Insurance: Managing Risk and Balancing Responsibility with Affordability

I've never been able to skydive, and I've always wanted to. I've probably done everything else, but for some reason the insurance company won't let me do it." 1

—Nick Cannon, rapper, comedian, entrepreneur, record producer

Have you ever wanted to go bungee jumping, hang gliding, or drive a race car? How about skydiving? Nick Cannon would like to try skydiving, but his insurance company doesn't want him to take the risk. Why would an insurance company be involved in Nick Cannon's activities? The insurance company probably doesn't care whether or not Nick Cannon performs stand-up comedy, so why object to skydiving? As you've probably guessed, the difference is that skydiving is riskier than standing on a stage being funny. Cannon would be putting himself—and his insurance company—at risk. He could get seriously injured—or worse—and the company would have to pay hospital bills and maybe lost income, which, considering Cannon's income, could be very expensive. Nick Cannon probably carries insurance just in case something bad happens, and a lot of other people carry insurance for that same reason. Transferring risk, or the chance of loss, is the main reason people buy insurance. When people buy insurance, they pay fees, or premiums, to protect themselves in the event of an accident or other covered loss. Insurance differs from many goods and services because people generally do not want to have to use their insurance coverage; most people don't want to get hurt bungee jumping. So, how did insurance get started?

A Brief History of Insurance

Fear of loss provides a strong motivation for people to protect themselves and their property. But accidents do happen, so insurance has existed in some form since ancient times. In Babylonia during the eighteenth century BC,2 the Code of Hammurabi included the first record of a form of insurance. While it wasn't like today's insurance, the Hammurabi Code provided a debtor legal freedom from repayment of loans if extreme difficulties prevented the borrower from repaying the debt. Examples of covered events included disasters such as floods, the inability to work, or death.3

In the Middle and Dark ages, tradespeople worked in apprenticeships for little or no pay until they became masters at their trade. As masters, they paid into organizations called guilds. In the event of a fire, robbery, death, or disability, the guild would pay for the costs of rebuilding or providing for the family affected by the loss. This arrangement of shared risk is the basis of group insurance, which is still around today.4 Because many people pay into a fund and individual losses are paid from the larger pool of money, no single loss is as devastating to an individual or the group. This spreading of risk provides protection at a smaller cost to each individual or family than covering the full cost of losses with their own savings.

Over time, insurance has become more sophisticated, using a math called actuary science. The risk of a loss caused by fire, tornado, death, or other catastrophic event is based on its probability, or how likely it is to occur. In the seventeenth century, Blaise Pascal, a mathematician, physicist, and religious philosopher, worked with another mathematician, Pierre de Fermat,5 and figured out how to determine the probability that certain events would occur. This meant insurers could make a reasonable guess as to the likelihood they'd have to pay for specific types of losses. The methods they used to calculate the risk of certain events are used in modern-day underwriting and rate setting—that is, determining how much to charge customers for different types of insurance.6

Types of Insurance

The ancient approach to managing losses by contributing to a group fund is very similar to today's insurance protection. Today, you can buy insurance coverage for your most expensive possessions, such as cars, houses, and businesses, as well as for your health and life. Insurance is generally divided into two broad categories: life, health, and disability insurance and property and casualty insurance. Property and casualty insurance is for material items, such as houses and cars, and for damage your actions might cause others.

Life Insurance

Life insurance is used primarily to replace the income of a deceased person and pay for funeral expenses. Life insurance can protect a family financially if the income of the person who dies is essential to the family. For example, if two parents each earn $50,000 per year and one dies, the family income is immediately cut in half. That would mean that a family might have to cut up to half of its spending. Many people buy life insurance to protect their family from serious financial loss temporarily in the event of a death, giving the family time to adjust financially. There are two basic types of life insurance, term and permanent. Term insurance is a specified death benefit amount purchased for a specific time period, say, $50,000 for 10 years. If the insured person were to die anytime within those 10 years, the insurance company would pay $50,000 to the person's beneficiary, the person designated in the policy to receive benefits. After 10 years, the insurance ends and there would be no payment. There are many variations of term insurance, however—for example, for 10-, 20-, and 30-year terms or as an annually renewable term—among others.

Permanent insurance is purchased for a specified amount, again, say $50,000, but it is priced so the policy remains in force for the insured person's entire life, up to age 100. Permanent insurance is likely to cost more because a payout is certain (for those 99 years of age or younger), but that is just one factor in the cost. For both term and permanent insurance, several factors are considered in determining not only the cost but also whether insurance will be granted in the first place. Underwriters consider the applicant's age and physical characteristics, such as height and weight, heart rate, and blood pressure. In addition, companies consider a person's health history, tobacco use, and other lifestyle choices. Remember probability? Underwriters will also consider the probability of death at certain ages as the result of tobacco use, certain health problems, or even jumping out of airplanes.

Health Insurance

If you broke your arm, would you have $2,500 to pay for treatment? What if your injury were more serious? The emergency room visit alone would cost over $1,000.7 Health insurance provides coverage to offset the costs associated with injury and illness. When people purchase insurance and pay premiums, the coverage usually provides for discounted payments for doctor visits, hospital stays, and medical treatment. Many health insurance policies have a co-payment (co-pay) for office visits. Co-pays are a set dollar amount the customer pays before the insurance company pays the difference. A typical co-pay for an office visit costs $15 to $30, while the actual charge for the office visit could be $120 to $150. In addition to co-pays, health insurance usually requires a deductible, an amount you must pay for expenses before the insurance company pays. The deductible amount is specified by the terms of the insurance policy. For example, if you have a $500 annual deductible, you must pay the first $500 of medical expenses for that year.

Disability Insurance

Sometimes an injury that results in an emergency room visit can also result in a long-term disability. If you couldn't work, what would you do for money? Disability insurance (sometimes called disability income insurance) would provide income in such a case. Again, there are many variations, but policies typically have a 30-, 60-, or 90-day waiting period before the policy starts paying. Disability insurance usually replaces less than 100 percent of a disabled person's income and has a time limit for payment—a year, for example. However, disability insurance can be the bridge that gets a person through a tough time of no work and no income.

Property and Casualty Insurance

Home and Renter's Insurance. Homeowners can transfer risk to a larger group by buying insurance, just as guild members did in the Middle Ages. In 2012, some people lost their homes in Hurricane Sandy. Were you one of them? Chances are you weren't, but it could be that your family's insurance premiums contributed to the home repairs of a Hurricane Sandy victim. The large repair bills were paid by many people's insurance premiums, so the risk was spread among many. In the event of a loss, such as a hurricane, fire, or tornado, insurance helps replace structures and personal belongings without requiring the homeowner to solely cover all of the expenses. Renters can buy insurance for their personal property. Underwriters evaluate properties, conditions, and applicants to determine good and bad risks for insurance companies. When evaluating risk for a building, underwriters look at the building's location, when and how it was built, the type of construction, its condition, and even how close it is to a fire hydrant.

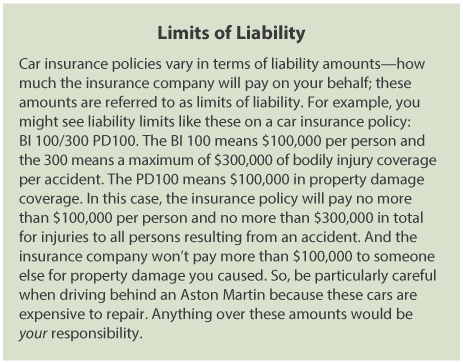

Auto Insurance. Chances are you know someone who has been involved in a car accident or has had car damage caused by fire, theft, or an errant tree limb. Once again, insurance comes to the rescue. But, what if you, while driving your car, cause damage to someone else's property? Most states require liability insurance coverage on motor vehicles. Liability means legal responsibility. Liability coverage pays for the damage you cause—or are responsible for—if you are at fault in an accident. The minimum coverages and requirements vary slightly from state to state, however, so make sure you understand your state's laws. See the "Limits of Liability" boxed insert for more on this important aspect of insurance.

A separate type of insurance pays for damage to your own car from any covered event except a collision. Comprehensive coverage, called "comp" for short, includes fire, theft, or that errant tree limb. Collision coverage applies to damage caused by colliding with anything, such as another car, a mailbox, or a street sign. Both comp and collision coverage are voluntary and usually subject to a deductible. For example, if you have a $1,000 deductible for comp coverage, you must pay for the first $1,000 of repairs before the company pays, per incident. If there is a loan on the car, the bank will probably require comp and collision coverage.

Insurance Agents and Websites

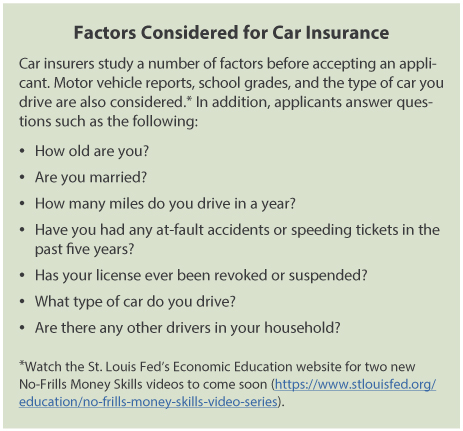

Insurance agents—and oftentimes, websites—serve as the public face of an insurance company. Agents gather potential client information during the application process. An applicant's credit score is a key factor in whether insurance is granted.

Young men typically pay more for insurance than women. Statistically, they get more tickets for speeding and reckless driving and they tend to engage in riskier behaviors. Young men also have more expensive accidents and make the most insurance claims. So, until age 25, male drivers pay much higher rates. In general, though, insurance rates decrease as drivers grow older if they don't have accidents or traffic tickets. Also, some insurance companies even offer a good student discount for students with a "B" average or above, so it pays to keep your grades up.

Managing Risk in Your Life with Insurance

With all the insurance options available, you may feel overwhelmed just thinking about it! Buying insurance involves important decisions, but it can be done using logic and cost-benefit analysis. Some insurance is mandatory, like car liability insurance. If you buy a house and have a mortgage, the bank will require insurance, too, but some insurance simply makes sense for people to have…just in case. Renter's insurance, for example, is usually inexpensive and will help replace your personal possessions in the event of a loss. When considering car, homeowner's, or renter's insurance, check the price of the coverage at various deductibles. The lower the deductible, the higher the monthly or annual premium will be. If you plan well and have savings to cover a higher deductible in the event of a loss, you can save money with lower premiums. If you work—or when you start—make sure you understand what benefits your employer provides and coordinate your health, life, and disability insurance with those benefits. It's important to find a good balance between having enough insurance to protect yourself, your assets, and your family, but not more than you can afford.

Notes

1 "Insurance Quotes." http://www.brainyquote.com/quotes/keywords/insurance_11.html.

2 Andrews, Evan. "8 Things You May Not Know About Hammurabi's Code." December 17, 2013; http://www.history.com/news/history-lists/8-things-you-may-not-know-about-hammurabis-code.

3 Beatie, Andrew. "The History of Insurance." September 20, 2014; http://www.investopedia.com/articles/08/history-of-insurance.asp.

4 Beatie, Andrew. "The History of Insurance." September 20, 2014; http://www.investopedia.com/articles/08/history-of-insurance.asp.

5 "Blaise Pascal Biography." Biography.com website, November 19, 2015; http://www.biography.com/people/blaise-pascal-9434176.

6 Beatie, Andrew. "The History of Insurance." September 20, 2014; http://www.investopedia.com/articles/08/history-of-insurance.asp.

7 Kliff, Sarah. "An Average ER Visit Costs More than an Average Month's Rent." Wonkblog (blog), Washington Post, March 2, 2013; https://www.washingtonpost.com/news/wonk/wp/2013/03/02/an-average-er-visit-costs-more-than-an-average-months-rent/.

© 2017, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Beneficiary: The person designated in the policy to receive benefits.

Co-payment (co-pay): A set dollar amount the customer pays, with the insurance company paying the difference.

Coverage: How much risk or liability is protected with an insurance policy.

Deductible: An amount you must pay for expenses before the insurance company pays. The deductible amount is specified by the terms of the insurance policy.

Liability: Legal responsibility.

Permanent insurance: A policy that does not expire until death, or age 100.

Premium: The fee paid for insurance protection.

Probability: The likelihood or chance of an event occurring.

Risk: The chance of loss.

Term insurance: A policy providing coverage for a specific time period, such as 10 years. When the policy term ends, the insurance expires.

follow @stlouisfed

follow @stlouisfed