Manufacturing and Service Sector Roles in the Evolution of Innovation and Productivity

The relative size of the manufacturing sector in an economy depends on its stage of development. As economies become more industrialized, employment and output increase rapidly. Eventually, for large-enough levels of development, the contribution of the manufacturing sector starts declining in favor of the service sector. That is, manufacturing's contribution to employment and output follows an inverted U-pattern.1 This key feature of economic growth reflects structural change across different sectors: The agriculture sector shrinks, the service sector expands, and the manufacturing sector exhibits a hump-shaped pattern.

In this essay, we analyze differences in trends between the manufacturing and service sectors along several dimensions. For a sample of 24 countries and for the period 2000-14, we collected annual data on employment and value added, which are the typical measures used to analyze structural change—the reallocation of economic activity across sectors within a country. We also gathered data on international trade (i.e., exports), innovation (i.e., research and development [R&D] spending), and labor productivity (i.e., value added divided by employment), as these provide additional information on the performance of the two sectors.

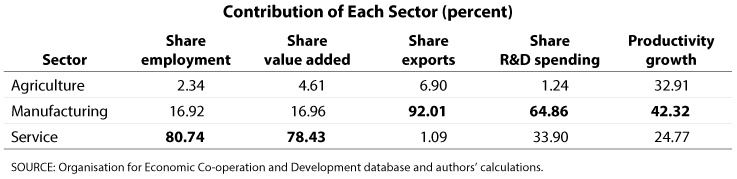

We obtain two main findings. First, in the past 15 years, the contribution of the service sector to employment and value added (our measure of output) has outweighed that of the manufacturing sector.2 In particular, the average shares of these variables in the service sector during 2000-14 were 80.74 percent and 78.43 percent, respectively, whereas in the manufacturing sector these were 16.92 percent and 16.96 percent, respectively (table). As technological change makes manufacturing more capital and skill intensive, this sector creates fewer jobs. The so-called third industrial revolution led by services has therefore implied that, in the past decade, industrialized countries have experienced a sustained growth of employment and value added in the service sector, and this generation of jobs has helped to outweigh the decrease in the number of jobs in manufacturing.

Second, we observe that despite the trends in employment and value added, manufacturing is still the largest sector in terms of exports, innovation, and productivity growth.3 In particular, our data show that the share of exports in the manufacturing sector was 92.01 percent, the share of R&D spending (as a percentage of value added) was 64.86 percent, and the share of productivity growth was 42.32 percent (in contrast to 1.09, 33.90, and 24.77 percent, respectively, in the service sector). These patterns are not surprising, as most services are still not traded. Indeed, although international trade in services is increasing, the observed expansion in world trade was mainly driven by manufacturing products. Furthermore, most technological advances have taken place in the manufacturing sector, and productivity growth has focused mainly on this sector. In fact, several studies attribute the slowdown of productivity in the United States to the large increase of the service sector.4 As consumers' demand for goods becomes saturated, they gradually turn toward the service sector, in which it is harder to foster productivity growth as rapid as the manufacturing sector's.5

The first finding that we report has been documented extensively in the literature, yet the second finding is less well understood. An interesting aspect of our second finding is that differences in the evolution of the manufacturing and service sectors with respect to trade, innovation, and productivity growth in the next few years may determine patterns of development and industrialization across countries. In fact, we already observe interesting differences in these evolutions between the two sectors in our sample. First, services are becoming more globalized. With the help of advancing technologies, such as a decrease in telecommunication costs, services are becoming more tradeable.6 This is especially the case in industries such as information and communication technology, in which trade in services has a much lower cost than moving goods around.7 Second, services are raising their contribution to R&D intensity, a measure of innovation. (R&D intensity is the amount of R&D spending as a percentage of value added, which controls for the size of the sector.) In Panel A of the figure, we observe that the contribution of the service sector to R&D intensity has been increasing over time. Third, our data appear to be consistent with the view that innovation is a major source of long-term productivity growth.8 In Panel B of the figure, we observe that productivity has been increasing over time in the service sector. Moreover, the evolution of labor productivity in the service sector follows very closely that of R&D spending.

Finally, an interesting fact the figures do not reveal is that services are used throughout the manufacturing process and the manufacturing value chain. Increasing globalization reinforces the relationship between the manufacturing and service sectors. Therefore, given the strong, positive correlation between R&D spending and productivity in the service sector, the evolution of innovation may determine the patterns of development and industrialization in the next few years.

Notes

1 See Buera and Kaboski (2012).

2, 3 See Manyika et al. (2012).

4 See Bosworth and Triplett (2000).

5 See Lee (2016).

6 See Gonzales et al. (2012).

7 See Gervais and Jensen (2014).

8 See Sveikauskas (2007).

References

Bosworth, Barry P. and Triplett, Jack E. "Productivity in the Services Sector." Brookings, January 2000; https://www.brookings.edu/research/productivity-in-the-services-sector/.

Buera, Francisco J. and Kaboski, Joseph P. "Scale and the Origins of Structural Change." Journal of Economic Theory, March 2012, 147(2), pp. 684-712; https://doi.org/10.1016/j.jet.2010.11.007.

Gervais, Antoine and Jensen, J. Bradford. "The Tradability of Services: Geographic Concentration and Trade Costs." Center for Economic Studies, CES14-03, January 2014; https://www2.census.gov/ces/wp/2014/CES-WP-14-03.pdf.

Gonzales, Frederic; Jensen, J. Bradford; Kim, Yunhee and Nordas, Hildegunn Kyvik. "Globalisation of Services and Jobs," in D. Lippoldt, ed, Policy Priorities for International Trade and Jobs. Chap. 5. OECD, May 2012; https://www.oecd.org/site/tadicite/50287724.pdf.

Lee, Timothy B. "The Productivity Paradox: Why We're Getting More Innovation but Less Growth." Vox, October 2016; https://www.vox.com/new-money/2016/10/24/13327014/productivity-paradox-innovation-growth.

Manyika et al. "Manufacturing the Future: The Next Era of Global Growth and Innovation." McKinsey Global Institute, November 2012; https://www.mckinsey.com/business-functions/operations/our-insights/the-future-of-manufacturing.

Sveikauskas, Leo. "R&D and Productivity Growth: A Review of the Literature." Working Paper 408, U.S. Bureau of Labor Statistics, September 2007; https://www.bls.gov/ore/pdf/ec070070.pdf.

© 2018, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed