Student Loan Delinquency: A Big Problem Getting Worse?

Over the past decade, the percent of student loan borrowers who are not making their debt payments on time has increased significantly. This trend has generated a large debate because the government subsidizes a very significant share of that debt.1 This essay analyzes the evolution of some key statistics relevant to this debate. The conclusion? Student loan delinquency is a big problem, but it is not getting worse.

The first figure shows delinquency for student loans: debt that is 30+ days delinquent. To avoid any seasonal variations, only information for the last quarter of each year is included; the last information available corresponds to 2014:Q4.

The red line in the figure represents the 30+ days delinquency rate for student loans. Borrowers are included in this group if they are at least 30 days delinquent on at least one of their student loans.2 The delinquency rate increased significantly over the past 10 years—from 11 percent to slightly above 17 percent. Delinquency was monotonically increasing before reaching 15.8 percent in 2010. Thus, about 77 percent of the increase over the past 10 years occurred between 2004 and 2010. The delinquency rate decreased during 2011 and then increased sharply during 2012; since then it has remained quite stable at about 17 percent.3

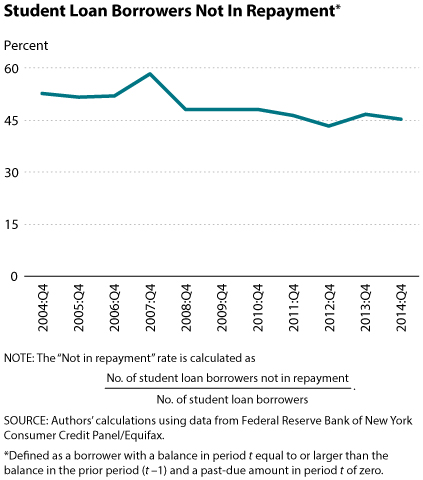

Given the previous analysis, we conclude that the delinquency rates are high, but the evolution over the past 10 years seems less problematic. To further analyze student loan delinquency, and given that many programs allow borrowers to postpone repayment on their student loans, it seems pertinent to study a measure of the share of loans not in repayment. The second figure shows the percent of student loan borrowers whose loans are not in repayment. Borrowers' loans are defined as "not in repayment" if (i) their student loan balance is larger than or equal to the previous period (i.e., quarter) and (ii) there is not a past-due student loan balance in the current period. Note that the "not in repayment" status includes the loans of most student loan borrowers who are still in college. It involves more than that, however, since it also incorporates loans in deferment and forbearance, which are mechanisms that allow borrowers to suspend or reduce student loan payments under certain circumstances. 4

For 2010:Q4, we find that about 45 percent of student loans were not in repayment; this implies that only about 55 percent of student loans were in repayment. As a consequence, if we adjust the delinquency rate to consider that only a fraction of the borrowers have payments due, this level of delinquency is very concerning: A delinquency rate of 15 percent for all student loan borrowers implies a delinquency rate of 27.3 percent for borrowers with loans in repayment. This level of delinquency is much higher than for any other type of debt (credit cards, auto loans, mortgages, and so on).

Interestingly, the second figure shows that the share of student loan borrowers whose loans are not in repayment has decreased from 53 percent to 45 percent over the past 10 years. This decrease confirms our earlier indication that the trend in delinquency is not as problematic as it seems. Because more loans are in repayment, one would expect an increase in the delinquency rate measured as a ratio of all student loans borrowers.

Research at the Federal Reserve Bank of St. Louis studies these trends in student loan repayments. The findings shed light on the characteristics of the student loan borrowers struggling to repay their debts and provide practical policy guidance for redesigning student loan programs.5

Notes

1 In 2012, this share was about 85 percent of all outstanding loans. For more information, see Consumer Financial Protection Bureau (2012).

2 Technically, they are delinquent if they have strictly positive "Number of Student Loan Trades Currently 30 DPD [days past due]" in Equifax. The delinquency rate is computed as the ratio of the number of delinquent borrowers to the total number of student loan borrowers.

3 Since these numbers are computed using a 1 percent random subsample of the survey, they may not coincide exactly with calculations elsewhere.

4 Actually, the not-in-payment ratio for borrowers younger than 23 years of age was as high as 80 percent in 2014:Q1. If we focus on student loan borrowers between 23 and 40 years of age, the not-in-repayment ratio was still as high as 39 percent in 2014:Q4. (We set the upper bound to 40 years of age because student loan borrowers past a certain age might borrow for their children's education.)

5 See Lochner and Monge-Naranjo (2014).

References

Consumer Financial Protection Bureau. "Private Student Loans: Report to the Senate Committee on Banking, Housing, and Urban Affairs, the Senate Committee on Health, Education, Labor, and Pensions, the House of Representatives Committee on Financial Services, and the House of Representatives Committee on Education and the Workforce." August 29, 2012; http://files.consumerfinance.g....

Lochner, Lance J. and Monge-Naranjo, Alexander "Student Loans and Repayment: Theory, Evidence and Policy." Working Paper No. 2014-040B, Federal Reserve Bank of St. Louis, November 12, 2014; http://research.stlouisfed.org....

© 2015, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed