Research Home > COVID-19 Resources > Preliminary Print

PRELIMINARY: Daily Data on Corporate Bond Spreads and the Pandemic

by Mahdi Ebsim, Miguel Faria-e-Castro, and Julian Kozlowski

posted online April 13, 2020

updated July 20, 2020

This post provides daily data updates on credit spreads during the pandemic.

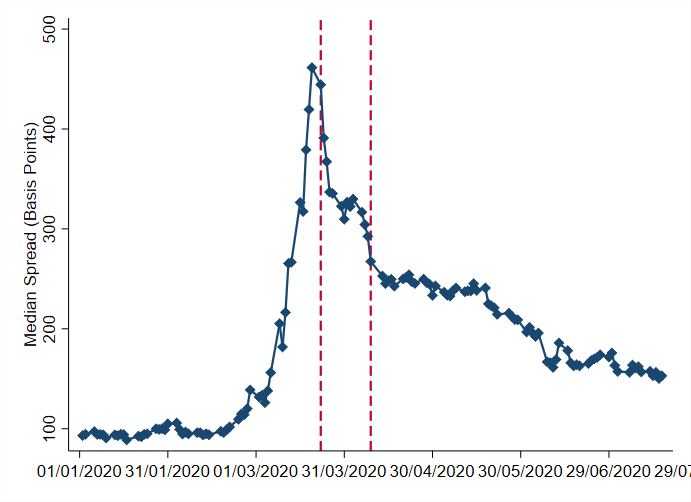

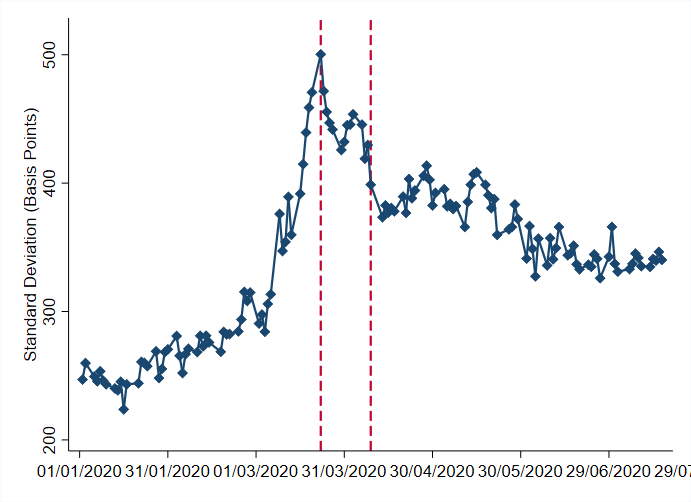

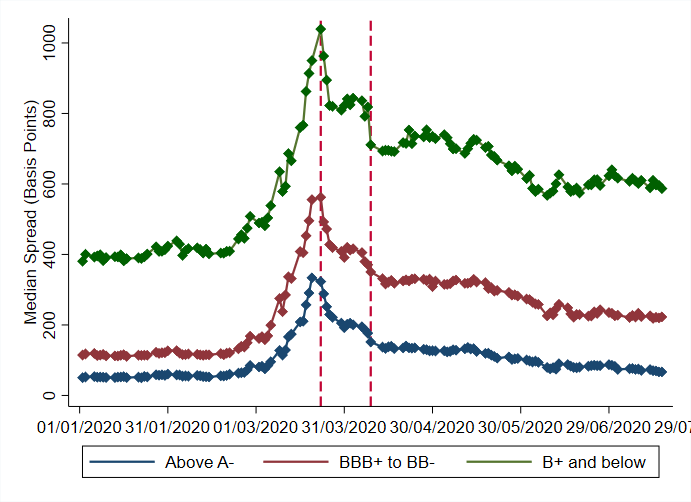

Financial markets, in particular, have experienced surges in volatility that had not been seen since the 2008-09 Financial Crisis. Some of our graphs track the median and the dispersion of corporate bond spreads, including the dispersion of spreads according to credit rating.

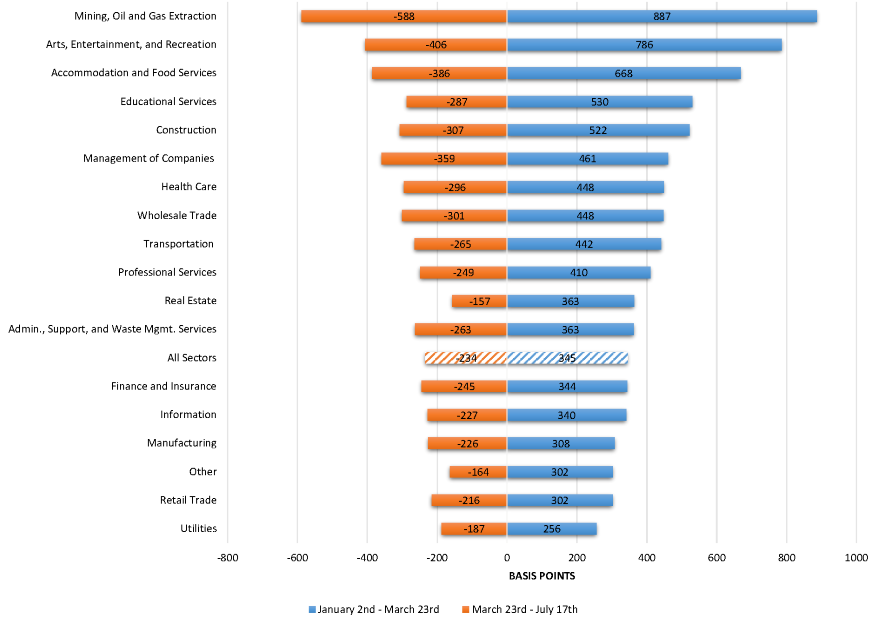

Corporate spread dynamics have not been uniform across sectors. Some of our graphs track the dispersion of credit spreads by looking at their evolution by sector. With other graphs, we incorporate a physical proximity index to divide sectors into two groups, high or low contact-intensity industries.

The red vertical lines in the plots below identify Federal Reserve policy announcement dates relevant to corporate bond markets. For March 23, the Federal Reserve directed the Open Market Desk to purchase commercial mortgage-backed securities and announced the following facilities: Primary Market Corporate Credit Facility (PMCCF), Secondary Market Corporate Credit Facility (SMCCF), and the Commercial Paper Lending Facility. On April 9, the Federal Reserve announced an increase in the flow of credit provided by PMCCF and SMCCF.

For more information, see our previous published analyses: "Corporate Bond Spreads and the Pandemic," "Corporate Bond Spreads and the Pandemic II: Heterogeneity across Sectors," and "Corporate Bond Spreads and the Pandemic III: Variance Across Sectors and Firms."

Figure 1: Median Credit Spreads

Figure 2: Dispersion of Credit Spreads

Figure 3: Median Credit Spreads by Credit Rating

Figure 4: Dispersion of Credit Spreads by Credit Rating

Figure 5: Credit Spreads by Sector

Figure 6: Credit Spreads by Proximity Industry

Figure 7: Credit Spreads by Sector

Preliminary, incomplete. To cite, please request author’s permission.

© 2020, Federal Reserve Bank of St. Louis. These views do not reflect the opinion of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Browse more resources on COVID-19 from the Research Division