Supply Chain Bottlenecks and Inflation: The Role of Semiconductors

A year and a half after the COVID-19 recession, one of the sharpest economic contractions in history, the U.S. economy has rebounded rapidly and now seems to be overheated. Inflation is at its highest level in 30 years, and supply chains are strained: Shipping costs and delivery lags are increasing substantially, inventories are running down, and firms are finding it difficult to get key production inputs.

However, there is no consensus on the extent to which disrupted supply chains account for recent increases in inflation relative to other channels. In particular, the bold fiscal response to the pandemic, along with the increased wealth due to the stock market and housing boom, have boosted demand for goods and services. Along with unprecedented labor market shortages, these forces can increase inflation even with well-oiled supply chains. Supply chain issues can exacerbate price increases: Even industries without large changes in demand might be forced to reduce supply and increase prices in response to shortages of key inputs.

This essay discusses the extent to which supply chain disruptions account for the recent rise in inflation. We focus on the case of semiconductors, for which demand increased along with the pandemic-driven demand for electronics. The following features of the semiconductor industry make it an important case for investigating the role of supply chains in inflation:

(i) Semiconductors, including microchips, are used in a wide range of goods, from computers to toys and automobiles, among many others.1 According to our calculations, approximately 25 percent of 226 manufacturing sectors use semiconductors as a direct input, and these industries account for 39 percent of total manufacturing output.2

(ii) Semiconductors are a key component for production in many sectors. Even though semiconductors typically account for only a small fraction of total input costs, scarcity of semiconductors can halt production of any good needing them because semiconductors have no close substitutes and production capacity is extremely costly to increase. Thus, semiconductor-dependent industries can do little in the short run in response to a shortage.

Figure 1

U.S. Domestic Production of Autos

SOURCE: FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DAUPSA, accessed December 8, 2021.

Figure 2

U.S. Producer Price Index by Industry: New Car Dealers: Vehicle Sales

SOURCE: FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCU4411104411101, accessed December 8, 2021.

For instance, modern vehicles cannot be produced without microchips, although each car only uses a few hundred dollars' worth. Semiconductor shortages have held up auto production (Figure 1) and driven up prices (Figure 2). We next conduct an exercise that investigates the extent to which such shortages have affected prices across the U.S. economy.

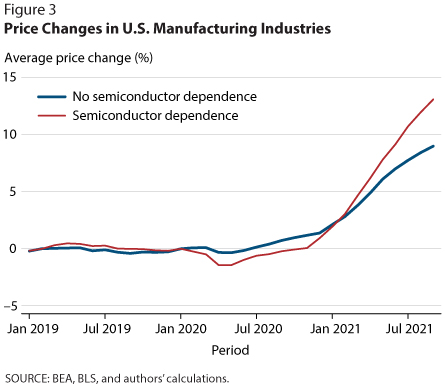

We contrast the dynamics of prices between two groups of manufacturing subsectors: (i) sectors that purchase semiconductors as a direct production input and (ii) sectors that do not. We use 2012 U.S. Bureau of Economic Analysis (BEA) data on over 400 industries to determine which industries rely on semiconductors as an input3 and U.S. Bureau of Labor Statistics (BLS) producer price index data4 for each industry.5

Figure 3 compares the average monthly price changes between the 170 manufacturing industries that do not use semiconductors as a direct input and the remaining 56 manufacturing industries that do.6 The figure shows that price changes were similar between the two groups and hovered around zero from the beginning of 2019 through the end of 2020. During 2021, prices have increased for both groups, and significantly more for those manufacturing industries that use semiconductors as a direct input.7 The price change gap between these two groups had risen to 4 percentage points by September. Higher prices for semiconductor-dependent manufacturing industries is economically meaningful, as these industries account for roughly two-fifths of all manufacturing output.

While this exercise suggests that supply chain challenges might be helping to fuel the recent surge in inflation, other factors are also likely at play. For instance, the pandemic has led to the introduction of unconventional credit policies and unprecedented peacetime fiscal expansion. A more rigorous overview of recent price inflation would be needed to account for these factors. The case of semiconductors nevertheless shows how disruptions in the production of a key input can affect vast supply chains, affecting prices across the economy—with significant macroeconomic implications.

Notes

1 For more on the semiconductor industry, see the following report from the Semiconductor Industry Association: https://www.semiconductors.org/wp-content/uploads/2021/09/2021-SIA-State-of-the-Industry-Report.pdf.

2 Our calculations are based on U.S. Bureau of Economic Analysis (BEA) data in "Use Table, Producer's Value, 2012."

3 BEA. "Use Table, Producer's Value, 2012."

4 BLS. "Producer Price Indexes." https://www.bls.gov/pPI/.

5 As the data are from 2012 and semiconductor use has been gaining importance over time, we expect more current data would yield even higher levels of semiconductor dependence.

6 We isolate the role of semiconductors by restricting attention to the set of 226 manufacturing industries, out of the total 400+ industries in the U.S. economy.

7 Bandyopadhyay (2021) documents that the price of semiconductors has remained largely flat throughout this period. This finding suggests that the higher price increases in industries that use semiconductors as inputs is driven by the decreased production scale due to the shortages, rather than by higher prices of semiconductors. (Bandyopadhyay, Subhayu. "Semiconductor bottlenecks and prices." Federal Reserve Bank of St. Louis FRED® Blog, December 13, 2021; https://fredblog.stlouisfed.org/2021/12/semiconductor-bottlenecks-and-prices/).

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed