Exploring the Dynamics of Unemployment

"Unemployment is of vital importance, particularly to the unemployed."

—Edward Heath

Introduction

Think of some reasons people become unemployed. Did you think of someone quitting, getting fired, or being laid off? Well, all of those reasons are correct; and, if the people who experience any of those events actively seek new work, they're considered unemployed and part of the labor market. But it's not just those who quit, are fired, or are laid off who enter the labor market. Some enter the market for the first time, and some get back into it after being out for some time.

This article provides Bureau of Labor Statistics (BLS) Consumer Population Survey (CPS) data on when people

- enter the labor market for the first time (new entrants),

- return to the market after being out for a while (re-entrants),

- choose to quit for a different job (job leavers), and

- lose their job and decide to find another one (job losers).

Each dataset provides information about labor market and economic conditions. We'll explore these unemployed groups and how they may behave differently over time and during recessions, which are typically associated with an increase in the overall unemployment rate.

Unemployment and the Business Cycle

Let's start with some basics. Economists and agencies such as the BLS define unemployment as a condition where people at least 16 years of age are without jobs and actively seeking work. Notice there are two conditions (besides age): The person is (1) without work and (2) looking for work.

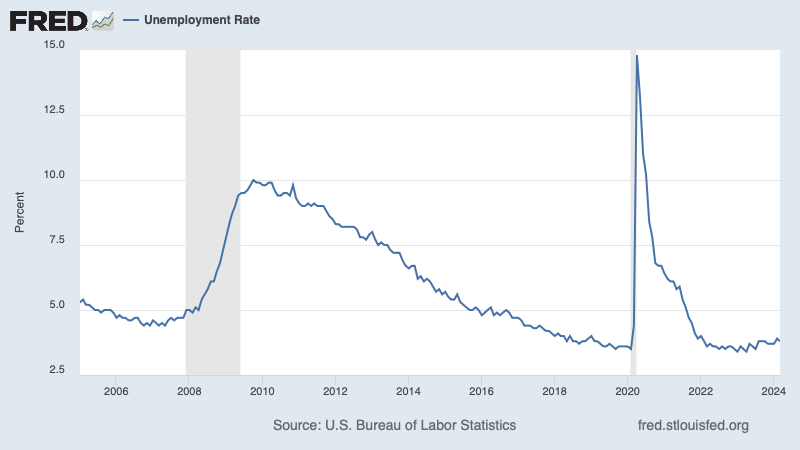

Figure 1

Unemployment Rate

SOURCE: US Bureau of Labor Statistics via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1jVuT.

Figure 1 shows the unemployment rate between 2005 and 2024. Each shaded area of the graph represents a recession (a contractionary phase of the business cycle).1 Note that the overall unemployment rate tends to be sensitive to business cycles. When the economy is contracting, such as during the Great Recession of 2008-09, fewer people are employed (an increase in the unemployment rate). Economists associate cyclical unemployment with recessions in the business cycle. When the economy is expanding, more people are employed (a decrease in the unemployment rate). Economists associate frictional unemployment with these times; unemployed people tend to be either new entrants to the labor market (such as recent graduates) or re-entrants (returning to the labor market after being out for a while).

The graph shows the unemployment rate overall, but the number of new entrants, re-entrants, job leavers, and job losers changes depending on economic conditions; how much they change tells us how sensitive each group is to the business cycle—cyclical sensitivity.

Entering the Labor Market

Everyone's journey through the labor market starts somewhere. More specifically, it starts with your first job. New entrants have never worked before and are entering the labor force for the first time.2 They are mainly students transitioning from education to employment. When new entrants begin their job search, they don't have a job (yet) but are officially looking for work, so they count as unemployed (frictionally unemployed). New entrants make up around 10% of the total unemployed.

However, new job seekers aren't the only ones jumping into the labor market; re-entrants previously worked but were out of the labor force before searching for another job. Re-entering the labor market is a personal and economic decision.

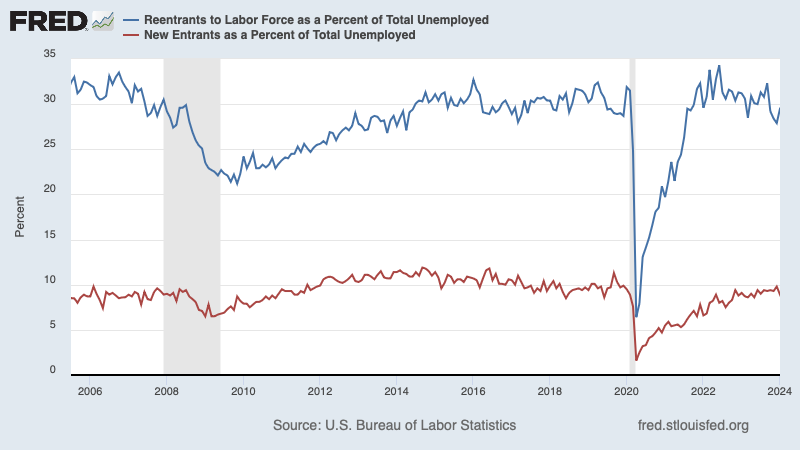

Figure 2

Re-entrants and New Entrants as a Percent of Total Unemployed

SOURCE: U.S. Bureau of Labor Statistics via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1jVvt.

Re-entrant unemployment is cyclically sensitive (Figure 2, blue line).3 When compared with new entrants (red line), re-entrants make up a more significant percentage of the total unemployed,4 particularly when there is economic expansion. As the economy expands, the percentage of re-entrants slowly increases because there is increased confidence the labor market is more favorable for job seekers. Conversely, as the economy contracts (such as during the 2008-09 and 2020 recessions), the proportion of re-entrants decreases significantly because they end their job searches, leaving the labor market.

Leaving the Labor Market Voluntarily

Job leavers voluntarily quit their job and look for new work.5 We also call these instances voluntary separations or voluntary layoffs. Job leavers can provide information about how people feel about the labor market's strength. For example, in the post-pandemic recovery of 2021-23, factors like re-evaluation of work-life balance and a tight labor market led to an increased number of job leavers, as they were seeking higher-paying jobs or new opportunities. So, an increase in the number of job leavers can indicate a healthy labor market: It shows that workers are confident about their chances of finding a new job and that they'll voluntarily leave their current job.

Figure 3

Job Leavers as a Percent of Total Unemployed

SOURCE: U.S. Bureau of Labor Statistics via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1jVvY.

Figure 3 shows job leavers as a percent of the total unemployed from 2005 to January 2024. During recessions, such as the Great Recession of 2008-09, the percentage of job leavers declines, as fewer people leave their jobs due to uncertainty about finding new ones; this is driven by decreased business investment and demand for hires. Conversely, in economic expansions, more job leavers emerge as confidence grows, businesses invest more, and hiring increases. For example, as the economy recovered after the Great Recession (expansionary phase), the percentage of job leavers climbed upward and started to exceed pre-recession levels until the 2020 pandemic.6 In September 2022, the percentage of job leavers peaked at 16%, and in October 2023 it returned to a pre-pandemic level of 12.3%, indicating the conclusion of what was headlined the "Great Resignation" or "Great Reshuffle."7 The percentage of unemployed job leavers is still relatively small, and the percentage change among this group is the smallest throughout business cycles, indicating minimal cyclical sensitivity.

Leaving the Labor Market Involuntarily

Job losers are either temporarily laid off from a job but expect to be recalled or permanently laid off or fired from a job and begin looking for new work. We also call these instances involuntary separations or involuntary layoffs. Job losers have been particularly interesting to analyze because they make up the largest single group of the unemployed.8

Figure 4

Job Losers as a Percent of Total Unemployed

SOURCE: U.S. Bureau of Labor Statistics via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=1jVwg.

Figure 4 shows job losers as a percent of the total unemployed from October 2005 to January 2024. The recessions in 2008-09 and 2020 show that the change in the percentage of job losers was reactive to each economic downturn. During the Great Recession it increased; after the recession ended in June 2009 the labor market recovery was slow, with the percentage of job losers ultimately returning to pre-recession levels in March 2015.9 With a substantial period of economic expansion in the following years, the percentage of job losers decreased.

Each recession affects some industries more than others. During the 2020 recession, workers in the leisure and hospitality industry were the hardest hit.10 This is an example of why job losers are the most cyclically sensitive of the four unemployed groups: As much as 70% of total business costs are employees.11 During recessions, when businesses are dealing with decreased revenues, they look to cut their numbers of employees, investing less in labor.

Conclusion

Why does this information matter? Maybe you have been part of one of these unemployed groups or know someone who experienced unemployment, either voluntarily or involuntarily. When people experience unemployment, there is a reaction among each group, and how each group reacts plays a role in defining what the labor market looks and feels like for the unemployed, employed, and businesses. How cyclically sensitive each group is can also provide valuable insights for policymakers to make the best decisions for the economy and for businesses to recover after a downturn or continue to grow at a healthy rate.

Notes

1 The National Bureau of Economic Research (NBER) Business Cycle Dating Committee maintains a chronology of U.S. business cycles, which identifies the dates of peaks and troughs that frame economic recessions and expansions. A recession is the period between a peak of economic activity and its subsequent trough, or lowest point. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief. However, the time it takes for the economy to return to its previous peak level of activity, or its previous trend path, may be quite extended. According to the NBER chronology, the most recent peak occurred in February 2020; the most recent trough occurred in April 2020. See https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions.

2 U.S. Census Bureau. "Current Population Survey: Design and Methodology." Technical Paper 66, October 2006; https://www2.census.gov/programs-surveys/cps/methodology/tp-66.pdf.

3 Gilroy, Curtis L. and McIntire, Robert J. "Job Losers, Leavers, and Entrants: A Cyclical Analysis." JSTOR Monthly Labor Review, November 1974, 97(11), pp. 35-9; http://www.jstor.org/stable/41839192. Accessed March 7, 2024.

4 Note that during the COVID recession, new-entrant unemployment seems to be equally sensitive (in terms of percentage drop).

5 U.S. Census Bureau, 2006. (See footnote 2.)

6 Lambert, Thomas E. "The Great Resignation in the United States: A Study of Labor Market Segmentation." Taylor & Francis Journals Forum for Social Economics, 2023, 52(4), pp. 373-86; https://doi.org/10.1080/07360932.2022.2164599.

8 Gilroy and McIntire, 1974. (See footnote 3.)

9 Weinberg, John. "The Great Recession and Its Aftermath." Federal Reserve Bank of Richmond, Federal Reserve History, 2013; https://www.federalreservehistory.org/essays/great-recession-and-its-aftermath.

11 See https://www.bizjournals.com/bizjournals/news/2022/05/01/the-biggest-cost-of-doing-business.html.

© 2024, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Business cycle: The fluctuating levels of economic activity in an economy over a period of time measured from the beginning of one recession to the beginning of the next.

Cyclical unemployment: Unemployment associated with recessions in the business cycle.

Frictional unemployment: Unemployment that results when people are new to the job market (for example, recent graduates) or are transitioning from one job to another.

Unemployment rate: The percentage of the labor force that is willing and able to work, does not currently have a job, and is actively looking for employment.

follow @stlouisfed

follow @stlouisfed