International Inflation Trends

In most traditional economic models, inflation is entirely a domestic event, fomented by domestic factors and/or policies, such as money creation. There is some truth to this in extreme cases. For example, essentially all hyperinflations—monthly inflation greater than 40 percent—result from uncontrolled domestic fiscal deficits that are financed by domestic money creation and followed by a self-reinforcing cycle of price rises and increases in the velocity of money. At less-pathological rates of inflation, domestic policies, especially those of central banks, are still important. Even central banks of small, open economies can approximately determine average levels of inflation over periods of at least several years.

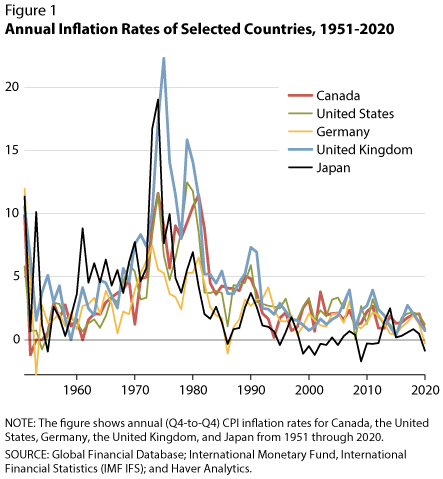

Yet international inflation rates clearly move together. Figure 1 shows that the inflation rates of several leading economies have moved together for many years, with the great inflation of the 1960s-70s and the subsequent great disinflation dominating that illustration.

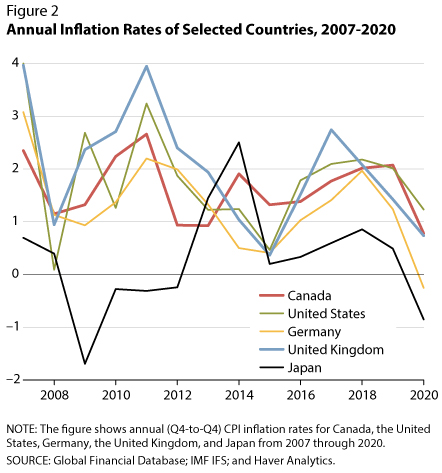

But correlation between international inflation rates also usually exists for shorter time spans. Figure 2 shows that international inflation rates generally moved together during 2007-20. For example, inflation rates were relatively high prior to the great Financial Crisis of 2007-09, then plunged sharply during that predicament. International inflation rates tended to rise and fall together, finally ending with low values in 2020. Japanese inflation during 2014-15 was an exception to this comovement because the introduction of a Japanese consumption tax hike temporarily boosted the inflation rate.1 Depending on the sample, the data frequency, and the model, researchers attribute 25 to more than 70 percent of inflation variability to international influences.2

Many factors potentially make inflation rates move together both globally and regionally—international commodity price shocks, especially oil shocks; comovement in business cycles; and price spillovers through traded goods. Researchers dispute the relative importance of these factors, but common supply shocks appear to be important determinants of inflation comovements.

Indeed, inflation rates have historically been more internationally synchronized than business cycle variables, such as output and employment, and the synchronization has broadened to include more types of goods and services. The globalization of supply chains, labor, and financial markets has helped link price changes more tightly.3

Economic theory is an important—but often-overlooked—channel of international inflation correlation. Central bankers and other economists communicate about how their economies work, and flawed academic models caused them to make the same sorts of mistakes at the same time. Most obviously, many central banks made the same mistake of allowing inflation to rise in the 1960s and 1970s. After their publics had begun appreciating the costs of inflation, many of these central banks took hard decisions to reduce inflation in the late 1970s and early 1980s.4

Figure 3 illustrates the similarities in U.S. and international inflation for 1951-2020. A statistical model of common components in international inflation rates produces the "predicted value" in the figure.5 The predicted values mirror not only the large swings in actual U.S. inflation, but also higher frequency movements.

It isn't obvious that such international influences should exist. For example, exchange rates can offset the domestic effect of higher import prices, and commodity price shocks need not lead to inflation, but rather to a one-time price rise, if central banks do not accommodate such shocks. Despite the potency of international influences over the short and even medium term, one should not overemphasize their power in the long run. Economists believe that an appropriate combination of domestic fiscal and monetary policies can (approximately) achieve a desired average inflation rate over a period of some years.

Figure 2 shows that international inflation rates generally fell substantially during the 2020 COVID-19 lockdown. Very large fiscal and monetary stimulus have assisted international economies to recover from that episode. As a result, expected inflation rates have recently risen in many countries. We shall see whether actual inflation follows.

Notes

1 Strong expansionary measures by the Bank of Japan in the wake of Prime Minister Abe's late-2012 election boosted Japanese inflation starting some months prior to the consumption tax hike. When the consumption tax was introduced, Japanese after-tax consumer prices jumped immediately, boosting the inflation rate. Twelve months later, when this price jump left the year-over-year calculations, the inflation rate fell again. Thus, Figure 2 shows a jump in the inflation rate that lasted about one year.

2 See Ciccarelli and Mojon, 2010; Neely and Rapach, 2011; and Ha, Kose, and Ohnsorge, 2019.

3 See Auer, Borio, and Filardo, 2017.

4 See Nelson, 2005a, 2005b; and Nelson and Nikolov, 2004.

5 See Neely and Rapach, 2011.

References

Auer, R.; Borio, C.E. and Filardo, A.J. "The Globalisation of Inflation: The Growing Importance of Global Value Chains." CEPR Discussion Papers 11905, 2017; https://ideas.repec.org/p/cpr/ceprdp/11905.html.

Ciccarelli, M. and Mojon, B. "Global Inflation." Review of Economics and Statistics, MIT Press, August 2010, 92(3), pp. 524–35; https://doi.org/10.1162/REST_a_00008.

Ha, J.; Kose, M.A. and Ohnsorge, F., eds. Inflation in Emerging and Developing Economies, World Bank Publications, No. 30657, June 2019; https://ideas.repec.org/b/wbk/wbpubs/30657.html.

Neely, C.J. and Rapach, D.E. "International Comovements in Inflation Rates and Country Characteristics." Journal of International Money and Finance, Elsevier, 2011, 30(7), pp. 1471-90; https://doi.org/10.1016/j.jimonfin.2011.07.009.

Nelson, E. "The Great Inflation of the Seventies: What Really Happened?" B.E. Journal of Macroeconomics, De Gruyter, July 2005a, 5(1), pp. 1–50; https://doi.org/10.2202/1534-6013.1297.

Nelson, E. "Monetary Policy Neglect and the Great Inflation in Canada, Australia, and New Zealand." International Journal of Central Banking, May 2005b, 1(1), pp. 133–179; https://www.ijcb.org/journal/ijcb05q2a4.pdf.

Nelson, E. and Nikolov, K. "Monetary Policy and Stagflation in the U.K." Journal of Money, Credit, and Banking, Blackwell Publishing, June 2004, 36(3), pp. 293–318; https://doi.org/10.1353/mcb.2004.0058.

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed