Where Do You Keep Your Liquid Wealth—Bank Deposits or T-bills?

With an inflation rate of 8%, it's important for households and firms to decide in which financial instruments to keep their liquid wealth. Individuals and organizations can hold liquid wealth in cash, as money in bank accounts (checking, savings, and time deposits), and in holdings of liquid financial assets, such as U.S. Treasuries.

In a high-inflation economy, there is also a high opportunity cost of holding cash, so consumers prefer to save their money in instruments that pay a positive nominal interest rate. Banks have historically been a safe, liquid place to park wealth, typically offering a range of products—from checking and savings accounts to money market and certificates of deposit (CDs). CDs typically pay a higher rate than checking or savings, but when you deposit money into a CD, you cannot withdraw that money until maturity or else you must pay penalties. CDs are often available at 3-, 6-, and 12-month maturities.1

The U.S. government issues bonds called U.S. Treasury Bills (T-bills). T-bills are short-term assets similar to CDs, but a consumer lends to the U.S. government instead of to a bank. The main difference between T-bills and CDs is that the secondary market for T-bills is one of the most-liquid financial markets, so it is much easier to exit from a T-bill than from a CD.

With low interest rates, there is very little difference between holding CDs and T-bills because they pay very similar interest rates. For example, in October 2021 the 12-month CD rate was 0.12% while the 12-month T-bill rate was 0.1%.

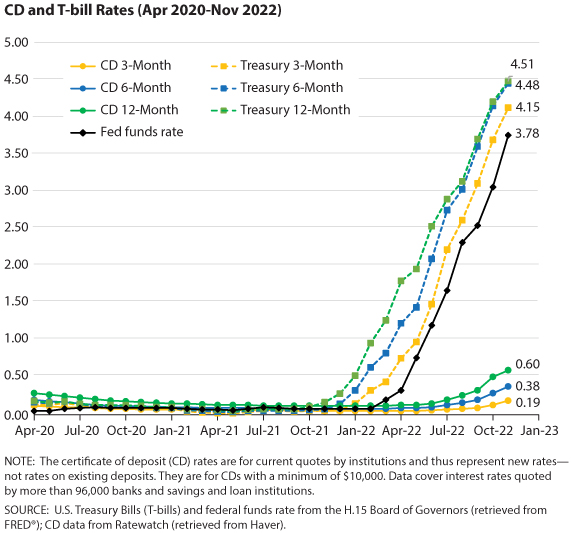

In the past 6 months, however, interest rates have increased very quickly. Today, the effective federal funds rate is 3.78%, while in October 2021 it was 0.08%. The speed of these increases has taken the economy from a market where rates on bank deposits and T-bills were almost indistinguishable to one in which they are vastly different. The figure compares the interest rates of CDs and T-bills at 3-, 6-, and 12-month maturities.

During the COVID-19 pandemic, the Federal Open Market Committee (FOMC) maintained the federal funds target rate—resulting in an effective rate around 8 basis points, or 0.08%. Many market options for saving money were also at low rates: From April 2020 until December 2021, all three maturities of CDs and T-bills paid less than 0.3%. At the beginning of 2022, the rates that T-bills paid began to lift off. Around this time, inflation was high and the FOMC was signaling that the federal funds rate needed to rise. In March, when the FOMC first raised the target range for the federal funds rate, by 0.25%, the 12-month T-bill rate was already 1.27%. Meanwhile, the 12-month CD rate that banks paid remained at 0.12%.

As in previous work, we define the deposit spread as the difference between the federal funds rate and the deposit rate—in this case for CDs.2 The figure shows that over the past 6 months, the deposit spread rose from near zero to more than 3%. The deposit spread has continued to increase because the FOMC is raising the target range for the federal funds rate much faster than banks are raising the interest they pay on deposits.

Likewise, disparities between the rates paid on T-bills and those paid on CDs have also increased. In November 2022, the federal funds rate was 3.78% while all three maturities of T-bills paid between 4.15% and 4.5%: This may be interpreted as the market anticipating further FOMC rate hikes.

T-bills are more liquid than CDs but have about the same level of safety and maturity, so we would expect CDs to pay a higher rate to compensate for the difference in liquidity. However, this is not the case: In November 2022, a 12-month CD paid a rate of 0.6%, with 3- and 6-month CDs paying even less. At the beginning of 2022, bank deposits paid similar interest rates to T-bills, but they now pay almost 4% less. Thus, bank deposits essentially function as holding cash and can be a bad choice for holding liquid wealth in the current high-rate and high-inflation environment.

Notes

1 The CD rates presented are for current quotes by institutions and thus represent new rates—not rates on existing deposits. They are for CDs with a minimum of $10,000.

2 Kozlowski, Julian and Jordan-Wood, Samuel. "Liquidity Dries Up." Federal Reserve Bank of St. Louis Economic Synopses, 2022, No. 24; https://doi.org/10.20955/es.2022.24.

© 2022, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed