Global Monetary Policy Amidst Deflationary Concerns

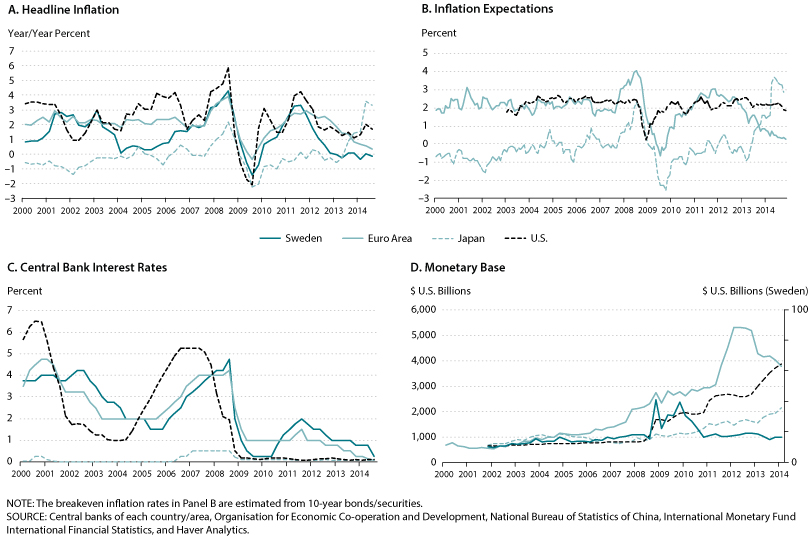

Global inflation is currently low and inflation expectations have been falling, especially in the euro area (Panels A and B of the figure). This trend, which started during the financial crisis of 2008, was exacerbated by the euro zone crisis in early 2009, and inflation expectations have been particularly anemic since 2011.1 Indeed, recent data show that consumer prices in the euro zone fell 0.2 percent in December, the first price decrease since 2009. One recent view is that a decrease in oil prices and the slowdown of global growth may have contributed to a further decrease of inflation and inflation expectations. Japan managed to increase inflation using the economic policies of its prime minister, Shinzo Abe, although an adjusted measure of core inflation (headline inflation that excludes fresh food products and the effects of an April sales tax increase) fell to its lowest level in over a year in November 2014. Some people argue this fall in inflation is due to weak consumer demand and falling oil prices. 2 Why do people worry about deflation, and how can monetary policymakers prevent the economy from falling into what some have labeled a "deflationary trap"?3

Central banks pay attention to inflation expectations because of their impact on actual inflation levels. Inflation expectations may become self-fulfilling: If workers or firms anticipate higher prices, they may incorporate these expectations into wage negotiations or price adjustments, which would affect future inflation. Developed economies (e.g., the United States, euro area, and the United Kingdom) have explicit or implicit inflation targets in the neighborhood of 2 percent. Less-developed economies tend to set higher inflation targets (e.g., 4 percent in China, 2.5 to 6.5 percent in Brazil, and 5 percent in Russia) or none at all.

Some evidence suggests that very volatile inflation has economic costs because it increases uncertainty in the economy.4 Evidence shows that high inflation tends to lead to volatile inflation. However, very low inflation or the possibility of deflation is also viewed as potentially harmful. Many worry about the possibility of a "vicious circle of deflation" in which consumers postpone consumption and firms cut investment in anticipation of lower prices, which contributes to a further reduction in demand and a further decrease in prices. The burden of debt increases, since falling incomes make it more difficult to repay past debt. With low or negative inflation, real interest rates (the difference between nominal interest rates and inflation) increase, hurting consumption and investment even more—hence, the vicious circle.

With these views in mind, in normal times central banks lower the short-term nominal interest rate to prevent deflation (expansionary monetary policy), with the objective of lowering real interest rates and thus boosting demand. This is what central banks did after the turmoil of 2008 (Panel C of the figure). However, the difficulty today is that global short-term nominal interest rates are reaching the zero lower bound. (Negative nominal interest rates would not be effective if consumers, firms, and governments simply chose to retain cash.)

The real interest rate cannot be reduced any further when nominal interest rates and inflation are both low. In such situations, the economy could be in a new equilibrium in which monetary policy does not change the nominal interest rate in response to changes in inflation.5 Central banks of major economies have therefore used unconventional monetary policies by buying long-term government debt and riskier assets (i.e., mortgage-backed securities). As a result, their balance sheets started to expand (Panel D of the figure). Despite these policies, inflation is still low and inflation expectations continue to fall.

Do persistently low inflation and inflation expectations mean central bank policies have been unsuccessful? Not necessarily. For instance, beginning in 2011 the Swedish Riksbank started to raise interest rates repeatedly—all the way up to 2 percent—in reaction to an increase in household debt. Inflation then started decreasing and went below zero. This episode suggests that doing nothing—or not being expansionary enough—may generate trends that are difficult to reverse. In turn, central bankers consider the Swedish case to be a potential warning.

Recent trends in inflation have created concerns about the possibility of deflation. So far, central banks have used expansionary monetary policies to avoid this scenario, but the zero lower bound limits the effectiveness of such policies. If deflation occurs, caused by a drop in demand, expansionary fiscal policies could be the next tool to use. The success (or even the enactment) of such policies will depend on the political environment.

Notes

1 Contessi, De Pace, and Li (2014).

2 Nakamichi (2014).

3 Fisher (1933).

4 Shiller (1996).

5 Benhabib, Schmitt-Grohé, and Uribe (2001) and Bullard (2010).

References

Benhabib, Jess; Schmitt-Grohé, Stephanie and Uribe, Martín. "The Perils of Taylor Rules." Journal of Economic Theory, January 2001, 96(1-2), pp. 40-69.

Bullard, James. "Seven Faces of 'The Peril'." Federal Reserve Bank of St. Louis Review, September/October 2010, 92(5), pp. 339-52; http://research.stlouisfed.org....

Contessi, Silvio; De Pace, Pierangelo and Li, Li. "An International Perspective on the Recent Behavior of Inflation." Federal Reserve Bank of St. Louis Review, Third Quarter 2014, 96(3), pp. 267-94; http://research.stlouisfed.org....

Fisher, Irving, "The Debt-Deflation Theory of Great Depressions." Econometrica, October 1933, 1(4), pp. 337-57.

Nakamichi, Takashi. "Japan Inflation Slows in October." Wall Street Journal, November 18, 2014; http://www.wsj.com/articles/ja....

Shiller, Robert. "Why Do People Dislike Inflation?" NBER Working Paper No. 5539, National Bureau of Economic Research, April 1996; http://www.nber.org/papers/w55....

© 2015, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed