myRA: A New Way To Save for Retirement

—Jackie Mason

"It is never too early to start saving for your retirement." You've certainly heard this advice before. Is it good advice? Sure it is. Is it easy to follow? Maybe not. Many of us have more immediate expenses that get our attention and money before we think about retirement. Routine payments to buy a house, pay for college, or buy a car may make saving for retirement less of a priority or something you believe you can do later. Then there are those who barely make ends meet, who may also believe that saving for retirement is out of the realm of possibility.

Many small companies do not offer 401(k) retirement plans to their employees. Without the ease of an employer-sponsored savings plan, many employees may not save for retirement. As we have often heard, Social Security income may not meet all your needs during your retirement years (Employee Benefit Research Institute, 2010). The average Social Security benefit for retirees is $1,294 per month. That is $15,528 per year (Social Security Administration, 2014). So, the best advice is to plan to build up a savings nest egg to help supplement your Social Security income.

Well, there's a new retirement savings option that may provide a means for you to start saving for retirement by removing the "I can't afford it right now" barrier.

Introducing myRA

The U.S. Department of the Treasury has unveiled its latest savings tool. "my Retirement Account"—myRA for short—is a retirement savings account designed for individuals who may not have access to a saving plan through their employers.

It costs nothing to open a myRA account, and there are no fees, no minimum balance, and no contribution requirements. In addition to being free of fees, a myRA account carries no risk of losing money and is backed by the U.S. Treasury (https://myra.gov/how-it-works/).

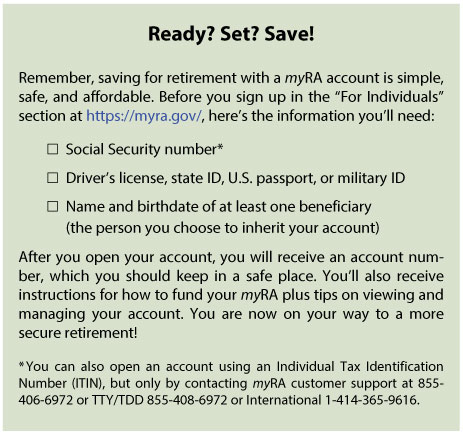

An additional myRA benefit is its flexibility. It stays with you even if you change jobs, so you don't have to worry about moving your savings from one company to another. If you have more than one job, you can contribute from multiple sources. You simply ask each employer to direct part of your paycheck to your myRA, keeping in mind that total contributions from multiple paychecks may not exceed the Roth IRA annual contribution limits, since myRA is a Roth IRA (individual retirement account). See the boxed insert for the personal information needed to open a myRA account and the table for annual contribution limits.

How Do You Save Money with myRA?

There are several ways to fund your myRA account:

- From your paycheck. You can set up automatic direct deposit to your myRA with your employer. Complete a direct deposit authorization form and give it to your employer. A direct deposit authorization form will be provided to you in your welcome packet or you can access and print the form on myRA.gov. Or, you can follow your company's process to set up funding from your paycheck.

- From a checking or savings account. You can set up recurring or one-time contributions to your myRA from a personal account, such as a checking or savings account. Link your personal account to your myRA either during the sign-up process or after you open your myRA account.

- From your federal tax refund. You can direct all or part of your federal income tax refund to your myRA when you file your taxes.

At any time, you can choose to transfer or roll over your myRA into a private-sector Roth IRA where your savings can continue to grow. You can have a maximum account balance of $15,000, or a lower balance, for up to 30 years. When either of these limits is reached, savings will be transferred to a private-sector Roth IRA.

Contributions to a myRA account earn interest at the same rate as investments in the Government Securities Fund available to federal employees, which had an average annual return of 3.19 percent over the 10-year period ending December 2014 (see https://myra.gov/get-answers/). And every little bit helps, right?

The myRA website even has a calculator to help you find the best way to reach your savings goal (https://myra.gov/savings-calculators/).

How Does myRA Work?

How Does myRA Work?

myRA is a Roth IRA that makes it easy to start saving. A Roth IRA allows you to deposit money into the account from net pay, which is gross pay minus deductions and taxes. Since you have already paid the taxes on the income contributed to the Roth IRA, you can withdraw the money you contribute without taxes and penalty. You will be taxed and penalized only if you withdraw interest earned.

For example, if you contribute $400 and earn $50 in interest, you will be taxed and/or penalized only if you withdraw the entire $450 from your account. You can withdraw up to $400 without taxes and penalty unless the funds are being used for qualified distributions. For qualified distributions, you can also withdraw the interest without taxes or penalties. Some qualified distributions are paying for your first-time home purchase or to a beneficiary after the owner's death or disability. And, as mentioned earlier, there are no fees and no minimum requirement.*

A Way To Test the Retirement Saving Waters

myRA is not designed to fund your entire retirement, and it certainly won't make you rich. A myRA account is meant to work in conjunction with your other retirement resources. If you are not saving for retirement, this is a tool to help jump-start your savings. If you set up automatic contributions into your myRA account, the process soon becomes something you consider a normal expense. With myRA, you are not diving right into a large financial commitment; instead, you can start the process slowly by first testing the waters.

Note

* Annual and lifetime contribution limits and annual earned income limits apply, as do conditions for tax-free withdrawal of earnings. Limits may be adjusted annually for cost-of-living increases. To learn about key features of a Roth IRA and for other requirements and details, go to https://myra.gov/roth-ira.

References

Employee Benefit Research Institute. "Social Security Averages 40% of Income of Elderly." June 3, 2010; http://www.ebri.org/pdf/PR.877.03June.SocSec.pdf.

Social Security Administration. "Social Security Basic Facts." April 2, 2014; http://www.ssa.gov/news/press/basicfact.html.

U.S. Department of the Treasury. "myRA." https://myra.gov/.

© 2016, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Earned income: Earned income is the money you get for the work you do. There are two ways to get earned income: You work for someone who pays you or you own or run a business or farm.

Gross pay: The amount people earn per pay period before any deductions or taxes are paid.

IRA (individual retirement account): A retirement account that allows individuals to direct pretax or after-tax income, up to specific annual limits, toward investments that can grow.

Net pay: Gross pay minus deductions and taxes.

Qualified distribution: A reason you may withdraw money from a Roth IRA without the withdrawal being subject to tax.

Retirement: Permanently leaving a job, career, occupation, or active working life.

Saving: Not spending on current consumption or taxes. Saving involves giving up some current consumption for future consumption.

Social Security income: The monthly monetary amount received by retired workers who paid into the Social Security system while they worked.

follow @stlouisfed

follow @stlouisfed