Two Percent Inflation Over the Next Year: Should You Take the Over or the Under?

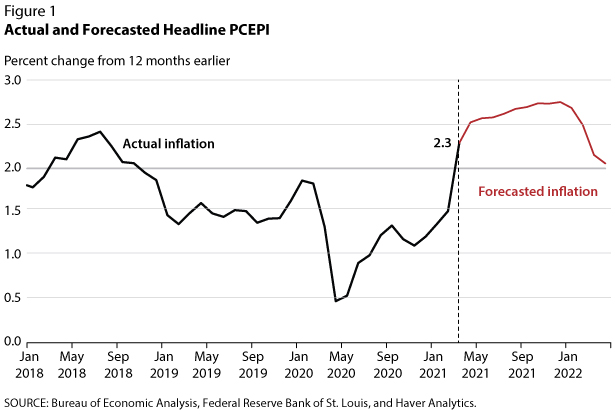

Inflation now exceeds the Federal Open Market Committee's (FOMC's) 2 percent inflation target. After measuring 1.5 percent in February 2021, the personal consumption expenditures price index (PCEPI), which the Fed targets, increased 2.3 percent in March 2021 from a year earlier. Inflation is likely to rise even more in April—and perhaps thereafter. How long will this overshoot last?

Chair Powell and most FOMC members have been conditioning the public and financial markets to expect inflation to rise temporarily beyond the FOMC's 2 percent inflation target this year. The March "Summary of Economic Projections" embodies this view2: The median FOMC participant expects headline PCEPI inflation of 2.4 percent in 2021, slowing to 2 percent in 2022 and 2023.

"Base effects" are one factor that explains inflation's rise. For example, prices of many goods and services, such as those of gasoline, air fares, and lodging, temporarily declined during the pandemic-spawned plunge in economic activity last year. But with the economy and prices recovering, the price increases in March and April 2021 are magnified because of the declines seen in March and April 2020—the base months for calculating the 12-month change in prices in 2021.3

Other factors are also at work. These include prices that have recently increased because of adverse weather, shortages due to supply chain disruptions, and the sizable increases in many commodity prices arising from the rebound in U.S. and global output growth (e.g., crude oil, lumber, and steel).

Forecasting inflation typically requires a model—or framework—of some kind. Martin (2021) reviews some of these approaches. One approach is a statistical model developed by Jackson, Kliesen, and Owyang (2015), which uses many types of data to forecast inflation. Figure 1 shows that the model is predicting that headline PCEPI will increase from 2.3 percent in March 2021 to 2.8 percent in December 2021. If that inflation rate is realized, the 2021 increase (December to December) would be the highest inflation rate since 2007 (3.4 percent). Thereafter, the model predicts that inflation will slow to 2.1 percent in April 2022—effectively at the FOMC's inflation target.

The point forecast is the model's expectation of inflation based on the current data and the model. But point estimates from any forecasting model are also subject to uncertainty. In other words, actual inflation will probably end up higher or lower than 2.8 percent in 2021. Indeed, the unexpectedly large increase in the April consumer price index points to some upside risk to this forecast—that is, the risk that inflation will be higher than expected.

The Federal Reserve Bank of St. Louis developed a price pressures measure that gauges inflation probabilities over the next 12 months. In effect, this statistical approach assesses the probability that the inflation rate (12-month percent change) over the next 12 months will end up in one of four buckets: less than zero (deflation); between 0 percent and 1.5 percent; between 1.5 percent and 2.5 percent; or greater than 2.5 percent.

Figure 2

Inflation Probabilities According to the St. Louis Fed's Price Pressures Measure

NOTE: The shaded area indicates the current recession; the end date is undecided.

As Figure 2 shows, the probability-based model estimates that there is a 3 percent probability that inflation over the next 12 months will average between 0 percent and 1.5 percent (blue line); a 36 percent probability that inflation will average between 1.5 percent and 2.5 percent (red line); and a 61 percent probability that inflation will average more than 2.5 percent over the next 12 months (black line labeled Price Pressures Measure). The model places an approximately 0 percent probability of deflation over the next 12 months (not shown on Figure 2).

Although the 2.5 percent threshold for the price pressures measure is arbitrary, it is a level that is consistent with the FOMC's desire to achieve an inflation rate that "moderately" exceeds 2 percent for some time.4 Whether that is a desirable outcome from a societal standpoint is a separate question.5

Notes

1 The author thanks Kathryn Bokun for research assistance.

2 Board of Governors of the Federal Reserve System (2021).

3 For example, see the Minutes of the March 16-17, 2021, FOMC meeting: https://www.federalreserve.gov/newsevents/pressreleases/monetary20210407a.htm.

4 Powell (2021).

5 See the summaries of the Fed Listens events: https://www.federalreserve.gov/publications/files/fedlistens-report-20200612.pdf.

References

Board of Governors of the Federal Reserve System. "Summary of Economic Projections." March 17, 2021; https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210317.pdf.

Jackson, Laura E.; Kliesen, Kevin L. and Owyang, Michael T. "A Measure of Price Pressures." Federal Reserve Bank of St. Louis Review, First Quarter 2015, 97(1), pp. 25-52; https://research.stlouisfed.org/publications/review/2015/03/20/a-measure-of-price-pressures/.

Martin, Fernando. "Is Inflation Making a Comeback?" Federal Reserve Bank of St. Louis On the Economy Blog, April 5, 2021; https://www.stlouisfed.org/on-the-economy/2021/april/inflation-making-comeback.

Powell, Jerome. "Transcript of Chair Powell's Press Conference." Board of Governors of the Federal Reserve System, April 28, 2021; https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20210428.pdf.

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed