Measuring Market-Based Inflation Expectations

One measure of financial-market inflation expectations is the difference between the yields on constant-maturity nominal Treasury securities and Treasury Inflation-Protected Securities (TIPS). Payments on nominal securities are fixed. That is, they are not adjusted for inflation. Payments on TIPS are adjusted for inflation—specifically, changes in the consumer price index (CPI).1

This difference between nominal and inflation-adjusted (real) Treasury yields is sometimes called the breakeven inflation rate (BEI) because, if actual inflation comes in at the BEI rate, then holders of nominal and real Treasury bonds will get the same return. Because the BEI rate provides the same return and, thus, a risk-neutral investor would be indifferent between holding the two types of bonds, BEI is considered a forecast of future inflation. This easy-to-measure gauge of the Treasury market's expectation for average inflation (over a given horizon) has been a boon to economists and policymakers since it was first introduced in the United States in the late 1990s.2

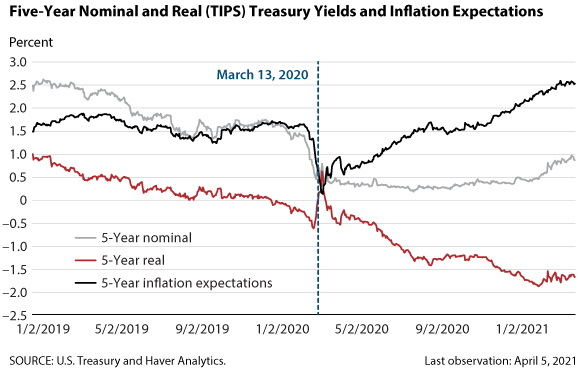

The figure shows the yields on nominal and real 5-year Treasury securities and the difference between those yields: that is, the five-year BEI that measures the bond market's expectation of average inflation over the next five years. The vertical line marks March 13, the Friday before the FOMC meeting announcement on Sunday, March 15, 2020. At the conclusion of that meeting, the FOMC lowered its intended federal funds target to the effective lower bound (0 to 0.25 percent) and also announced its intention to resume purchases of Treasury securities and mortgage-backed securities to help combat rapidly deteriorating economic and financial market conditions associated with the onset of the COVID-19 pandemic.3 This expansionary announcement caused a brief surge in BEI before the measure began falling again, as the extent of the COVID-induced recession became apparent.

Mechanically, the BEI measure of inflation expectations increases if (i) yields on nominal Treasury securities increase or (ii) yields on TIPS decrease. Over the past year, BEI expectations have mostly risen because of declines in real Treasury yields.

- Since March 13, 2020, the 5-year TIPS yield has declined by 1.87 percentage points.

- The 5-year nominal Treasury yield has risen by 0.15 percentage points.

- Thus, the 5-year BEI has risen by 2.02 percentage points to a little more than 2.5 percent. The all-time high is 2.94 percent, which occurred in mid-March 2005.

What do these yield changes tell us about market expectations of real growth and inflation?

Although the 5-year TIPS yield briefly rose prior to the FOMC's action on March 15, 2020, the real yield declined persistently after the FOMC's action and is now near a record low, in negative territory. Because real yields tend to reflect expectations of real activity, as measured by indicators such as payroll employment and labor productivity, the sharp decline in the 5-year TIPS yield in the aftermath of the pandemic-spawned recession was not too surprising. The continued decline in real yields in the midst of a strong rebound in real GDP growth over the second half of 2020—and the expectation of strong real GDP growth in 2021 and 2022 by private-sector forecasters and FOMC participants—is surprising.4

If investors perceive higher future inflation, they will bid down the yield on available TIPS, which implies an increase in its price, thus signaling an increased demand for TIPS.5 Two recent developments could explain the increased demand for TIPS. First, the Fed has increased its holdings of TIPS securities by $203.7 billion to about $335 billion from February 2020 to March 2021. Over this period, the Fed's TIPS holdings have increased from about 8.75 percent to a little more than 21 percent of the amount outstanding. Research has shown that Federal Reserve asset purchases modestly reduce yields on Treasury securities—nominal or TIPS—through their influence on expected short-term rates, term premiums, and/or liquidity premiums.6 Second, since TIPS offer a hedge against inflation risks, demand for such securities may be up because investors are worried about the long-run inflationary effects of large federal budget deficits and, perhaps most important, the Fed's new strategy that seeks to achieve inflation moderately above 2 percent for some time. In other words, fiscal and monetary developments may be driving the rise in BEI rates.

Notes

1 The TIPS principal is also adjusted according to changes in the CPI to maintain a constant principal value in real terms. The principal of the nominal Treasury security is not adjusted for price changes.

2 Technically, the nominal Treasury yield comprises three components: the real yield, the BEI, and the inflation risk premium that compensates investors for the risk that actual inflation may be higher than expected over the life of the security. An inflation risk premium is also embedded in TIPS yields, but TIPS yields also contain a liquidity premium; the latter is the extra compensation investors demand to hold securities that are less liquid than nominal Treasury securities. This liquidity premium increases the real yield and thus reduces the BEI.

3 See https://www.federalreserve.gov/monetarypolicy/files/monetary20200315a1.pdf.

4 See the FOMC's March 2021 Summary of Economic Projections: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210317.pdf.

5 Bond prices and yields move in opposite directions because a bond yield is defined as the interest rate that discounts the bond's payoff to equal the bond's price. For the case of a simple one-year, zero-coupon bond, the relation is

For a given payoff, a rise (fall) in the bond price requires a lower (higher) yield to discount the payoff to equal the price.

6 See Christensen and Gillan (2019) or Bhattarai and Neely (forthcoming).

References

Bhattarai, Saroj and Neely, Christopher J. "An Analysis of the Literature on International Unconventional Monetary Policy." Journal of Economic Literature, forthcoming.

Christensen, Jens H.E. and Gillan, James M. "Does Quantitative Easing Affect Market Liquidity?" Federal Reserve Bank of San Francisco Working Paper 2013-26, December 2019.

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed