Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

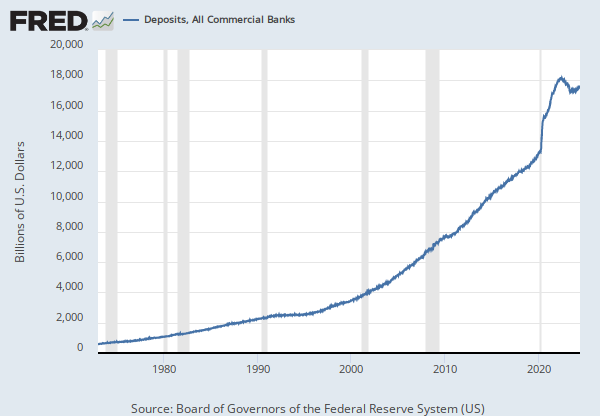

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

For further information, please refer to the Board of Governors of the Federal Reserve System's H8 release.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Commercial and Industrial Loans, All Commercial Banks [BUSLOANS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BUSLOANS, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

For further information, please refer to the Board of Governors of the Federal Reserve System's H.8 release, online at http://www.federalreserve.gov/releases/h8/.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Loans and Leases in Bank Credit, All Commercial Banks [LOANS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LOANS, May 21, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A190RC

A Guide to the National Income and Product Accounts of the United States - http://www.bea.gov/national/pdf/nipaguid.pdf

Suggested Citation:

U.S. Bureau of Economic Analysis, Final Sales of Domestic Product [FINSAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FINSAL, May 21, 2024.

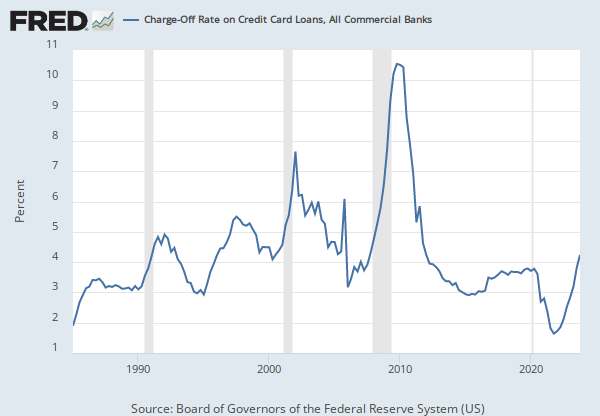

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

Charge-offs are the value of loans and leases removed from the books and charged against loss reserves.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Net Charge-Offs on All Loans and Leases, Commercial and Industrial, All Commercial Banks [NCOALLCIACB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCOALLCIACB, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Delinquent loans and leases are those past due thirty days or more and still accruing interest as well as those in nonaccrual status.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Delinquencies on All Loans and Leases, Commercial and Industrial, All Commercial Banks [DALLCIACBEP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DALLCIACBEP, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

Charge-offs are the value of loans and leases removed from the books and charged against loss reserves.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Net Charge-Offs on All Loans and Leases, To Consumers, All Commercial Banks [NCOALLCACB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCOALLCACB, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Delinquent loans and leases are those past due thirty days or more and still accruing interest as well as those in nonaccrual status.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Delinquencies on All Loans and Leases, To Consumers, All Commercial Banks [DALLCACBEP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DALLCACBEP, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Delinquent loans and leases are those past due thirty days or more and still accruing interest as well as those in nonaccrual status.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Delinquencies on All Loans and Leases, To Consumers, Credit Cards, All Commercial Banks [DALLCCACBEP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DALLCCACBEP, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

Charge-offs are the value of loans and leases removed from the books and charged against loss reserves.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Asset Quality Measures, Net Charge-Offs on All Loans and Leases, To Consumers, Credit Cards, All Commercial Banks [NCOALLCCACB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCOALLCCACB, May 21, 2024.

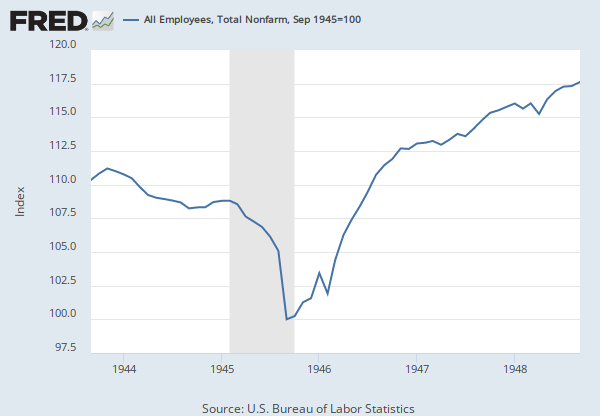

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Thousands of Persons, Seasonally Adjusted

Frequency: Monthly

Notes:

All Employees: Total Nonfarm, commonly known as Total Nonfarm Payroll, is a measure of the number of U.S. workers in the economy that excludes proprietors, private household employees, unpaid volunteers, farm employees, and the unincorporated self-employed. This measure accounts for approximately 80 percent of the workers who contribute to Gross Domestic Product (GDP).

This measure provides useful insights into the current economic situation because it can represent the number of jobs added or lost in an economy. Increases in employment might indicate that businesses are hiring which might also suggest that businesses are growing. Additionally, those who are newly employed have increased their personal incomes, which means (all else constant) their disposable incomes have also increased, thus fostering further economic expansion.

Generally, the U.S. labor force and levels of employment and unemployment are subject to fluctuations due to seasonal changes in weather, major holidays, and the opening and closing of schools. The Bureau of Labor Statistics (BLS) adjusts the data to offset the seasonal effects to show non-seasonal changes: for example, women's participation in the labor force; or a general decline in the number of employees, a possible indication of a downturn in the economy. To closely examine seasonal and non-seasonal changes, the BLS releases two monthly statistical measures: the seasonally adjusted All Employees: Total Nonfarm (PAYEMS) and All Employees: Total Nonfarm (PAYNSA), which is not seasonally adjusted.

The series comes from the 'Current Employment Statistics (Establishment Survey).'

The source code is: CES0000000001

Suggested Citation:

U.S. Bureau of Labor Statistics, All Employees, Total Nonfarm [PAYEMS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PAYEMS, May 21, 2024.

RELEASE TABLES

- Table 1.2.5. Gross Domestic Product by Major Type of Product: Quarterly

- Table 1.4.5. Relation of Gross Domestic Product, Gross Domestic Purchases, and Final Sales to Domestic Purchasers: Quarterly

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Commercial and Industrial Loans, All Commercial Banks

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted Weekly, Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change at Annual Rate, Annual, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Quarterly, Seasonally AdjustedLoans and Leases in Bank Credit, All Commercial Banks

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted Weekly, Seasonally Adjusted Percent Change at Annual Rate, Annual, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Quarterly, Seasonally AdjustedFinal Sales of Domestic Product

Percent Change from Preceding Period, Annual, Not Seasonally Adjusted Percent Change from Preceding Period, Quarterly, Seasonally Adjusted Annual RateAll Employees, Total Nonfarm

Monthly, Not Seasonally Adjusted