Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Source ID: FL155035015.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

The FRED series Household - Assets - Balance Sheet of Households and Nonprofit Organizations is now known as Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value.

This series appears in Table B.101.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value, Level (DISCONTINUED) [HABSHNO], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HABSHNO, May 13, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: A2015C

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Owner-occupied housing: Net interest [A2015C1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A2015C1A027NBEA, May 13, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A048RC

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Rental Income of Persons with Capital Consumption Adjustment (CCAdj) [RENTIN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RENTIN, May 13, 2024.

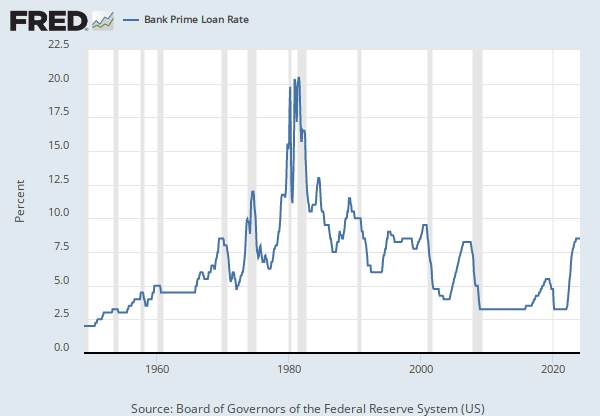

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed [FII30], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FII30, May 13, 2024.

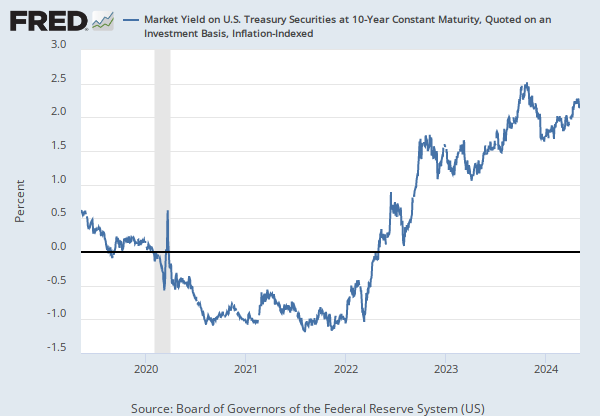

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Federal Reserve Board has discontinued this series as of October 11, 2016. More information, including possible alternative series, can be found at http://www.federalreserve.gov/feeds/h15.html.

Contract interest rates on commitments for fixed-rate first mortgages. Source: Primary Mortgage Market Survey data provided by Freddie Mac.

Copyright, 2016, Freddie Mac. Reprinted with permission.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Contract Rate on 30-Year, Fixed-Rate Conventional Home Mortgage Commitments (DISCONTINUED) [MORTG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTG, May 13, 2024.

Source: University of Michigan

Release: Surveys of Consumers

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Median expected price change next 12 months, Surveys of Consumers. The most recent value is not shown due to an agreement with the source.

This data should be cited as follows: "Surveys of Consumers, University of Michigan, University of Michigan: Inflation Expectation© [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/MICH/, (Accessed on date)"

Copyright, 2016, Surveys of Consumers, University of Michigan. Reprinted with permission.

Suggested Citation:

University of Michigan, University of Michigan: Inflation Expectation [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MICH, May 13, 2024.

Source: Haver Analytics

Source: Federal Reserve Bank of St. Louis

Release: Monthly Treasury Inflation-Indexed Securities

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This series will no longer be updated. It has been replaced with DTP30A28 that updates on a daily basis.

Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). The principal increases with inflation and decreases with deflation. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater.

Monthly average of business days calculated by Federal Reserve Bank of St. Louis. Yield to maturity on accrued principal.

Calculated from data provided by the Wall Street Journal.

Copyright, 2016, Haver Analytics. Reprinted with permission.

Suggested Citation:

Haver Analytics and Federal Reserve Bank of St. Louis, 30-Year 3-5/8% Treasury Inflation-Indexed Bond, Due 4/15/2028 (DISCONTINUED) [TP30A28], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TP30A28, May 13, 2024.

RELEASE TABLES

- Table 1.10. Gross Domestic Income by Type of Income: Quarterly

- Table 1.12. National Income by Type of Income: Quarterly

- Table 1.13. National Income by Sector, Legal Form of Organization, and Type of Income: Annual

- Table 2.1. Personal Income and Its Disposition: Quarterly

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Rental Income of Persons with Capital Consumption Adjustment (CCAdj)

Millions of Dollars, Quarterly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedContract Rate on 30-Year, Fixed-Rate Conventional Home Mortgage Commitments (DISCONTINUED)

Annual, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted30-Year 3-5/8% Treasury Inflation-Indexed Bond, Due 4/15/2028 (DISCONTINUED)

Weekly, Not Seasonally Adjusted