Trade Adjusts Gradually After Trade Liberalization

In recent years, the impact of international trade liberalization on economic outcomes such as output, investment, and employment has been at the forefront of political and economic discussions. Trade economists have confronted important and difficult questions, such as

- To what extent should countries open up to international trade?

- Have Chinese exports reduced manufacturing employment in the United States and elsewhere?

- What are the costs of withdrawing from trade agreements?

To answer these questions, economists first need a theory of the role of international trade in modern economies. Such theories can guide empirical studies aimed at measuring the impact of trade on economic outcomes and can also be used to evaluate the desirability of alternative policies before implementation.

Theories of international trade need to be consistent with the data to be of use to policymakers. In particular, economists interested in understanding the impact of international trade openness on economic outcomes should base their analyses on economic theories consistent with the dynamics of international trade flows in trade liberalization episodes.

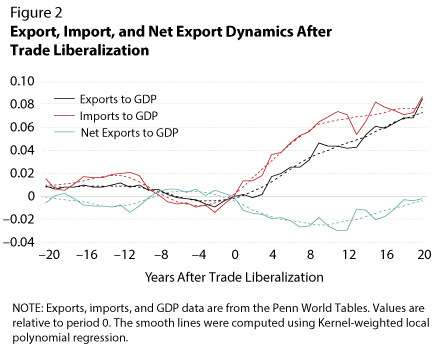

This essay documents the evolution of international trade flows in such episodes. In particular, we examine the dynamics of the exports-to-GDP, imports-to-GDP, and net exports-to-GDP ratios before and after trade liberalization.

To do so, we follow Wacziarg and Welch (2008) and Sachs and Warner (1995) in identifying episodes of trade liberalizations. We define a country to be open to trade in a given year if all of the following conditions hold simultaneously: (i) average tariff rates are below 40 percent, (ii) non-tariff barriers cover less than 40 percent of trade, (iii) the black-market exchange-rate premium is less than 20 percent (if such a market exists), (iv) the government does not monopolize major exports, and (v) the country is not socialist. We identify the year in which trade is liberalized as the first period in which all of these conditions are met simultaneously.

Figure 1 shows for a panel of 88 countries the average dynamics of the real exports-to-GDP ratio in a 40-year window—1950 to 2001—centered on the liberalization of trade according to the definition above. The data are normalized to equal zero at the time trade is liberalized. That is, the value for each period is the average difference between the exports-to-GDP ratio in that period and its value at liberalization across all countries.

Of the 88 countries, few have data for all 40 years: 69 include data for all 20 years before trade liberalization, while only 22 include data for all 20 years after. For each year, we compute the average exports-to-GDP ratio for the countries for which data are available.

As expected, the average exports-to-GDP ratio increases substantially after trade liberalization—by more than 8 percentage points after 20 years. But it takes time for that increase to occur: The ratio increases by only 4.3 percentage points 10 years after trade liberalization. These dynamics may reflect the time it takes new exporters to adapt their production decisions to the lower trade barriers. Thus, the long-run effects of trade openness differ substantially from the short-run effects. Theories of international trade that abstract from international trade dynamics may not accurately capture the short-run impact of trade openness.

Figure 2 contrasts the dynamics of exports and imports. On average, imports increase more rapidly than exports in the short-run after trade liberalization (yet also gradually), causing trade imbalances to worsen. Imports might grow immediately because they come from large international markets, which do not necessarily require an increase in production capacity. In the long-run, however, exports and imports increase by a similar amount, with trade imbalances returning to pre-liberalization levels.

The short-run shift in trade imbalances, although transitory, may explain some of the resistance to trade liberalization. To the extent that imports adjust faster than exports after trade liberalization, policymakers may face relatively stronger resistance when advocating for subsequent rounds of trade liberalization.

As recent studies show (see, for instance, Kohn, Leibovici, and Szkup, 2017; Alessandria and Choi, 2014; Eaton et al., 2016; and Ravikumar, Santacreu, and Sposi, 2017), these findings suggest that it is important to model international trade with economic theories that explicitly consider the dynamic nature of trade flows.

While more effort needs to be placed on improving the measurement and identification of trade liberalization episodes, the evidence in this essay suggests that trade openness is not a static phenomenon: It takes time for trade and economic reforms to impact international trade flows and, thus, economic outcomes. Moreover, the slower adjustment of exports relative to imports may help explain some of the political resistance to adjusting to a more open economic environment.

References

Alessandria, George and Choi, Horag. "Establishment Heterogeneity, Exporter Dynamics, and the Effects of Trade Liberalization." Journal of International Economics, 2014, 94(2), pp. 207-223; https://doi.org/10.1016/j.jinteco.2014.08.006.

Eaton, Jonathan; Kortum, Samuel; Neiman, Brent and Romalis, John. "Trade and the Global Recession." American Economic Review, 2016, 106(11), pp. 3401-438; https://doi.org/10.1257/aer.20101557.

Kohn, David; Leibovici, Fernando and Szkup, Michal. "Financial Frictions and Export Dynamic in Large Devaluations." Working Paper 2017-013A, Federal Reserve Bank of St. Louis, May 2017; https://files.stlouisfed.org/files/htdocs/wp/2017/2017-013.pdf.

Ravikumar, B.; Santacreu, Ana Maria and Sposi, Michael. "Capital Accumulation and Dynamic Gains from Trade." Working Paper 2017-005C, Federal Reserve Bank of St. Louis, November 2017; https://files.stlouisfed.org/files/htdocs/wp/2017/2017-005.pdf.

Sachs, Jeffrey and Warner, Andrew. "Economic Reform and the Process of Global Integration." Brookings Papers on Economic Activity, 1995, 26(1), pp. 1-118; https://doi.org/10.2307/2534573.

Wacziarg, Romain and Welch, Karen Horn. "Trade Liberalization and Growth: New Evidence." World Bank Economic Review, 2008, 22(2), pp. 187-231; https://doi.org/10.1093/wber/lhn007.

© 2018, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed