The Yield Curve: The Basics

A "yield" is the return on an investment in a bond.

A "yield curve" is a comparison between long-term and short-term bonds that depicts the relationship between their rates of interest. The rate for a longer-term bond is usually higher than the rate for a shorter-term bond. This is because of the term premium, which reflects the amount investors expect to be compensated for lending for longer periods.

A "yield curve inversion" is when the rate for a longer-term bond is lower than the rate for a shorter-term bond.

These inversions have occurred before all U.S. recessions (and recessions in other countries as well) for the past 50 years.

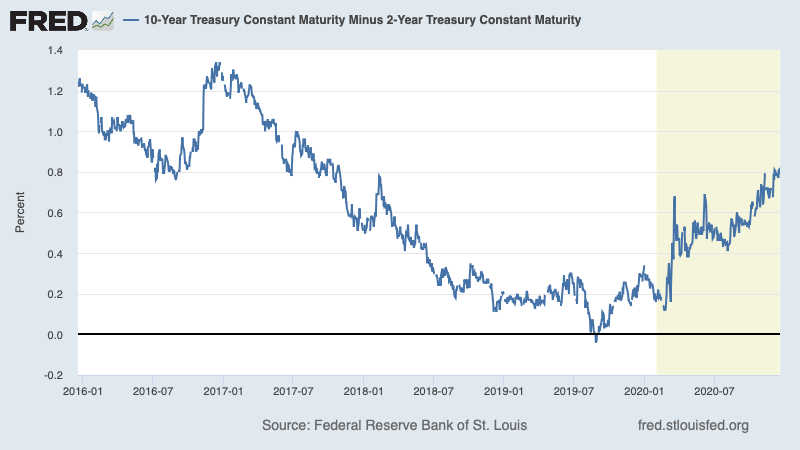

This FRED graph shows the most common "yield curve": the relationship between the 10-year Treasury note at constant maturity and the 2-year Treasury note at constant maturity.

Read more research on the yield curve here.