Teaching the Linkage Between Banks and the Fed: R.I.P. Money Multiplier

Well, when you and I studied economics a million years ago, M2 and

monetary aggregates generally seemed to have a relationship to economic growth…that classic relationship between monetary aggregates and

economic growth and the size of the economy, it just no longer holds…

so something we have to unlearn, I guess.

—Jerome Powell, Federal Reserve Chair1

Introduction

Many introductory economics classes include lessons on the important roles of banks and the Federal Reserve (Fed) in the U.S. financial system and how these two entities are linked. While some textbooks provide sound descriptions of these topics, many miss some key aspects of how banks make decisions, inaccurately explain how the Fed implements monetary policy, and contain outdated descriptions of the linkage between banks and the Fed. This outdated link is often tied to the concept of the "money multiplier," which is anchored in an obsolete explanation of how the Fed operates and influences banks. We recommend that textbook authors and teachers eliminate the use of the money multiplier concept in explaining the linkage between banks and the Fed. Instead, we suggest that classroom materials emphasize a contemporary description of how the Fed operates, focusing on changes in interest rates, not monetary quantities, as the mechanism through which Federal Reserve policies are linked with the banking system and the rest of the economy.

In this article, we start with a description of the role of banks and the Fed in the financial system. From there we discuss some linkages between the two. We conclude with a summary of the key, current concepts most relevant for the classroom.

The Role of Banks in the Financial System

Banks are a key part of the financial system.2 They interact with a wide range of consumers and businesses, helping to shape their savings and investment decisions. At the end of 2020, banks held about $20.5 trillion of assets on their balance sheets, including $10 trillion in outstanding loans. They also held about $16 trillion in deposits, which are liabilities of banks.3 While these numbers are large, they reflect only a share of the intermediation activity—the financial transactions—that banks account for in the economy. Banks also provide many financial services, such as enabling payments among a wide range of participants in the economy. And banks participate in financial markets on their own behalf, including to invest funds and to manage their own liquidity needs.

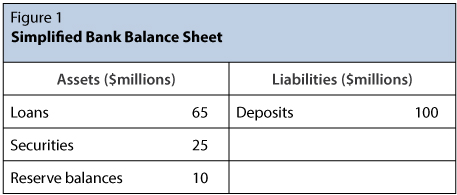

Figure 1 shows a very simplified balance sheet of a bank—the major assets and liabilities it holds. For illustration purposes, the bank's assets are split between three investment options: loans, securities, and reserve balances. Reserve balances are the deposits that a bank holds in its account at the Fed (you can think of a bank's reserve account like you would a household's checking account). The bank's liabilities are the deposits its customers have placed with it, in return for earning interest (the bank's deposit rate). The particular quantities shown are of course also illustrative, both in terms of their levels and relative sizes.

The actual size and composition of a bank's balance sheet are influenced by many factors. Banks are businesses themselves; they make decisions with profits in mind, including the return they are likely to receive from a given investment. Banks also consider the risks they will bear in making an investment. For example, a bank needs to gauge its credit risk (whether it will be paid back in full when an investment period ends) and liquidity risk (how readily it could convert a given investment into cash, if needed). In light of these and other risks, banks must meet a range of regulatory requirements as they operate. Specifically, banks must maintain sufficient "cushions" (financial capital) against losses and against falling short of cash (lack of liquidity). Banks' balance sheets are also influenced by their customers' decisions—their customers' demand for loans, deposits, and various bank products and services.

Let's focus on how a bank makes its investment (asset-allocation) decisions using the simplified example shown in Figure 1. In choosing to allocate funds among the three options depicted—loans, securities, and reserve balances—a key factor is interest rates. The bank sets its loan rate, the amount of interest it will earn from its borrowers. Its borrowers—both households and businesses—take that interest rate into account in deciding whether and how much to borrow (their loan demand). To earn a profit, the bank will generally set its loan rate above the deposit rate it pays to customers that place funds at the bank. In deciding its securities holdings, the bank will consider the market interest rates on various securities. For example, it may hold some U.S. Treasury securities; government securities carry relatively low risk while yielding a return that is typically higher than that on cash but lower than that on most loans. The bank will also decide how many reserve balances to hold; this asset is highly liquid. The Fed pays interest on reserve balances at a rate that it sets called the interest on reserve balances (IORB) rate.4 The IORB rate is generally lower than the interest rates a bank earns on other investment options in part because reserve balances are immediately available and carry no risk.5 And given these characteristics, a bank has no incentive to choose an investment option that pays less than the IORB rate. In economics terms, the IORB rate acts as a reservation rate for banks.

As you might have already gathered, in setting the IORB rate, the Fed influences banks' decisions, including how banks set their deposit and loan rates. In turn, these bank-driven decisions influence the cost and availability of bank credit for households and businesses. But the IORB rate plays an even bigger role. The IORB rate is a special interest rate known as an administered rate because it is set by the Federal Reserve as it implements its monetary policy decisions. Let's now take the Fed's perspective and think about how it makes its policy decisions and then implements them.

The Role of the Federal Reserve in the Financial System

The Federal Reserve is the central bank of the United States. Part of its mission is to conduct monetary policy to meet its Congressional mandate of maximum employment and stable prices. The Fed's monetary policymaking body, the Federal Open Market Committee (FOMC), accomplishes this "dual mandate" by gathering eight times each year (sometimes more) to discuss and set the stance, or position, of monetary policy to guide employment and prices in the desired direction.

A simple overview of the FOMC's monetary policy actions and how they achieve the dual mandate is shown in Figure 2.6 At each FOMC meeting, policymakers evaluate current and expected economic conditions. With this information in mind, as noted in Box 1, the FOMC sets the stance of monetary policy by announcing a target range for its policy rate—the federal funds rate, the interest rate that banks charge each other for lending or borrowing reserve balances overnight. The FOMC may tighten the stance of monetary policy by raising the target range for the federal funds rate, ease the stance of monetary policy by lowering the target range for the federal funds rate, or leave the stance of its interest rate policy unchanged by making no change to the target range for the federal funds rate.7

Then, as noted in Box 2, the Fed uses its policy implementation tools to ensure the new target range for the federal funds rate is achieved. For over a decade, the Fed has operated with ample reserves in the banking system and uses IORB as its principle tool for policy implementation. Typically, as reported Table 1, the Fed raises the IORB rate when it tightens the stance of policy (raises the target range for the federal funds rate) and lowers the IORB rate when it eases the stance of policy (lowers the target range for the federal funds rate). Using IORB and its other policy implementation tools, the Fed ensures that any change in the policy rate transmits effectively and efficiently through the economy (monetary transmission).8 For example, when the Fed raises the IORB rate, banks earn more on the funds they place in their reserve accounts at their regional Federal Reserve Bank. This sets a higher reservation rate for banks' investment and operational decisions; banks generally will not accept a lower rate of return than this new IORB rate on any investment. Then, through arbitrage, similar market interest rates are also pulled up, including the federal funds rate.

The Fed uses its administered rates to keep the federal funds rate (black solid line) in the FOMC's target range (gray shaded region). The IORB rate (black dashed line)—the Fed's primary policy implementation tool—helps steer the federal funds rate into the target range.

This interest-rate-focused policy has worked very well over the past several years. As shown in Figure 3, as the FOMC raised and lowered the target range for the federal funds rate (gray shaded region), the Fed raised or lowered the IORB rate (black dashed line) and this action (and others) kept the federal funds rate (black solid line) in its target range. This approach to implementing the FOMC's policy decisions is referred to as an ample-reserves regime. In 2019, the FOMC announced that it would continue to use this implementation regime—with IORB as its primary tool of policy implementation—over the longer run.9

The Fed's changes in the IORB rate affect not only the federal funds rate at which banks borrow and lend; the changes also transmit to other interest rates in the economy and to financial market conditions more broadly (Box 3 of Figure 2). For example, as noted above, changes in the IORB rate influence how much banks charge consumers and businesses for loans. The changes also help anchor where various short-term market interest rates settle and thereby influence the levels of longer-term market interest rates. In addition, changes in the general level of interest rates affect the prices—or valuations—of financial assets, such as stocks (shares of equity in companies), as well as some nonfinancial assets, such as houses. Changes such as these in overall financial conditions influence consumers' and businesses' spending and investment decisions (Box 4 of Figure 2). For example, higher interest rates in the economy might dissuade a business from taking out a bank loan. Or a noticeable, sustained rise in the value of a household's assets might cause it to feel wealthier and encourage additional spending.

As households and businesses make their various saving and spending decisions, the overall demand for and supply of goods and services are affected. As aggregate demand and supply shift, so does the need for labor and other inputs to produce those goods and services. And of course, shifts in demand and supply also affect the prices of goods and services (Box 5 of Figure 2). So, changes in the FOMC's stance of monetary policy ultimately move the economy toward the Fed's dual mandate—maximum employment and stable prices.

The Links Between the Fed and Banks

As we discussed above, the link between the Fed and banks is through the setting of the IORB rate: When the Fed raises the IORB rate, banks earn more on the funds they place in their reserve balance accounts at their Federal Reserve Bank. This sets a higher reservation rate for banks' investment decisions: Banks will not accept a lower rate of return than this new IORB rate on any investment of funds. Through arbitrage, the new IORB rate helps pull up similar market interest rates, including the federal funds rate.

The Fed can also signal about a future change to its policy rate (and hence the IORB rate) that affects banks' decisions. For example, at times, the FOMC has said it plans to keep its policy rate constant for some time or until economic conditions evolve in a particular way. Such communication is called forward guidance, and it provides an expectation of future short-term interest rates. Banks use this information to set their longer-term interest rates; long-term interest rates are related to today's short-term interest rates and where those rates will likely reside in the future. So, for example, if FOMC communications trigger the expectation that the Fed will increase its policy rate (and, hence the IORB rate) in the near future, banks will tend to make an incremental increase in their loan rates. The Fed interacts with banks in other ways as well, from setting other administered rates to proving bank supervision and regulation, but the most important linkage for monetary policy transmission is IORB.

Make Sure Your Teaching Is Current

The Fed's implementation framework is the nuts and bolts of making sure the FOMC's decision about the appropriate policy rate setting is transmitted to financial markets. However, unless you specialize in this area, it might not be obvious that the Fed made a significant operational change more than a decade ago or that this change requires an overhaul of instructional materials. Perhaps it is not surprising then that some textbooks make two fundamental mistakes in their descriptions of the linkage between banks and the Fed.10 The first is relying on an outdated description of how the Fed operates—that is, teaching the Fed's pre-2008, limited-reserves framework that focuses on the quantity of reserves and open market operations instead of the current ample-reserves framework that relies on setting administered interest rates—with the primary tool being IORB—to implement its decisions and affect economic conditions. Related, the second mistake takes the outdated focus on quantities further by linking the Fed and banks through the money multiplier and teaching that the monetary aggregates are a key factor in the linkage. Let's take a closer look at each of these.

Mistake 1: Using an Outdated Description of How the Fed Operates

Some textbooks describe the Fed's old, limited-reserves implementation regime with two key policy tools: open market operations and reserve requirements. As shown in Figure 4, prior to mid-2008 the Fed operated with a relatively small quantity of reserves in the banking system. Here reserve requirements kept banks' demand for reserves stable. And, the Fed used open market operations to frequently adjust the quantity of reserves it supplied to the banking system to affect banks' trading in the federal funds market and influence the level of the federal funds rate.

Figure 4

Reserve Balances in the Banking System

SOURCE: FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=FHtM, accessed September 8, 2021.

But, a meaningful shift in monetary policy, and consequently in the amount of reserves in the banking system, took place during the Global Financial Crisis of 2007-09. During that crisis, the Fed pushed the policy rate to near zero and turned to balance sheet policy—also referred to as large-scale asset purchases and "quantitative easing"—to put downward pressure on longer-term interest rates and help steer the economy out of the depths of the Great Recession. This action increased reserve balances. Then, beginning in March 2020, an even steeper increase in reserve balances occurred, one which reflects the Fed's purchases of securities to offset the severe shock to the economy from the COVID-19 pandemic. When reserves are plentiful, small changes in their level, such as via open market operations, cannot affect the federal funds rate; rather the Fed must lean on IORB as its principle implementation tool.

The Fed has said it plans to operate with ample reserves in the longer run. So, the key policy implementation concepts and tools that should be discussed in the classroom are the following: Reserves are ample, and the Fed relies on IORB (with the IORB rate) to implement its policy rate decisions. This is a very different framework from that used pre-2008. There is a different level of reserves, different key policy tools, and a different story for the link between the Fed and banks.11 These differences bring us to the second mistake many textbooks make in linking banks and the Fed—focusing on the money supply (deposits) and the money multiplier.

Mistake 2: Relying on the Money Multiplier

The outdated textbooks tend to focus on the money multiplier, describing how money expands and contracts in the economy and tying the Fed's tool of reserve requirements into their discussions of bank lending. They essentially argue that banks would lend more if they did not have to hold back funds to meet their Fed-determined reserve requirements. So, in explaining bank lending, these textbooks use a concept called the money multiplier, which depicts a strict linkage between banks, the Fed, and the money supply. This outdated concept is represented by a simple equation that describes the maximum increase in money (deposits) that is created in the economy from each additional dollar loaned by banks:

Money multiplier = 1 / RR,

where "RR" is the reserve requirement ratio set by the Fed. The equation shows how the amount of money (deposits) banks "create" is a fraction of the reserve requirement ratio set by the Fed. For example, if a bank subject to a 10 percent reserve requirement lent an additional $100 of funds, $1,000 (or 100 × 1/0.10) in total would ultimately be added to the money supply. In this case, reserves in the banking system would create 10 times as many deposits. And if instead the reserve requirement ratio were 5 percent, $2,000 (or 100 × 1/0.05) of money (deposits) would be created for each additional $100 of loans made by the bank. In this case, additional reserves would create 20 times as many deposits. This focus on fractional reserves suggest that reserve requirements can be a powerful monetary policy tool of the Fed, yet reserve requirements are not currently used in this way.

Knowing how the Fed's operations have changed, we can readily see why the money multiplier no longer applies. First, banks still make loans with profits, risks, and regulatory considerations firmly in mind, but with the Fed keeping reserves in the banking system consistently ample, meeting reserve requirements is not one of those considerations. Second, and as described in the boxed insert "The Fade to Irrelevance of the Money Multiplier," even during the period when reserves were limited, many banks had not been constrained by reserve requirements for quite some time. Third, the Fed eliminated reserve requirements in March 2020—it set reserve requirement ratios ("RR" in the equation above) to zero—reflecting the fact that reserve requirements have no essential role in an ample-reserves regime.12 So, mathematically, the money multiplier equation is literally no longer definable.

The Ratio of M2 Deposits to Reserve Balances

SOURCE: FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=Eh5M, accessed September 8, 2021.

Going Forward: What Should Be Taught in the Classroom

We recommend that teachers weave in the following key themes when they describe the banking system, the way the Fed operates, and how the two are linked:

- Teach that the Fed has a dual mandate, assigned by Congress, of maximum employment and stable prices. Emphasize that the Fed relies on a very wide range of information—in the form of data, models, analysis, research, and more—to assess the state of financial and economic conditions, judge the outlook for the economy, and make its policy decisions.

- Teach that the Fed steers the economy toward its Congressional mandate by taking actions that affect overall financial conditions, thereby influencing economic activity.

- Teach that the primary way the Fed achieves its dual mandate is by adjusting its target range for its policy rate, the target range for the federal funds rate. In times of stress, or to support economic recovery, the Fed may turn to balance sheet policy.

- Teach that the Fed uses an ample-reserves regime to implement its policy decisions: The Fed keeps reserves (at least) ample at all times. The ample-reserves implementation framework ensures that when the Fed raises (lowers) the target range for the federal funds rate, short-term market interest rates increase (decrease).

- Teach that IORB is the Fed's primary tool for implementing changes in the target range for the policy rate. The IORB rate serves as a reservation rate, and through arbitrage the IORB rate affects market interest rates.

- Teach that banks make loans with profits, risks, and regulatory considerations in mind.

- Teach that the Fed influences banks' decisionmaking—about setting deposit and loan rates, and lending and investment options—through the IORB rate (a reservation rate for banks).13

- Teach that monetary policy is transmitted broadly through interest rates via financial markets (through arbitrage and other channels); in turn, broad changes in financial conditions influence the spending and savings decisions of households and businesses and ultimately affect employment and prices.

- Overall, emphasize the role of interest rates in transmitting changes in monetary policy to overall financial conditions and ultimately to the demand and supply of goods and services.

Resources for Teaching the Current Tools of Monetary Policy

The following resources have been designed to help educators transition to teaching the current tools of monetary policy. A complete list of resources may be found here: https://www.stlouisfed.org/education/teaching-new-tools-of-monetary-policy.

Article

"The Fed's New Monetary Policy Tools." Federal Reserve Bank of St. Louis Page One Economics®: Econ Primer, 2020.

https://www.stlouisfed.org/edu...

Lecture guide with slides, student notetaking guide, and assessment

"How the Federal Reserve Implements Monetary Policy." Federal Reserve Bank of St. Louis, 2021.

https://www.stlouisfed.org/edu...

Online learning module

"The Fed's New Monetary Policy Tools." Econ Lowdown Online Learning, Federal Reserve Bank of St. Louis, 2021.

https://www.econlowdown.org/re...

Notes

1 U.S. Senate, Committee on Banking, Housing, and Urban Affairs. "The Semiannual Monetary Policy Report to the Congress." February 23, 2021; https://www.govinfo.gov/content/pkg/CHRG-117shrg44741/pdf/CHRG-117shrg44741.pdf.

2 We use the term "banks" throughout to refer to depository institutions, which include commercial banks, savings banks, credit unions, thrift institutions, and most U.S. branches and agencies of foreign banks.

3 Estimates of banks' assets and liabilities are reported each week by the Federal Reserve in the H.8 statistical release (Table 2) available at https://www.federalreserve.gov/releases/h8/.

4 The Federal Reserve began paying interest on required and excess reserve balances in October 2008. Between October 2008 and March 2020, the interest rates paid on required and excess reserves were set to the same rate. Beginning in late March 2020, reserve requirement ratios were set to zero and, as a result, effective July 29, 2021, a single interest on reserve balances (IORB) rate was implemented.

5 Banks also hold actual cash—paper currency and coin—in their vaults to meet customer withdrawals. As is the case for everyone, these holdings earn no interest. Banks' vault cash is not included in the Fed's measures of the money supply, including M1 and M2, because this cash is not yet in circulation. Banks use many forms of near cash to shore up their liquidity. For example, certain types of securities holdings can be used to raise cash quickly.

6 For a full discussion of how the Fed implements monetary policy see the following: Ihrig, Jane and Wolla, Scott. "The Fed's New Monetary Policy Tools." Federal Reserve Bank of St. Louis Page One Economics®:Econ Primer, August 2020; https://research.stlouisfed.org/publications/page1-econ/2020/08/03/the-feds-new-monetary-policy-tools.

7 In addition, the FOMC typically offers some information about the likely future path of the policy rate—how it expects it will set the target range for the policy rate in the future. This information also contributes to how easy or tight monetary policy is because households and businesses take account of how interest rates may or may not change in the future (their interest rate expectations) when making their spending and savings decisions.

8 The Fed actually seeks to keep the daily "effective" federal funds rate in the FOMC's target range. The effective federal funds rate is the volume-weighted median rate of all overnight federal funds transactions that occurred on a given day. These data, published daily, are available from the Federal Reserve Bank of New York at https://apps.newyorkfed.org/markets/autorates/fed%20funds.

9 The FOMC's announcement is available at https://www.federalreserve.gov/newsevents/pressreleases/monetary20190130c.htm.

10 Ihrig, Jane and Wolla, Scott. "Let's Close the Gap: Revising Teaching Materials to Reflect How the Federal Reserve Implements Monetary Policy." Finance and Economics Discussion Series, Board of Governors of the Federal Reserve System, August 2020; https://doi.org/10.17016/FEDS.2020.092.

11 Ihrig and Wolla (2020). See footnote 6.

12 See the Federal Reserve's announcement and explanation at https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm. More information about reserve requirements and their history is available at https://www.federalreserve.gov/monetarypolicy/reservereq.htm.

13 Advanced students may readily grasp that nonbank financial institutions are also very important in the economy and so the Fed also uses its overnight reverse repurchase agreement (ON RRP) facility and standing repurchase agreement facility (SRF) to help control short-term interest rates; the Fed's administered rates associated with these facilities act as additional reservation rates for financial institutions' investment and borrowing decisions, respectively. (See the glossary for additional information.)

Additional Resources

Ihrig, Jane; Senyuz, Zeynep and Weinbach, Gretchen. "Implementing Monetary Policy in an 'Ample-Reserves' Regime: The Basics (Note 1 of 3)." Board of Governors of the Federal Reserve System FEDS Notes, July 1, 2020; https://doi.org/10.17016/2380-7172.2552.

Ihrig, Jane; Senyuz, Zeynep and Weinbach, Gretchen. "Implementing Monetary Policy in an 'Ample-Reserves' Regime: Maintaining an Ample Quantity of Reserves (Note 2 of 3)." Board of Governors of the Federal Reserve System FEDS Notes, August 28, 2020; https://doi.org/10.17016/2380-7172.2553.

Ihrig, Jane; Senyuz, Zeynep and Weinbach, Gretchen. "Implementing Monetary Policy in an 'Ample-Reserves' Regime: When in Crisis (Note 3 of 3)." Board of Governors of the Federal Reserve System FEDS Notes, October 2, 2020; https://doi.org/10.17016/2380-7172.2744.

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Administered rate: An interest rate that is set directly by a central bank rather than being determined by the market forces of supply and demand.

Ample reserves regime: The name of the Fed's approach to implementing monetary policy. This regime features a sizable level of reserves in the banking system such that small adjustments to the level do not affect the market-determined federal funds rate.

Arbitrage: The simultaneous purchase and sale of an asset in different markets or in different forms in order to profit from a difference in price for that asset.

Asset: A resource with economic value that an individual, corporation, or country owns with the expectation that it will provide future benefits.

Balance sheet: A statement of the assets and liabilities of a firm or individual at some given time.

Balance sheet policy: A central bank's use of open market operations to buy and/or sell a large quantity of securities with the intention of affecting financial market conditions, either to influence longer-term interest rates, stabilize key financial markets, or both.

Dual mandate: The Federal Reserve's statutory responsibility to use monetary policy to promote maximum employment and stable prices.

Federal funds rate: The interest rate at which depository institutions lend reserve balances to each other overnight.

Federal Open Market Committee (FOMC): The Federal Reserve committee created by law to make monetary policy decisions. It consists of the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and, on a one-year rotating basis, the presidents of four other Reserve Banks. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion.

Financial capital: The funds invested in a bank that are available to absorb loan or other losses and therefore protect depositors. Capital includes all equity and some types of debt.

Forward guidance: A tool that central banks use to provide communication to the public about the likely future course of monetary policy. When central banks provide forward guidance, individuals and businesses will use this information in making decisions about spending and investments. Thus, forward guidance about future policy can influence financial and economic conditions today.

Interest on reserve balances (IORB): The interest the Fed pays on the funds that banks hold in their reserve balance accounts at Federal Reserve Banks. This is the Fed's principle monetary policy implementation tool.

Interest on reserve balances (IORB) rate: The administered interest rate associated with IORB; the rate of interest the Fed pays on the funds that banks hold in their reserve balance accounts at Federal Reserve Banks. The rate acts like a reservation rate because banks are unlikely to be willing to invest funds overnight in the market at a rate below the IORB rate. The Fed uses the IORB rate to steer the federal funds rate into the target range set by the FOMC.

Liability: Money owed; debt.

Liquidity: The quality that makes an asset easily convertible into cash with relatively little loss of value in the conversion process.

Monetary policy: Actions taken by a central bank to achieve its goals; for the Federal Reserve, its goals are maximum employment and stable prices.

Monetary transmission: How monetary policy-induced changes in the policy rate impact economic variables such as aggregate output, employment, and inflation.

Money multiplier: In a fractional-reserve system, the maximum amount of money (deposits) the banking system generates through lending from each additional dollar of reserves.

Open market operations: The buying and selling of government securities through primary dealers by the Federal Reserve. When the securities are bought or sold, the amount of reserves in the banking system is increased or decreased, respectively.

Policy rate: The interest rate that is used by a central bank to set and communicate its monetary policy stance (or position). In the United States, the Federal Reserve's FOMC uses the federal funds rate as the policy rate.

Reservation rate: The lowest rate of return that banks are willing to accept for lending out funds.

Reserve balances: The deposits a bank maintains in its account with a Federal Reserve Bank.

Reserve requirement: The percentage of a bank's deposits that it is required to keep on hand (in the form of either reserve balances or vault cash). For the Federal Reserve, as of March 26, 2020, reserve requirements have been zero.

U.S. Treasury securities: Bonds, notes, and other debt instruments issued by the U.S. Treasury to finance U.S. government operations.

follow @stlouisfed

follow @stlouisfed