Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

This series has been discontinued and will no longer be updated. It was a duplicate of the following series, which will continue to be updated: https://fred.stlouisfed.org/series/NCBEILQ027S

The FRED series Real Estate - Assets - Balance Sheet of Nonfarm Nonfinancial Corporate Business is now known as Nonfinancial Corporate Business; Real Estate at Market Value.

The source series id is FL105035005.Q.

This series no longer appears in Table B.103.

This data still updates, to see data for this series, go to https://fred.stlouisfed.org/series/NCBEILQ027S.

For further information see the assistance provided in the guide to the Financial Accounts at https://www.federalreserve.gov/apps/fof/.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Corporate Equities; Liability, Level (DISCONTINUED) [MVEONWMVBSNNCB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MVEONWMVBSNNCB, May 17, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

The source no longer includes this series on their release causing the discontinuance of the series in FRED.

The FRED series Total Credit Market Debt Owed by Domestic Nonfinancial Sectors - Nonfinancial Corporate Business is now known as Nonfinancial Corporate Business; Credit Market Instruments; Liability.

The source series id is FL104104005.Q.

This series appeared in both Table L.1 and Table B.102. For further information see the assistance provided in the guide to the Financial Accounts at http://www.federalreserve.gov/apps/fof/.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Credit Market Instruments; Liability (DISCONTINUED) [NCBTCMDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCBTCMDODNS, May 17, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Source ID: FL102090005.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Net Worth, Level [TNWMVBSNNCB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TNWMVBSNNCB, May 17, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Percent, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Source ID: FL104104016.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Debt as a Percentage of the Market Value of Corporate Equities, Level [NCBCMDPMVCE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCBCMDPMVCE, May 17, 2024.

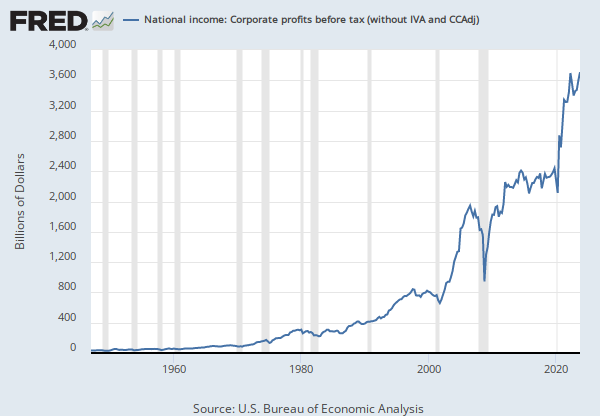

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A464RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Nonfinancial corporate business: Profits before tax (without IVA and CCAdj) [A464RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A464RC1Q027SBEA, May 17, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Annual

Notes:

Source ID: FA106130001.A

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Interest Paid, Transactions [NCBIPAA027N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCBIPAA027N, May 17, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: W326RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Net value added of nonfinancial corporate business: Net operating surplus [W326RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W326RC1Q027SBEA, May 17, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A261RC

Gross domestic income is an alternative way of measuring the nation's economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the "statistical discrepancy." BEA considers GDP more reliable because it's based on timelier, more expansive data.

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Income [GDI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDI, May 17, 2024.

RELEASE TABLES

- Table 1.7.5. Relation of Gross Domestic Product, Gross National Product, Net National Product, National Income, and Personal Income: Quarterly

- Table 1.10. Gross Domestic Income by Type of Income: Quarterly

- Table 1.14. Gross Value Added of Domestic Corporate Business in Current Dollars and Gross Value Added of Nonfinancial Domestic Corporate Business in Current and Chained Dollars: Quarterly

- Table 1.17.5. Gross Domestic Product, Gross Domestic Income, and Other Major NIPA Aggregates: Quarterly

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Nonfinancial Corporate Business; Net Worth, Level

Millions of Dollars, Annual, Not Seasonally AdjustedNonfinancial Corporate Business; Debt as a Percentage of the Market Value of Corporate Equities, Level

Annual, Not Seasonally AdjustedNonfinancial corporate business: Profits before tax (without IVA and CCAdj)

Annual, Not Seasonally AdjustedNonfinancial Corporate Business; Interest Paid, Transactions

Annual, Not Seasonally Adjusted Quarterly, Not Seasonally Adjusted Quarterly, Seasonally Adjusted Annual RateNet value added of nonfinancial corporate business: Net operating surplus

Annual, Not Seasonally AdjustedGross Domestic Income

Annual, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted