Money and Missed Opportunities

"The way we should think about the opportunity cost of money is that when we spend money on one thing, it's money that we cannot spend on something else, neither right now, nor any time later."

—Dan Ariely, author of Dollars and Sense

Imagine you're at the mall and deciding between two different smoothie flavors—mango or strawberry-banana. Both cost $7. If you're like most people, you think simply about whether you want the drink; if yes, you are likely to pay the $7. Now imagine you put on a unique pair of "economist glasses" that allow you to see the world from an economic perspective. In this scenario, you are likely to ask yourself a series of questions: "How much do I value this smoothie?" "What am I giving up now to have a smoothie?" "What am I giving up in the future to have this smoothie now?" The critical difference is that you are more likely to consider the opportunity cost of your decision when looking at your options from an economic perspective.

Money and Opportunity Cost

We have many choices in life and must decide among them because we can't have everything we want. You can blame good 'ol scarcity (unlimited wants going after limited goods, services, time, money, and opportunities) as the reason we must make choices that involve costs and trade-offs. These costs are not limited to just money; they can also be social and emotional. But money is a way to access some of those wants.

It can be challenging to think of every possible use for the money you spend because there are so many possibilities. Opportunity costs make these choices even more complicated. Opportunity cost is the value of the next-best alternative when a decision is made; it's what is given up. Unfortunately, opportunity costs tend to be neglected. For example, rather than thinking of a smoothie transaction as costing $7, think of it as costing a ticket for that movie you've been wanting to see or perhaps $7 from your college fund. Too often, people fail to consider all the options when faced with a decision.

We all face opportunity costs. For example, professional athletes often sign very lucrative contracts with major league teams at a young age. In these cases, they receive large incomes at a relatively young age and in many cases before they even graduate college. Their lack of knowledge about how to handle and allocate large amounts of money often results in many high-priced impulse purchases. They do not visualize or consider the opportunity costs of some of their financial decisions. Their lack of awareness regarding how, on what, and the rate they spend their earnings during their professional careers (which are not lifetime careers) leads to almost 80 percent of professional athletes declaring bankruptcy or experiencing financial stress within five years of retirement.1 Had they taken the time to think about the opportunity costs of their financial decisions, they may not have had to face the consequences of their impulse spending.

Opportunity Costs and Not Going Broke

Studies have shown that opportunity costs are neglected even more so when making high-priced purchases, such as a home or car. Let's say, for example, you're purchasing a pre-construction home with a base price of $200,000. Buying a pre-construction home allows you to customize the house by choosing paint colors, flooring, cabinets, doorknobs, hinges, and other accessories and finishes. Notice that the price stated is a "base price"—that is, the price before the added costs of any customizable options. You go down the list of options, and you see one for satin nickel doorknobs and hinges that cost $1,300 (it could be a house with 16 doors). It's an upgrade from the standard brass hardware, which does not cost extra. You say to yourself, "Well, what's another $1,300 relative to the $200,000 I'm willing to spend?" This way of comparing the price of doorknobs to the cost of the house is known as relative value, the value of one item relative to the value of another item.2 Do you know what the real value of those doorknobs and hinges are? Like most people, you may not, so you look for a different way to assess the value. It is easier in our minds to compare one item to another or, in this case, the price of the doorknobs to the price of the house. The $1,300 seems relatively inexpensive when compared to the $200,000; it is less than 1 percent (0.65 percent) of the total price.

Is this way of thinking considering opportunity costs? The real value of the $1,300 lies not in comparing it to the $200,000, but in considering that if you spent it, you would have $1,300 less in your bank account and have given up the opportunity to purchase $1,300 worth of other goods and services. Think for a minute about how much those doorknobs and hinges really mean to you. If you bought an older house that has brass doorknobs and hinges, without the option to customize before you move in, would you really pay $1,300 for someone to switch them all out? It is really about evaluating the value of that $1,300 by thinking more about the implicit alternatives—"unseen" opportunity costs—and not basing your decision solely on explicit alternatives—the information, alternatives, and opportunity costs present at the time of making a decision. It's about thinking beyond the present and assessing alternative uses for the money—that is, not being shortsighted.

The "Unseen" Costs

One of the authors of Dollars and Sense, Dan Ariely, and his research assistant visited car dealerships to test how shortsighted consumers can be when purchasing cars. They surveyed people at a Toyota dealership and asked what they thought the opportunity cost would be if they purchased the Toyota. The hope was that people would include in their answers both the explicit and implicit alternatives for the amount they were willing to spend. Surprisingly, most people did not have a comprehensive answer. When Ariely posed the question differently by asking what other goods and services they could not purchase if they bought the Toyota, most consumers answered by stating they could not buy another brand of vehicle (e.g., a Honda) or other simple alternatives. Consumers were spending a large sum of money, and they did not seem to think about all the other financial opportunities they had with that money.3

Consumers shopping for cars tend to focus on the explicit alternatives, not the implicit alternatives. Car dealerships do not post signs that say "You can buy a car today for $24,000, or pay for college tuition!" They are more likely to advertise that their brand is better and a better value compared with other car brands, models, and prices, which focuses on only one use for the money—a car. Dealerships also throw in what they consider mind-blowing deals and decorate their showrooms with balloons. It's like welcoming you to a car-buying party.4

Impatience

"No opportunity cost, I want it now!" …may be something you'll say to yourself while you shop and start thinking of the opportunity costs of your decisions. Most of our decisionmaking that involves money is based on immediate or sooner-than-later consumption.5 One opportunity cost that people may think of when spending money is not having that amount to save. The benefits of saving are not realized until sometime in the future, while the costs of saving are felt now. Saving is setting money aside, so you may have less to spend now but hopefully more money in the future.

The excitement of consuming today is valued significantly more than the thought of consuming in the future. The various forms of payments involving borrowing money (also referred to as "charging it") allow people to enjoy goods today and pay them off later, blurring the future effects of our spending decisions. Some of these various forms of payment are credit cards, rent-to-own purchases, and car loans.6 In these cases, consumers enjoy the benefits today, while the costs are pushed off to the future. Considering choices carefully and not neglecting opportunity costs are both significant when making decisions about what and why you purchase anything using credit. There are times when individual decisions offer more incentives if we wait—that is, saving up money and paying with cash versus borrowing money and committing future income toward a monthly payment plus interest. Borrowing is negative saving, and some people borrow to spend more money than they earn (imagine someone purchasing items totaling $40,000 when they earn only $30,000 a year). People will have to save more money in the future, and thus consume less in the future, if they borrow funds for consumption today.

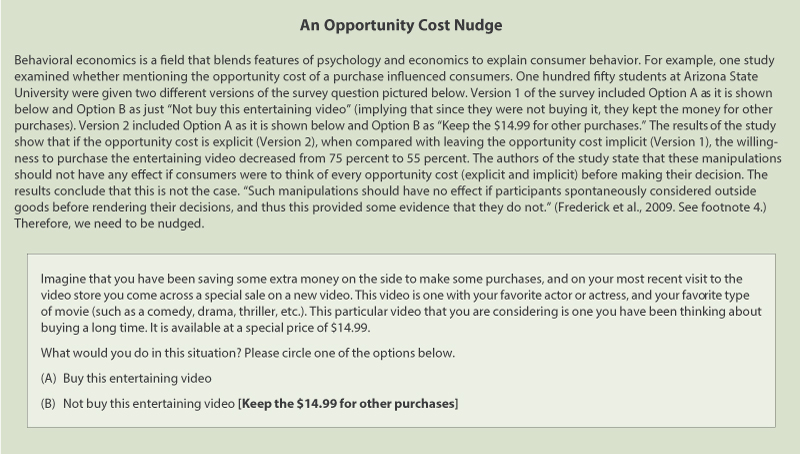

Some professional athletes have shared their stories about how they overspent and incurred a significant amount of debt. They claim to have had plenty of cash, but their access to more money through credit was very enticing. The explicit alternatives between which house and which car(s) to buy were made more accessible to them through the buy-now, pay-later model of using credit. It seems that just like people in other careers, professional athletes need a little nudge to spend wisely. (See boxed insert.) As these athletes claimed, they wish they would have thought of the opportunity costs of their careless spending during their careers. For example, instead of spending $150,000 on a third fancy car, they could have saved or invested it for future income once their professional careers ended.7

Conclusion

While it may not sound like a lot of fun to think about the opportunity costs of every financial decision, we need to be careful and not get too caught up in an "autopilot" mode of decisionmaking. Thinking about everything we could do with our money is hard. At the time you make a purchase, remember that you can spend the money only once. More costs exist, so you may miss future opportunities such as a more significant purchase, interest earned on savings, bill payments, or other possibilities. The difficulty of considering several options leads us to revert to mental shortcuts during our decisionmaking.

Think of as many alternative uses for your money as you can. If you haven't done this often, begin doing it little by little, even for small purchases such as a pack of gum or can of soda. Thinking of opportunity costs may go quicker the more you do it. You probably won't think of every single opportunity cost all at once, because that would be exhausting. However, keep in mind that your future well-being depends on the financial decisions you make today. Remember that our most common money mistakes are failing to consider opportunity costs altogether or not considering them enough.8

Notes

1 Holmes, L. "ESPN's 'Broke' Looks At the Many Ways Athletes Lose Their Money." National Public Radio, October 2012; https://www.npr.org/series/pop-culture-happy-hour/2012/10/02/162162226/espns-broke-looks-at-the-many-ways-athletes-lose-their-money. Accessed July 18, 2019.

2 Ariely, D. and Kreisler, J. Dollars and Sense. New York, NY: HarperCollins, 2017.

3 Ariely and Kreisler, 2017. See footnote 2.

4 Frederick, S.; Novemsky, N.; Wang, J.; Dhar, R. and Nowlis, S. "Opportunity Cost Neglect." Journal of Consumer Research, 2009, 36(4), pp. 553-61; http://faculty.som.yale.edu/ravidhar/documents/OpportunityCostNeglect.pdf. Accessed July 19, 2019.

5 Thaler, R.H. Misbehaving: The Making of Behavioral Economics. New York, NY: W.W. Norton & Company, 2015.

6 Ariely and Kreisler, 2017. See footnote 2.

7 Holmes, 2012. See footnote 1.

8 Ariely and Kreisler, 2017. See footnote 2.

© 2019, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Consumers: People who buy goods and services to satisfy their wants.

Opportunity cost: The value of the next-best alternative when a decision is made; it's what is given up.

Scarcity: The condition that exists because there are not enough resources to produce everyone's wants.

follow @stlouisfed

follow @stlouisfed