graduates-enrolled-in-college-in-october-2021.htm.

2 "Americans Are Losing Faith in College Education, WSJ-NORC Poll Finds." Wall Street Journal, March 31, 2023; https://www.wsj.com/articles/americans-are-losing-faith-in-college-education-wsj-norc-poll-finds-3a836ce1.

3 See https://www.officialdata.org/us/stocks/s-p-500/1957?amount=100&endYear=2022/.

4 Wolla, Scott A. "College: Learning the Skills To Pay the Bills?" Federal Reserve Bank of St. Louis Page One Economics®, December 2015; https://research.stlouisfed.org/publications/page1-econ/2015/12/01/college-learning-the-skills-to-pay-the-bills/.

5 Bernanke, Ben S. "Education and Economic Competitiveness." Speech presented at the US Chamber Education and Workforce Summit, Washington, DC, September 24, 2007; https://www.federalreserve.gov/newsevents/speech/bernanke20070924a.htm.

© 2023, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Asset: A resource with economic value that an individual, corporation, or country owns with the expectation that it will provide future benefits.

Benefits: Things favorable to a decisionmaker; rewards gained from an action/activity.

Costs: Things unfavorable to a decisionmaker.

Financial asset: A contract that states the conditions under which one party (a person or institution) promises to pay another party cash at some point in the future.

Income: The payment people receive for providing resources in the marketplace. When people work, they provide human resources (labor) and in exchange they receive income in the form of wages or salaries. People also earn income in the forms of rent, profit, and interest.

Investment: An asset purchased with the hope that it will gain value and provide a financial return.

Investment in human capital: The efforts people put forth to acquire human capital. These efforts include education, experience, and training.

Rate of return: A useful measure to compare how different assets may increase your wealth.

Real: Monetary values, wages, or prices, adjusted for inflation and measured in constant prices—that is, in prices of a given or base period. Real monetary values are obtained by adjusting nominal wages or prices with a price measure such as the CPI.

follow @stlouisfed

follow @stlouisfed