Tail Risk: Part 2, The Missing Recovery After the Great Recession

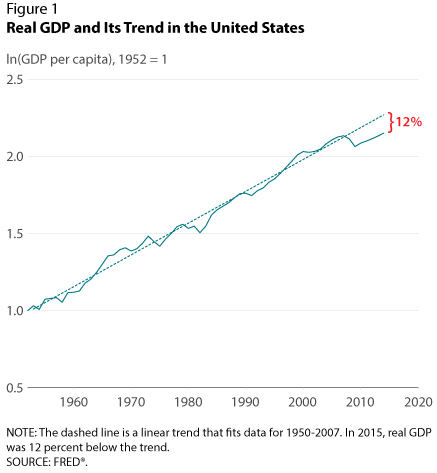

In a typical post-WWII recession, economic activity first declines and then exhibits a sharp rebound toward a stable trend line. Following the Great Recession of 2007-09, however, this rebound is missing; the missing recovery is what some economists call "secular stagnation."1 For example, Figure 1 shows real gross domestic product (GDP) in the United States. The dashed line is a linear trend that fits data for 1950-2007. In 2015, real GDP was 12 percent below the trend; this is the so-called missing recovery.

What caused the missing recovery after the Financial Crisis? In Part 1 of this three-part series, I argued that tail risk increased after the Great Recession; that is, the perceived probability that a large negative shock to the economy would occur increased after the 2007-09 recession. In this Part 2 essay, I discuss how this increase in tail risk can help us understand the missing recovery.

Think about a firm making risky investment choices. To determine how much to invest, the firm takes into account the upfront cost of investment, as well as the expected return of the project and its associated risks. The return of the project depends not only on the actions of the firm, but also on the overall performance of the macroeconomy and its associated risks. Therefore, investment is inherently risky and depends on outcomes that are not under the control of the individual firm. Hence, the firm has to forecast both what will happen to the aggregate economy and how those events will affect its investments.

Before the Great Recession, the probability of a tail event on the overall economy was very small. Hence, the probability of an abnormally low return on investment projects was also very small. This small probability of tail risk led firms to make large investments, ultimately generating economic growth until 2008.

After the Great Recession, however, the probability of abnormally low returns increased substantially. This change in tail risk implies investments are more prone to abnormally low returns. Consequently, investors reassessed their investment plans and decided to cut investment. As a result, economic growth is lower now than before the Financial Crisis.

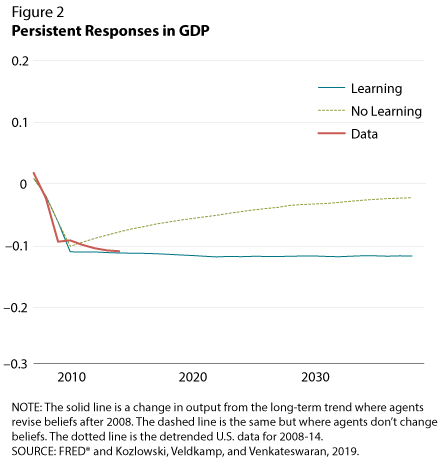

Recently, colleagues and I constructed a quantitative macroeconomic model to gauge the magnitude of the real effects of this change in tail risk.2 Our model predicts that capital, employment, and output drop 17 percent, 8 percent, and 12 percent, respectively, after the Financial Crisis, with almost no rebound back to trend. Figure 2 shows the response of the model (blue line) is similar to the data (red line) after the Great Recession. It shows a pattern of prolonged stagnation, and the economy never recovers from the negative shocks in 2008-09.

In Part 3 of this series, I extend the discussion to assess the effects on the return on safe and liquid assets.

Notes

1 See Eggertsson and Mehrotra, 2014; Teulings and Baldwin, 2014; Gomme, Ravikumar, and Rupert, 2015; Summers, 2016; and Shiller, 2018.

2 See Kozlowski, Veldkamp, and Venkateswaran, 2019.

References

Eggertsson, Gauti and Mehrotra, Neil. "A Model of Secular Stagnation." Working Paper No. 20574, National Bureau of Economic Research, October 2014.

Gomme, Paul; Ravikumar, B. and Rupert, Peter. "Secular Stagnation and Returns on Capital." Federal Reserve Bank of St. Louis Economic Synopses, August 2015.

Kozlowski, Julian; Veldkamp, Laura and Venkateswaran, Venky. "The Tail That Wags the Economy: Beliefs and Persistent Stagnation." Working Paper No. 2019-006B, Federal Reserve Bank of St. Louis, February 2019.

Kozlowski, Julian. "Tail Risk: Part 1, The Persistent Effects of the Great Recession." Federal Reserve Bank of St. Louis Economic Synopses, July 2019.

Shiller, Robert. "Why Our Beliefs Don't Predict Much About the Economy." New York Times, October 12, 2018.

Summers, Lawrence H. "The Age of Secular Stagnation: What It Is and What to Do About It." Foreign Affairs, March/April 2016, pp. 2-9.

Teulings, Coen and Baldwin, Richard, eds. Secular Stagnation: Facts, Causes and Cures. CEPR Press, 2014.

© 2019, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed