Making Technical Adjustments: The Difference Between “Conducting” and “Implementing” Monetary Policy

At the end of his prepared remarks at the June 16, 2021, press conference, Federal Reserve Chair Jerome Powell noted both that the Federal Reserve System (Fed) made a "technical adjustment" to its administered interest rates and that it "has no bearing on the appropriate path for the federal funds rate or stance of monetary policy." So you might be wondering, what exactly is a technical adjustment and how is it different from the Federal Open Market Committee's (FOMC's) actions to adjust the stance of monetary policy?

This technical adjustment to the Fed's administered rates is the difference between the FOMC conducting monetary policy and the Fed implementing monetary policy. The FOMC conducts monetary policy by determining a target range for the Fed's policy rate—the federal funds rate (FFR)—to move the economy toward its congressionally mandated goals of maximum employment and price stability. When the FOMC sets this target range, the idea is that it will influence the FFR and other market interest rates, which, in turn, affects the spending, investing, and saving decisions of businesses and consumers.

But how does the Fed ensure market interest rates follow the target range for the policy rate set by the FOMC? The Fed implements policy by using its tools to keep the FFR within the FOMC's desired target range. Note that the Fed does not directly set the FFR, as this is determined by institutions borrowing and lending in the federal funds market. Rather, the Fed uses it policy tools and sets two of its administered rates—the interest on reserve balances (IORB) rate and the overnight reverse repurchase agreement (ON RRP) rate—to guide the FFR within the target range. These administered interest rates are relatively new tools of monetary policy for use when there are ample reserves within the banking system, both as the system exists today and for the foreseeable future. Definitions of the rates include the following:

- The IORB rate1 is the interest rate that banks earn from the Fed on the funds they deposit in their reserve balance accounts. IORB is the Fed's primary tool for guiding the FFR.2

- The ON RRP rate is the interest rate that a broad set of financial institutions can earn on deposits with the Fed. The ON RRP rate is associated with the ON RRP facility, which is a supplemental tool of monetary policy.3

The Fed adjusts the IORB and ON RRP rates up or down, with market conditions, to ensure the FFR stays well within the FOMC's target range. Such a tweaking occurred on June 16, 2021: Chair Powell announced that both the IORB and ON RRP rates would be shifted 5 basis points higher to nudge the FFR up a bit within the existing target range.

The table shows that the 5-basis-point rise in administered rates on June 16 boosted the market-determined FFR by 4 basis points, up from 6 to 10 basis points and nearing the center of the 0- to 25-basis-point target range.

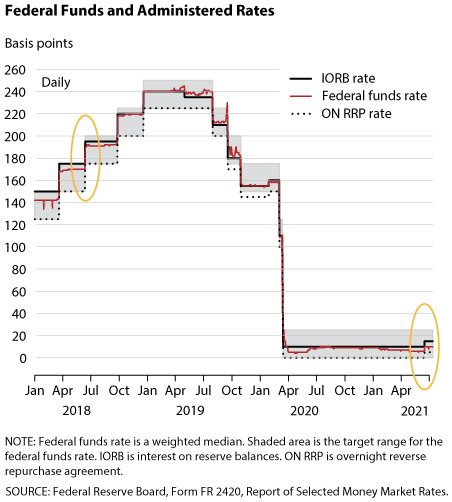

Over the past several years, the Fed has changed one or both of its administered rates several times to keep the FFR within the target range. For example, in mid-2018 when market pressure moved the FFR toward the top of the target range, the Fed lowered the IORB rate. Whereas more recently, downward pressure on the FFR prompted the Fed to raise both the IORB rate and the ON RRP rate.

The figure illustrates these two technical adjustments, as well as the target range (gray region). Before mid-June 2018, the IORB rate (solid black line) was at the upper limit of the federal funds target range. Then, with upward pressure on the FFR, the Fed lowered the IORB rate 5 basis points. When the Fed adjusts the IORB rate, it does not necessarily adjust the ON RRP rate. There have been only three adjustments to the ON RRP rate (black dotted line) in recent history, one of which was in June 2021. At that time, the rate was moved 5 basis points above the lower limit of the target range, and it continues to serve as a floor for the FFR.

Overall, the Fed can technically adjust its administered interest rates at any time to keep the policy rate within the target range and help it achieve its goals of maximum employment and price stability. It's important to remember that these technical adjustments to the Fed's administered rates do not change the stance of monetary policy but merely implement existing policy in changing market conditions.

Notes

1 Beginning October 2008, the Fed began paying interest on required and excess reserve balances. Between October 2008 and March 2020, the interest rates on required and excess reserves were set to the same rate. As of July 29, 2021, the Fed replaced these rates with a single interest on reserve balances (IORB) rate, which we use in the notation throughout this discussion.

2 See https://www.federalreserve.gov/monetarypolicy/reserve-balances.htm.

3 See https://www.federalreserve.gov/monetarypolicy/overnight-reverse-repurchase-agreements.htm.

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed