The Rising Complexity of the FOMC Statement

Over the years, the Federal Reserve has developed numerous communication tools aimed at increasing transparency.1 One tool in particular has evolved significantly—post-meeting statements by the Federal Open Market Committee (FOMC), the body within the Federal Reserve in charge of setting monetary policy. The FOMC began releasing these statements in February 1994. Initially, the statements provided a brief summary of policy decisions and were released only if there was a change in the policy stance. Since the May 1999 meeting, the FOMC has issued a statement after every regularly scheduled meeting.2 Today, the statement details the FOMC's views on the current and future state of the economy, current policy choices, and the likely course of future policy decisions.

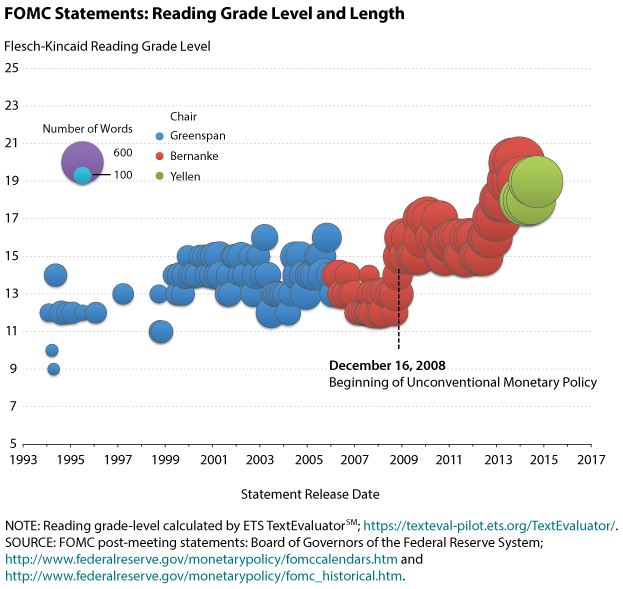

Increased FOMC transparency has benefitted financial markets by anchoring inflation expectations. But it also has led to longer and potentially more complex statements, which could unsettle financial markets if they are too difficult to understand.3 To analyze the clarity of FOMC statements, we use the Flesch-Kincaid Grade Level index, a readability measure based on education grade levels. The index combines two measures of text complexity—average word length and average sentence length—to generate a reading level that corresponds to a U.S. grade level or the number of years of education generally required to understand the text.4

The figure shows the reading grade level (bubble height) and the length (bubble size) of each FOMC statement since 1994. In the early 1990s, the statements ranged from about 50 to 200 words, with reading grade levels from 9 to 14. (That is, they were accessible to individuals with an education ranging from the first year of high school to two years beyond high school.)

During Federal Reserve Chair Alan Greenspan's tenure, which lasted until January 2006, FOMC statements averaged 210 words with a reading grade level of 14. The statements continued on this track with Chair Bernanke from March 2006 until the end of 2008, when they started to change dramatically with the onset of the financial crisis and the beginning of so-called unconventional monetary policy.5 By January 2009, the statements were over 400 words with reading grade levels around 16.

Under Chair Yellen, the FOMC issued five statements from March to September 2014. All five exceeded 800 words and had reading grade levels of 18 or 19, suggesting that readers would require an education level of about three years beyond a four-year college degree to understand them.

Our analysis indicates that, while the FOMC has lengthened its post-meeting statements to provide more information about policy decisions, the statements have increased in complexity. Economist David-Jan Jansen (2011) suggests that clear Fed communications help reduce volatility in financial markets. Unclear communications, on the other hand, may cause market participants to delay important investment decisions, generating more uncertainty. With the recent financial crisis, the complexity of unconventional policies likely contributed to the increased reading grade levels of FOMC statements. As the Fed returns to using conventional monetary policy tools, it is likely that the reading levels of its statements will decline. However, if the Fed continues to use unconventional instruments for a considerable period, it may need to consider how to explain its policy actions in simpler terms to avoid volatility in financial markets.

Notes

1 For a historical description of the various FOMC communication tools, see http://www.federalreserve.gov/monetarypolicy/fomc_....

2 Wynne (2013).

3 Gomes (2013).

4 See Flesch (1948) and Kincaid et al. (1975). A higher reading grade level indicates a text is more difficult to read because it contains longer words or longer sentences, not because of ambiguity or less-familiar words.

5 In the December 2008 statement, the Federal Reserve established the current 0 to 0.25 percent target range for the federal funds rate and began its first round of quantitative easing.

References

Flesch, Rudolph. "A New Readability Yardstick." Journal of Applied Psychology, June 1948, 32(3), pp. 221-33.

Gomes, Joao. "The Bernanke Fed's Transparency Has Been Rather Opaque." Real Clear Markets, December 18, 2013; http://www.realclearmarkets.com/articles/2013/12/1... transparency_has_been_rather_opaque_100800.html.

Jansen, David-Jan. "Does the Clarity of Central Bank Communication Affect Volatility in Financial Markets? Evidence from Humphrey-Hawkins Testimonies." Contemporary Economic Policy, October 2011, 29(4), pp. 494-509.

Kincaid, J. Peter; Fishburne, Robert P.; Rogers, Richard L. and Chissom, Brad S. "Derivation of New Readability Formulas (Automated Readability Index, Fog Count and Flesch Reading Ease Formula) for Navy Enlisted Personnel." Research Branch Report 8-75, Naval Technical Training Command, February 1975; http://www.dtic.mil/dtic/tr/fulltext/u2/a006655.pd....

Wynne, Mark A. "A Short History of FOMC Communication." Federal Reserve Bank of Dallas Economic Letter, September 2013, 8(8), pp. 1-4; http://www.dallasfed.org/assets/documents/research....

The original version of this Economic Synopses essay, published October 31, 2014, included an incorrect reading grade level (14) for the September 17 FOMC statement. The corrected value (19) is shown in the figure.

© 2014, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed