Industry Connectivity: A Case Study of the Construction Industry

The production network is the web of product flows between firms and industries in an economy. In a recent Economic Synopses, we explored the structure of the U.S. production networks, noting that there is a lot of intersectoral trade in U.S. industries—meaning that output from one industry becomes the inputs for other industries. For example, tires are an input in auto manufacturing. If the tire industry experienced a negative shock (e.g., an industry-wide strike or a sudden rise in rubber prices), it would reduce the available supply of tires, increase the cost of tires, and impact production in the automobile industry. In short, an industry-specific shock would spill over to other industries.

In this essay, we consider the role of the construction industry in the 2007-09 recession—the Great Recession. The construction industry has important connections to other industries and is one of the biggest industries in the country. When the construction industry contracted during the Great Recession, industries that trade heavily with the construction industry were hit harder than those that don't.

Case Study: The Construction Industry

The construction industry buys material inputs from other industries and accounts for about 5 percent of final U.S. economic output. This output is strongly positively correlated with U.S. business conditions. This combination means that construction is central to the U.S. production network. Indeed, the construction industry played a key role in the Great Recession. Ongoing research from Federal Reserve Bank of St. Louis economists Carlos Garriga, Juan Sanchez, and coauthors finds that the construction sector accounted for 52 percent of the decline in employment and 35 percent of the decline in output during the Great Recession.1

The authors highlight one factor of the construction industry that made it a major player in the Great Recession: its interconnections with others industries. The construction industry buys a lot of material inputs from other industries and sells a lot of material inputs to other industries. In fact, inputs purchased from other industries make up 38 percent of the construction industry's gross output. The industry groups that the construction industry buys the most from are other services; metals manufacturing; wholesale and retail trade; and financial, insurance, and real estate, while the industry groups that it sells the most to are metals manufacturing, lumber manufacturing, electrical machinery, and mining.

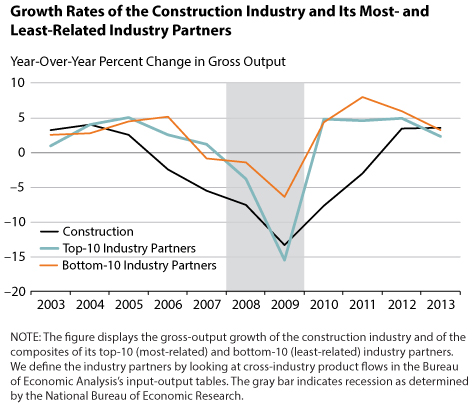

In addition to being highly connected to other industries, the construction industry is slow to recover after a dip. That is, after the housing recession started, it took a long time for the existing housing stock to sell down and create demand for new homes. The figure shows the growth rate of gross output for the construction industry through the Great Recession and also composite growth rates for the construction industry's top-10 (most-related) and bottom-10 (least-related) industry partners. The construction industry's output started to decline in 2004, a year or two before the two composite groups. Output growth for the top-10 partners (the blue line) started falling a few quarters after and even more a year after the construction industry's initial decline. Output growth for the bottom-10 partners (the orange line) started falling about two years after the construction industry's initial decline. That is, the industries most related to the construction industry were hit harder than those least related. Both groups were growing around 5 percent before the construction industry shock. After the shock, growth of the top 10 declined to below –15 percent year over year, while growth of the bottom 10 declined to only about –6 percent year over year. In the recovery, both composite groups quickly regained positive growth in 2009, while the construction industry's output remained negative through 2011. That is, after the economy hit a trough, the construction industry bounced back more slowly than either of the other industry groups.

Conclusion

Because of the interconnectivity of the U.S. production network, industry-specific shocks have the potential to impact aggregate economic health. We study growth in the construction industry—a large buyer and seller of material inputs—and its most- and least-related industry partners, during the 2007-09 recession. We find that industries most related to the construction industry were hit sooner and harder.

Note

1 Boldrin, Michele; Garriga, Carlos; Peralta-Alva, Adrian and Sanchez, Juan. "Reconstructing the Great Recession." Working Paper 2013-006C, Federal Reserve Bank of Saint Louis, revised January 2016; https://research.stlouisfed.org/wp/more/2013-006.

© 2018, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed