The Great Resignation vs. The Great Reallocation: Industry-Level Evidence

It's been two years since the start of the COVID-19 pandemic, and the U.S. economy has substantially recovered. The unemployment rate was 3.9% in December 2021, and real GDP growth has remained above 2% since 2020:Q2. Despite these positive indicators, there is growing sentiment that the pandemic has inflicted long-lasting effects on the labor market. Specifically, a recent, anecdotal impediment to employers has been the lack of available workers; news sources, political pundits, and economists alike are calling it the "Great Resignation"—a phrase stemming from the idea that, since the economy's recovery, a large quantity of workers have quit their jobs. People generally view the Great Resignation in a negative way, with the underlying connotation that quits are mostly harmful to the economy and that people do not want to work anymore. However, we should be careful when discussing the growing number of quits because it does not necessarily imply a worker has left the labor market or even entered unemployment; many quits are due to workers switching jobs.

A common labor market occurrence, and what we refer to as a job-to-job transition, is when a worker quits their job to take another job. In previous work, we note that a high frequency of job-to-job transitions is associated with high wage growth. In this essay, we examine the Great Resignation hypothesis in the context of two industries—(i) manufacturing and construction and (ii) leisure. We choose these two industries because job mobility is high in both—a fact that stems from job-to-job transitions being more frequent at the bottom of the income distribution. Overall, we provide evidence that job-to-job transitions are the underlying reason behind the recent rise in quits in the leisure industry; this is inconsistent with the presumptions of the Great Resignation hypothesis and instead more indicative of worker reallocation after the COVID-19 recession, which we call the "Great Reallocation."

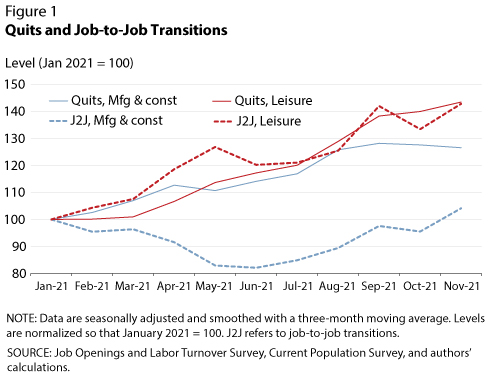

To understand the industry-specific trends in quits and job-to-job transitions, we work with monthly Job Openings and Labor Turnover Survey (JOLTS) and Current Population Survey (CPS) data from January to November 2021.1 We focus on 2021 because this is when the frequency of quits moved above pre-pandemic levels.2 Figure 1 plots the normalized (January 2020 = 100) number of quits (solid lines) and job-to-job transitions (dashed lines) in the manufacturing and construction (blue) and leisure (red) industries. The solid lines show that both industries faced sizeable increases in the number of quits, with levels increasing from January to November by 27% and 43% in manufacturing and construction and in leisure, respectively. The blue dashed line indicates that the growth in job-to-job transitions in manufacturing and construction in this period severely fell behind the growth in quits. On the other hand, the red dashed line indicates that the number of job-to-job transitions in leisure increased at an equal pace to the number of quits—that is, 43% in the same period. Overall, these results suggest that most quits in the leisure industry were driven by job switches, whereas in manufacturing and construction they were not.

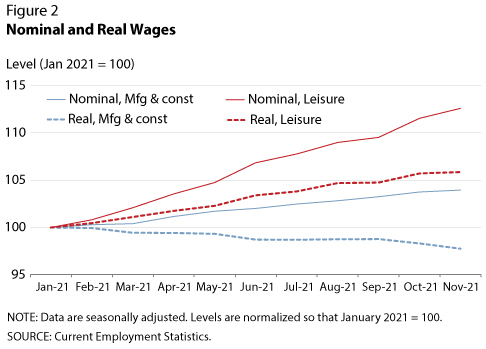

What do these differences in the underlying reason for quits mean for these two industries? As mentioned, job-to-job transitions often positively affect wages. As such, we should expect stronger wage growth in leisure than in manufacturing and construction because the former industry's increase in quits is explained by an increase in job-to-job transitions. We investigate whether this is the case in Figure 2, which plots the normalized (January 2021 = 100) average nominal (solid lines) and real (dashed lines) hourly earnings from January to November 2021 for the manufacturing and construction (blue) and leisure (red) industries.3 The solid lines show that the average nominal wages in manufacturing and construction increased by only about 4%, whereas those in the leisure industry increased by nearly 13% between January and November. In fact, in real terms, the average wages in manufacturing and construction slightly decreased by roughly 2% in this period, whereas those in leisure still increased, by nearly 6%. These results are consistent with the hypothesis that the larger the increase in job-to-job transitions, the larger the wage growth.

Not all quits are created equal. Quits due to job switches are often associated with the benefit of stimulating wage growth, whereas quits to unemployment or out of the labor force can create labor shortages. Our results show that one might slightly misconstrue the recent rise in quits as the Great Resignation. There has been a sizeable increase in the number of quits since January 2021, but the data tell us that in certain industries, such as leisure, this increase is due to an increase in job-to-job transitions, which have led to real wage growth. Hence, the patterns in the manufacturing and construction industry seem to follow the pattern associated with the Great Resignation, whereas those in the leisure industry are more suggestive of strong worker reallocation patterns—that is, the Great Reallocation.

Notes

1 JOLTS data provide the number of quits in each industry, while CPS data provide microdata that allow us to calculate the number of job-to-job transitions in each industry over time. See our previous work for more information on how we calculate job-to-job transitions with CPS data.

2 In January 2020, before the pandemic, the monthly quit rate was 2.3%. Throughout 2020, the quit rate declined but steadily recovered by January 2021 to its pre-pandemic level. Since the start of 2021, the quit rate steadily increased to 3% by November 2021, its highest historic rate. (See FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=KvFo.)

3 We use Current Employment Statistics (CES) data from January to November 2021 to calculate the average hourly earnings for both industries and pull consumer price index data from FRED® to convert these earnings to real terms.

© 2022, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed