“Unemployment Claims Hit 8½-Year Low”: Interpret with Caution

Recent media headlines point to a raft of good economic news: The advance estimate of second-quarter gross domestic product (GDP) was 4 percent at an annual rate. Also, 2013 GDP was revised upward, and private-sector employment growth has been above 200,000 for the past 6 months. Among the morass of numbers, initial unemployment insurance (UI) claims was reported to be at an 8½-year low, back to pre-recessionary levels in the summer of 2006. However, initial UI claims is a very volatile, weekly indicator and that alone should immediately inspire caution before crowing about a single observation. But even if this low level is a statistical blip, the underlying trend in initial claims is certainly solidly declining. Yet, this is not unequivocally good news: The steady decline in initial UI claims also reflects larger macroeconomic trends of fewer job separations and fewer hires.

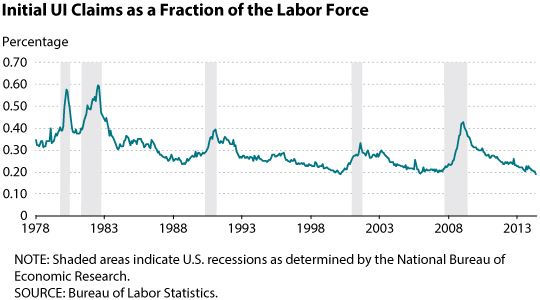

Initial UI claims measures the number of workers in a week who initiate a claim for unemployment insurance benefits. It is a proxy for the number of workers separating from their jobs and is often interpreted as a barometer for the labor market; it is also useful because it is released at a very high (weekly) frequency. Headlines often present new UI claims in levels, but historical comparisons are clearer if we consider the number of new claims as a fraction of the labor force (see the first figure). Indeed, the ratio of new UI claims to the labor force is at its pre-recession level both because the number of claims has declined and the size of the labor force has grown little.

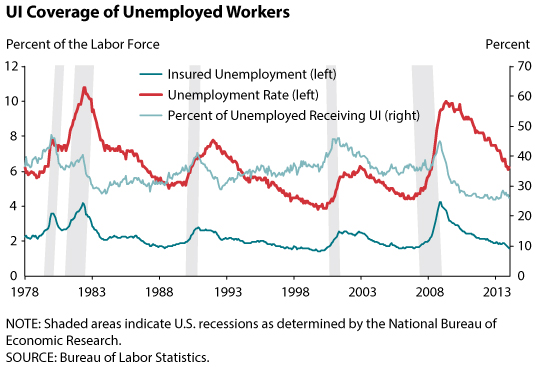

New UI claims are problematic indicators of the state of the labor market for several reasons. First, there are long-term trends that affect the rate of new claims and the coverage of UI in general. Note that in the first figure claims are lower than at any time during the 1980s and most of the 1990s. It is certainly not because the labor market is doing much better than anytime during those two decades. The change could be the result of other trends—for example, eligibility requirements for receiving UI benefits, the number of separations in the economy, and even the gender mix among the new separations (men claim UI benefits less often)—all of which could affect the average rate of initial UI claims without necessarily signifying an improving labor market. As the second figure shows, the fraction of unemployed workers covered by UI is at an all-time low, but a statistic based on unemployment insurance is less useful because it does not measure unemployment itself.

Second, job separations themselves are poor predictors of changes in the unemployment rate. When unemployment increases, it may be because more workers are separating from their jobs and entering unemployment or because currently unemployed workers are finding new jobs at a lower rate. Work by a number of authors, including Elsby, Hobijn, and Şahin (2013) and Shimer (2012), has decomposed changes in the unemployment rate due to differences in the finding and separations rates and found that approximately 75 percent to 80 percent of these are due to changing job-finding rates. As a proxy for separations, initial UI claims is inherently a weak predictor of changes in unemployment.

Finally, during the Great Recession, the rate of separations fell along with the rate of hires, meaning there were fewer people to initiate UI claims. But this has not necessarily had any effect on unemployment. Despite the simple intuition that fewer job separations indicates a healthy labor market, as pointed out in an earlier essay (Wiczer, 2014), a low level of separations also corresponds to a low level of hires. In fact, the rates of worker separations and hires slowed drastically during the Great Recession and are still about 10 percent lower than their pre-recession levels, even though unemployment has recovered more quickly.

References

Elsby, Michael W.L.; Hobijn, Bart and Şahin, Ayşegül. "Unemployment Dynamics in the OECD." Review of Economics and Statistics, May 2013, 95(2), pp. 530-48.

Shimer, Robert. "Reassessing the Ins and Outs of Unemployment." Review of Economic Dynamics, April 2012, 15(2), pp. 127-48.

Wiczer, David. "Job Separation Rate Shows Economic Shifts." Federal Reserve Bank of St. Louis Economic Synopses, 2014, No. 15, June 20, 2014; http://research.stlouisfed.org/publications/es/14/....

© 2014, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed