Quantitative Easing the Swedish Way

The 2008 international financial crisis strongly affected Sweden through its export sector. Real gross domestic product (GDP) decreased at a 15 percent annual rate during 2008:Q4 and by 5 percent during 2009. The Riksbank (Sweden's central bank) initiated a credit easing (CE) program during 2008:Q4 to assist banks and certain severely impaired financial market sectors.1 By July 2009, the conditions that motivated credit easing had abated but weak overall economic activity suggested it unwise to remove monetary easing altogether. The Riksbank reduced its policy rate to 0.25 percent, announced its intention to sustain this rate for at least a year, and initiated a program of quantitative easing (QE).

Since 2007, a number of central banks have faced the decision of how to transition from CE to QE. CE programs, prominent during late 2007 to early 2009, seek to channel funds to specific markets perceived as suffering unusual temporary difficulties. In contrast, QE programs seek to provide increased central bank money to the economy as a whole without focusing on specific sectors. When economic weakness continues (i) after the conditions that induced CE abate and (ii) the policy rate is at zero, monetary policy transitions to QE. Because both CE and QE affect market interest rates, the line between the two is not always distinct. The Federal Reserve, for example, introduced the Term Auction Facility, a CE program, in December 2007. The facility peaked at $477 billion in March 2009 but wound down quickly during 2009 as the Fed purchased assets for its QE1 program. Some analysts have argued that the QE1 program closely resembled CE. 2 However, QE is not a new policy tool: Central banks have used it over the past several decades (Anderson, Gascon, and Liu, 2010).

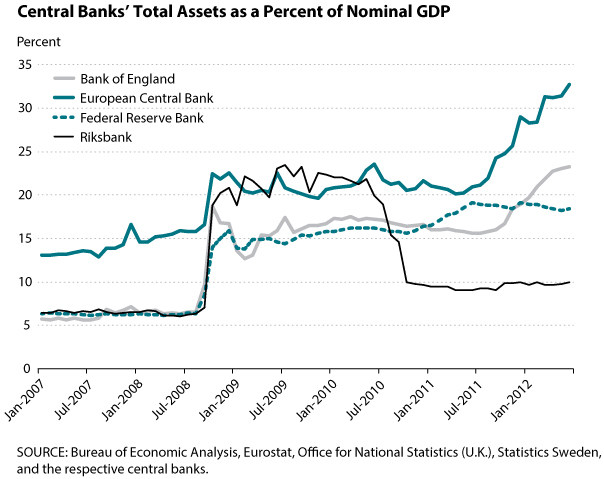

Generally speaking, QE programs seek to (i) increase asset prices throughout the economy and (ii) reinforce "forward guidance"—that is, policymakers' commitment to sustain the policy rate at an unusually low level for a significant period (Eggertsson and Woodford, 2003). Most central banks tend to implement QE through large-scale purchases of government securities or similar assets. The Riksbank's executive board considered but decided against purchasing assets, in part because banks play a larger role than financial markets in Sweden's credit system. The Riksbank began QE with a July 2009 auction to banks of SEK 100 billion in 12-month, fixed-rate loans at a minimum auction interest rate of 0.40 percent. 3 Two more auctions followed. By November, SEK 296.5 billion had been auctioned, equal to approximately 9 percent of Sweden's GDP. Analyses by Riksbank staff suggest that the loans reduced long-term interest rates by 20 to 40 basis points. As shown in the chart, the loans during 2009 helped sustain the Riksbank's asset holdings just short of 25 percent of GDP despite the unwinding of 2008's credit easing initiatives. The innovative use of lending to implement QE offered several advantages over large-scale asset purchases. The loan's fixed term and fixed interest rate reinforced the Riksbank's forward guidance by reducing any temptation to increase the policy rate before the date expected by the market. The fixed term also eased reducing the size of the balance sheet when appropriate. The last fixed-rate loans matured in October 2010. The last variable-rate loans, also included in the program, matured in January 2011.

Recently, both the Bank of England (BOE) and the Bank of Japan (BOJ) announced bank lending programs as part of their QE programs. The BOE program, announced in June and set at £80 billion, is aimed at reducing banks' cost of funds, which increased 1 percentage point between July 2011 and May 2012 due largely to turbulence in European financial markets.4 The program encourages banks to borrow U.K. Treasury bills from the BOE by pledging discount-window-eligible assets, including business and household loans, as collateral. The intent is for banks to subsequently borrow loanable funds in the marketplace, at a reduced rate, by pledging the Treasury bills as collateral. A bank's borrowing is linked to increases in its domestic lending, and loans may be for as long as four years (for details, see Bank of England, 2012). Lloyds Bank was the first borrower, drawing £1 billion during September. The BOJ, in late October, announced it would offer unlimited loans to commercial banks, subject to collateral. As with the BOE program, the BOJ program links a bank's borrowing to increases in its lending. As of this writing, further details are not available.

Large-scale lending to banks through CE programs is not unusual. Traditionally, QE has been implemented through large-scale asset purchases of primarily government debt. Recent policy actions of the Riksbank, BOE, and BOJ have extended large-scale lending to banks through QE programs, thereby blurring the distinction between CE and QE.

Notes

1 GDP is based on the production approach adjusted for working days and seasonality. See Elmér et al. (2012).

2 See, for example, the discussion in Krishnamurthy and Vissing-Jorgensen (2011).

3 SEK indicates Swedish crown, or krona. As of this writing, $1 equals approximately SEK 6.5.

4 As of July 2012, the BOE had purchased approximately £375 billion of long-term government bonds (gilts) as part of its QE program.

References

Anderson, Richard G.; Gascon, Charles S. and Liu, Yang. "Doubling Your Monetary Base and Surviving: Some International Experience." Federal Reserve Bank of St. Louis Review, November/December 2010, 92(6), pp. 481-505; http://research.stlouisfed.org/publications/review....

Bank of England. "The Funding for Lending Scheme." July 13, 2012; www.bankofengland.co.uk/markets/Documents/explanat....

Eggertsson, Gauti B. and Woodford, Michael. "The Zero Bound on Interest Rates and Optimal Monetary Policy." Brookings Papers on Economic Activity, 2003, Issue 1, pp. 139-233; www.brookings.edu/~/media/Files/Programs/ES/BPEA/2....

Elmér, Heidi; Guibourg, Gabriela; Kjellberg, David and Nessén, Marianne. "The Riksbank's Monetary Policy Measures During the Financial Crisis—Evaluation and Lessons Learnt." Sveriges Riksbank Economic Review, 2012, 3, pp. 8-31; www.riksbank.se/Documents/Rapporter/POV/2012/rap_p....

Krishnamurthy, Arvind; Vissing-Jorgensen, Annette. "The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy." Brookings Papers on Economic Activity, Fall 2011, Issue 1, pp. 215-65. www.brookings.edu/~/media/Projects/BPEA/Fall 201....

© 2012, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed