Examining Racial Wealth Inequality

"To turn $100 into $110 is work. To turn $100 million into $110 million is inevitable."

—Edgar Bronfman, Canadian businessman (1929-2013)

Introduction

If you have ever worked at a job, owned a business, or received interest from your bank, then you have earned an income. Income is most often associated with the money people earn for the work they do, and economists typically study income relative to how much is earned in a given year.

In order to investigate economic inequality between races, this article will often compare median income and wealth for respective groups. You may remember calculating medians and averages in middle school math class. The median is defined as the middle number in a set of numbers.

Consider, for example, three middle school students who each complete chores to earn a weekly allowance from their parents: Dynitta receives $3, Max receives $1, and Sarah receives $20. To find the median allowance, we first have to list the numbers in order from lowest to highest: $1, $3, $20. The middle number in the list is the median; so, the median allowance is $3.

The median often provides a better description for the majority of a group than an average. To see why, let's calculate the average allowance—add up the allowances and divide by the number of students: average = ($1 + $3 + $20)/3 students = $8 per student. The average is over double Dynitta's allowance and eight times Max's allowance, whereas the median of $3 is at least in the ballpark of both Dynnita and Max. In this case, the median of $3 better represents what most of the group earns.

Income Inequality

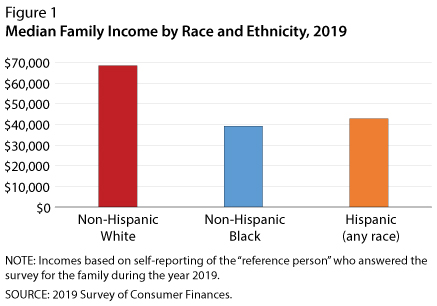

Based on a survey of American families in 2019 called the Survey of Consumer Finances,1 Figure 1 shows that the median yearly income of non-Hispanic White families ($68,000) exceeded that of non-Hispanic Black families ($39,000) and Hispanic families ($43,000) by a large margin.

Data from the U.S. Bureau of Labor Statistics show that as opposed to getting smaller, differences in wages and salaries between those of White and All Other households and those of Black households have endured over the past two decades (Figure 2). In fact, as Figure 3 shows, in the United States, Black households are not gaining ground in wages and salaries and may be falling farther behind White and All Other households.

Figure 2

Average Household Wages and Salaries by Race

NOTE: In 2015 dollars. Shaded areas indicate U.S. recessions.

SOURCE: U.S. Bureau of Labor Statistics and Organisation for Economic Co-operation and Development via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=KuTL.

Figure 3

Amount White and All Other American Households Earn in Wages and Salaries Above Those of Black American Households

NOTE: Averages in 2015 dollars. Shaded areas indicate U.S. recessions.

SOURCE: U.S. Bureau of Labor Statistics and Organisation for Economic Co-operation and Development via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=KuTY.

Wealth Inequality

While many politicians and policymakers often focus on closing the income gap between races, there is another form of economic inequality that has persisted over time and is important to consider: wealth inequality.

Individual wealth is usually measured as net worth, which is the value of a person's or family's assets minus the value of their liabilities, where liabilities is another word for debt. If the value of your assets exceeds the value of your liabilities, you have a positive net worth. Thus, the more positive net worth an individual possesses, the wealthier they are. Wealth offers a wide range of economic benefits, from having money for basic necessities when a surprise event occurs (e.g., illness or unemployment) to being able to afford housing, good public schools, or a college education.2

Disparities in wealth between races have existed throughout history and are currently more pronounced than disparities in income in the United States. For example, in 2019, the median income of non-Hispanic White families was less than double that of Black families (Figure 1), while the median net worth of non-Hispanic White families was roughly eight times that of Black families (Figure 4).

This wealth gap persists across all current adult generations (Figure 5). The Millennial generation has the highest gap, with the net worth of the median White family roughly 19.1 times that of the median Black family, while Generation X has the lowest, with a still significant 3.4 times difference.

Figure 6 looks at the wealth gap relative to a dollar of White family wealth and shows how the gap has also endured over time. In 2021, Black families held 23 cents in wealth and Hispanic families held 19 cents in wealth for every dollar held by White families, on average.3 In fact, over the preceding 32 years, the wealth gap between White and non-White families stayed relatively constant, with Black families holding on average 24 cents and Hispanic families 22 cents for every dollar held by White families (Figure 6).4

Figure 6

NOTE: "Real" indicates that values have been inflation adjusted to 2019 dollars.

SOURCE: Distributional Financial Accounts and Federal Reserve Bank of St. Louis Institute for Economic Equity calculations.

Persisting Wealth Inequality

Many research studies have examined why the racial wealth gap has endured over time. In a 2018 article, researchers investigate the role of education as well as age, race or ethnicity, and parents' education level on wealth outcomes.5 They determine that while obtaining a four-year college degree does improve wealth outcomes for all groups, it does not eliminate the wealth differences between groups. For example, for a middle-aged family whose head of household had parents without a college degree, obtaining a college degree (vs. not obtaining a college degree) lifts the expected net worth of the typical White family from $97,572 to $409,110, while it lifts that of the typical non-White family from $18,500 to $100,354. Both groups benefit greatly from a college education, but the wealth gap still exists between the two groups.

In fact, the researchers find what they refer to as a head-start effect, where if the family head has certain favorable inherited characteristics, their wealth will be boosted. Specifically, they determine that White families with college-educated parents typically had wealth outcomes that were higher than families without one or more of these traits. In the case of having college-educated parents, because such parents are generally wealthier than parents without such education, the authors point out that educated parents are better able to gift and leave more money to their children, invest more in their development, and provide greater financial security.

In another study, based on the 2019 Survey of Consumer Finances, researchers attribute persisting racial wealth inequality from one generation to the next to several factors.6 First, White families are more likely to receive an inheritance or gift, and in larger amounts, than Black or Hispanic families. Second, non-White families are less likely to own their home, often due to not having help with a down payment or being able to obtain a mortgage. Finally, non-White families are less likely to have a retirement account and/or an emergency savings account.

Historical Underpinnings of White-Black Wealth Inequality

For Black Americans, the roots of wealth inequality can be traced to slavery—when they owned little to no assets—but also to discriminatory policies and actions after slavery was abolished. These policies and actions include the following:

- Ownership of Land: After the Civil War, Union General William T. Sherman issued an order to redistribute land to former slaves as a form of reparations since land was a valuable asset to build wealth. President Andrew Johnson rescinded the order in late 1865, causing most former slaves who wanted to farm to have to rent land in a practice called sharecropping.7

- Access to Housing: The National Housing Act of 1934 made home loans and home ownership available for White people while allowing the Federal Housing Association to refuse to back loans to Black people or even those living in predominantly Black neighborhoods.8 This practice, called redlining,9 was effectively used to deny homeownership and thus deny Black families the ability to build wealth through their homes.

- Access to Education: Many states and universities denied Black students access to educational institutions under the guise of segregation10 policies that intended to keep Black and White Americans "separate but equal." Supreme Court rulings were often required, such as McLaurin v. Oklahoma State Regents for Higher Education (June 5, 1950) that addressed taxpayer funded education, to force universities to accept Black students in spite of state laws.11

- Access to Credit: The GI Bill of 1944 was established to help World War II veterans adjust to life upon returning home by offering low interest mortgages and business loans. However, the benefits were denied to many Black veterans.12

Impacts of the COVID-19 Pandemic on Inequality and the Economy

Average Family Wealth: Real (i.e., inflation-adjusted) average, family wealth fell for most groups early in the pandemic—in the first quarter of 2020. However, many of those losses reversed in the second quarter and, as of the most recent data (2021:Q1), average wealth was at all-time highs for White, Black, and Hispanic families and families of all education levels except those without high school diplomas. Nevertheless, large, persistent racial, ethnic, and educational wealth gaps remain.*

You may naturally wonder how COVID-19 has affected median wealth. Data that capture median wealth are only released every three years, most recently in 2019. We thus need to rely on other measures of financial well-being to understand how the typical household fared.

Two Different Recoveries: While some families, particularly those who were better off before the pandemic, have done quite well, others with less assets or higher demands on their time have done more poorly. Women, particularly women of color and mothers of young children, were hit hard early on in the pandemic.† Many juggled greater caregiving responsibilities as schools and daycares closed or introduced remote learning and also faced higher unemployment rates and greater drops in labor force participation rates than men.‡

* Kent, A.H. and Ricketts, L.R. "The Real State of Family Wealth: Quarterly Trends in Average Wealth and Demographic Wealth Inequality." Federal Reserve Bank of St. Louis, July 2021; https://www.stlouisfed.org/household-financial-stability/the-real-state-of-family-wealth.

† Covington, M. and Kent, A.H. "The 'She-Cession' Persists, Especially for Woman of Color." Federal Reserve Bank of St. Louis On the Economy Blog, December 24, 2020; https://www.stlouisfed.org/on-the-economy/2020/december/she-cession-persists-women-of-color.

‡ Boesch, T.; Grunewald, R.; Nunn, R. and Palmer, V. "Pandemic Pushes Mothers of Young Children Out of the Labor Force." Federal Reserve Bank of Minneapolis, February 2021; https://www.minneapolisfed.org/article/2021/pandemic-pushes-mothers-of-young-children-out-of-the-labor-force.

Summary

Black and Hispanic Americans have experienced ongoing income inequality and even more substantial wealth inequality compared with White Americans. This inequality persists across time, generations, and education levels. While education in the form of a college degree is shown to improve wealth outcomes for all groups on average, obtaining a college degree alone does not eliminate the racial wealth gap. As the data show, inherited factors such as family wealth, housing ownership, family education, and lack of access to banking services can play significant roles in maintaining wealth disparity. Thus, there are many complex factors affecting wealth, and policymaking will require a multi-faceted approach to develop effective policies that address inequality.

Notes

1 Board of Governors of the Federal Reserve System. 2019 Survey of Consumer Finances. Updated November 4, 2021; https://www.federalreserve.gov/econres/scfindex.htm.

2 Aliprantis, D. and Carroll, D. "What Is Behind the Persistence of the Racial Wealth Gap." Federal Reserve Bank of Cleveland Economic Commentary, February 28, 2019; https://www.clevelandfed.org/newsroom-and-events/publications/economic-commentary/2019-economic-commentaries/ec-201903-what-is-behind-the-persistence-of-the-racial-wealth-gap.aspx.

3 Kent, A.H. and Ricketts, L.R. "Real State of Family Wealth, Institute for Economic Equity." Updated November 1, 2021; https://www.stlouisfed.org/institute-for-economic-equity/the-real-state-of-family-wealth.

4 Based on data through the second quarter of 2021. Institute for Economic Equity. "Racial and Ethnic Household Wealth Trends and Wealth Inequality." Federal Reserve Bank of St. Louis, n.d.; https://www.stlouisfed.org/institute-for-economic-equity/the-real-state-of-family-wealth/racial-and-ethnic-household-wealth, accessed December 2021.

5 Emmons, W.R.; Kent, A.H. and Ricketts, L.R. "Essay No. 1: The Financial Returns from College Across Generations: Large But Unequal." Federal Reserve Bank of St. Louis The Demographics of Wealth, 2018 Series: How Education, Race and Birth Year Shape Financial Outcomes, February 2018; https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/files/pdfs/hfs/essays/hfs_essay_1_2018.pdf.

6 Bhutta, N.; Chang, A.C.; Dettling, L.J. and Hsu, J.W. "Disparities in Wealth by Race and Ethnicity." Board of Governors of the Federal Reserve System FEDS Notes, September 28, 2020; https://www.federalreserve.gov/econres/notes/feds-notes/disparities-in-wealth-by-race-and-ethnicity-in-the-2019-survey-of-consumer-finances-20200928.htm.

7 Myers, B. "Sherman's Field Order No. 15." New Georgia Encyclopedia, September 25, 2005; https://www.georgiaencyclopedia.org/articles/history-archaeology/shermans-field-order-no-15/. The Glossary definition for sharecropping is from the following: History.com Editors. "Sharecropping." Updated June 7, 2019; https://www.history.com/topics/black-history/sharecropping.

8 Gross, T. "A 'Forgotten History' of How the U.S. Government Segregated America" (transcript). NPR and WBEZ Chicago Fresh Air. May 3, 2017; https://www.npr.org/2017/05/03/526655831/a-forgotten-history-of-how-the-u-s-government-segregated-america.

9 The Glossary definition for redlining is from https://www.merriam-webster.com/legal/redlining.

10 The Glossary definition for segregation is from https://www.merriam-webster.com/dictionary/segregation.

11 Winston, R.; Peck, K.; Rowan, D.C. "Black Americans and the Law." Berkeley Law; https://www.law.berkeley.edu/library/legal-research/black-americans-and-the-law/, accessed December 2021.

12 Blakemore, E. "How the GI Bill's Promise Was Denied to a Million Black WWII Veterans." History.com, June 21, 2019; http://www.history.com/news/gi-bill-black-wwii-veterans-benefits.

© 2022, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Asset: A resource with economic value that an individual, corporation, or country owns with the expectation that it will provide future benefits.

Average: For a set of numbers, it is equal to the sum of the numbers divided by the amount of numbers in the set.

Income: The payment people receive for providing resources in the marketplace. When people work, they provide human resources (labor) and in exchange they receive income in the form of wages or salaries. People also earn income in the forms of rent, profit, and interest.

Interest: The price of using someone else's money. When people place their money in a bank, the bank uses the money to make loans to others. In return, the bank pays interest to the account holder. Those who borrow from banks or other organizations pay interest for the use of the money borrowed.

Liability: 1. Money owed; debt. 2. Legal responsibility.

Median: The value in an ordered set of values below and above which there is an equal number of values; the number that divides numerically ordered data into two equal halves; the middle number of a set of numbers.

Net worth: The value of a person's assets minus the value of his or her liabilities.

Redlining: The illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents).

Segregation: The practice or policy of keeping people of different races, religions, etc., separate from each other.

Sharecropping: The act of farming land that belongs to someone else. The sharecropper only receives a portion of the crop farmed, with the rest going to the landowner.

follow @stlouisfed

follow @stlouisfed