College: Learning the Skills To Pay the Bills?

![]()

"An investment in knowledge pays the best interest."

—Benjamin Franklin

It's often said that a college education is the key to success. And the decision to go to college is one of the most important choices young people encounter. But you might wonder why a college degree makes such a big difference. Does college really teach valuable skills, or is it all about the degree itself—the piece of paper that serves as your ticket to success? Or is it a bit of both?

The Economic Benefits of Education

Economists observe that individuals benefit greatly from education, and those benefits accumulate into benefits for the entire economy. For the individual, education increases job opportunities and usually results in a higher income. This occurs because workers with more education tend to have higher productivity, which means they tend to produce more output with the same inputs. Because businesses can sell this extra output to earn higher revenues, firms are willing to pay highly productive employees a higher wage.1 In other words, higher productivity increases the value of these employees to the firm.

So, as noted above, an educated workforce benefits society by producing more goods and services with the same level of resources. Productivity gains fuel economic growth, which increases the standard of living in an economy—for both the highly educated workers and the population more broadly. In a sense, these are two sides of the same coin: Education increases productivity, and higher productivity results in higher incomes for workers and more economic growth for the economy.

How Are Education and Productivity Linked?

In some ways, discussing the relationship between education and productivity is like trying to answer the old question "Which came first, the chicken or the egg?" On the one hand, education might nurture productivity, causing it to grow and develop (like a chick hatching from an egg). On the other hand, productivity might already exist (like the chicken) in varying degrees in different people, and the presence of high productivity can lead to the successful completion of higher education. Economists usually view this dynamic through one of two models and can sometimes disagree over which is really at play.

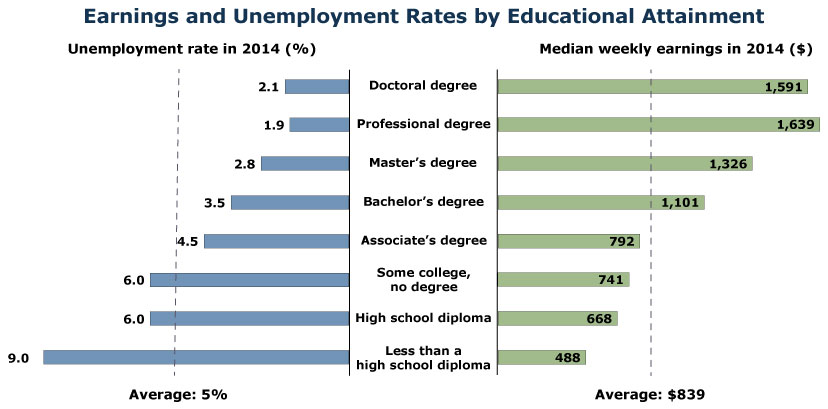

The first is the human capital model, sometimes called the "schooling model." Human capital is the knowledge and skills that people obtain through education, experience, and training. One way workers invest in human capital is by pursuing education after high school. This can be expensive not only in terms of tuition, room, and board (direct costs), but also in terms of the opportunity cost, or what is given up. College students give up the opportunity to work (and earn income), but the knowledge and skills acquired will enable them to earn more in the future. This is generally a good trade-off. Economic data strongly suggest that education, income, and success in the labor market are positively related (see the figure), and studies confirm that the benefits of a degree exceed both the direct costs and the opportunity cost for most students.2

NOTE: Generally speaking, higher education is related to higher median weekly earnings and a lower unemployment rate.

SOURCE: Current Population Survey, U.S. Bureau of Labor Statistics, U.S. Department of Labor.

One way to discuss the benefits from investing in higher education is to determine the college wage premium, which is the percent increase in earnings of those with a bachelor's degree compared with those with a high school diploma. Research suggests that the college wage premium has risen from 40 percent in the late 1970s to 84 percent in 2012.3 In short, the human capital (or schooling) model says education raises a worker's productivity through the knowledge learned and skills acquired, and this increase in productivity results in higher wages. In other words, human capital is the chick that emerges from the egg, which grows and develops into a productive chicken.

Other economists argue that education primarily serves as a signal of one's productivity. And, not surprisingly, the economic model that captures this is known as the signaling model. Suppose a business hires two types of workers: low-productivity workers and high-productivity workers. Low-productivity workers earn a good wage at the firm, but high-productivity workers earn much more. If the firm asks applicants about their productivity during the interview process, all applicants will claim to be high-productivity workers because they know high-productivity workers earn higher wages. In this model, employers lack information about the actual productivity of workers at the time of the interview. Economically speaking, the labor market has asymmetric information, which is a situation in which one party to an economic transaction has less information than the other party. In this case, the job applicant knows more about his or her actual productivity than the employer. As a result, the firm will seek information about a worker's productivity and often use education credentials as an indicator, or "signal," of productivity.

Imagine a business seeking a computer programmer. Several applicants might claim to know how to write computer code in the interview process, but firms will likely give preference to applicants with a college degree in computer science. To the employer, the degree communicates that the worker is cut out for high-productivity work. The worker has demonstrated his or her talents and ability while earning a degree, and the college has affirmed that ability by granting the degree. So, the degree serves as a signal that the worker has the qualifications for high-productivity employment. Note that both sides benefit from the signal sent by the degree: Employees gain access to higher-paying jobs, and employers gain information about a prospective employee's productivity.

Some economists take the signaling model one step further. They attribute productivity to an innate combination of intelligence and work ethic. While colleges might teach knowledge and skills, in this model, the primary role of a college is to serve as a filter to categorize workers. Put differently, the college sets the bar high enough so that only high-productivity students can clear the hurdle. This process provides information, which helps firms separate the low-productivity workers (who do not go to college or fail to finish with a degree) from the high-productivity workers (who earn a degree). Along these lines, the degree both filters and signals the innate abilities of potential employees.

Conclusion

In the human capital model, education leads to increases in productivity. In the signaling model, high productivity leads to successful completion of higher education. In the end, the results are similar: Those who earn a college degree tend to be more productive workers and earn more money. Perhaps blending the models provides something more complete: People should earn a college degree because the knowledge gained and the skills acquired will increase their productivity, and they can use the degree to signal their productivity to prospective employers.

Notes

1 Economic theory suggests that competition in labor markets ensures that firms reward highly productive workers with higher wages to keep them from looking for employment elsewhere.

2 Abel, Jaison R. and Deitz, Richard. "Do the Benefits of College Still Outweigh the Costs?" Federal Reserve Bank of New York Current Issues in Economics and Finance, 2014, 20(3); https://www.newyorkfed.org/medialibrary/media/research/current_issues/ci20-3.pdf.

3 Jonathan, James. "The College Wage Premium." Federal Reserve Bank of Cleveland Economic Commentary, No. 2012-10, August 8, 2012; https://www.clevelandfed.org/newsroom-and-events/publications/economic-commentary/2012-economic-commentaries/ec-201210-the-college-wage-premium.aspx.

© 2015, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Glossary

Asymmetric information: A situation in which one party to an economic transaction has less information than the other party.

Human capital: The knowledge and skills that people obtain through education, experience, and training.

Innate: Something determined by factors present in an individual from birth rather than learned by experience.

Opportunity cost: The value of the next-best alternative when a decision is made; it's what is given up.

Productivity: The ratio of output per worker per unit of time.

follow @stlouisfed

follow @stlouisfed