Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Commercial and Industrial Loans, All Commercial Banks [TOTCI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTCI, May 19, 2024.

Source: Board of Governors of the Federal Reserve System (US)

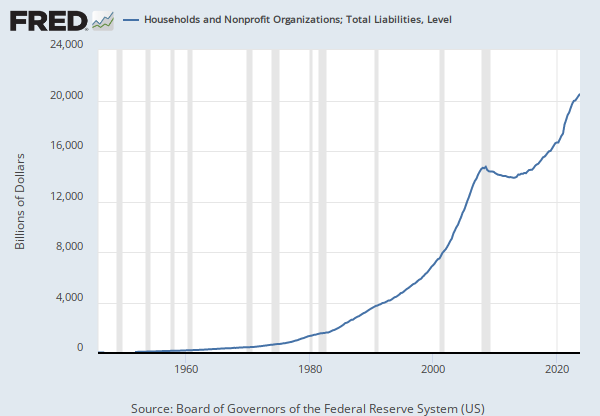

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Source ID: LA153165105.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Households and Nonprofit Organizations; One-to-Four-Family Residential Mortgages; Liability, Level [HHMSDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HHMSDODNS, May 19, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Percent Change at Annual Rate, Seasonally Adjusted

Frequency: Quarterly

Notes:

These series are break adjusted. The percent changes are at a simple annual rate and have been adjusted to remove (i) the effects of nonbank structure activity of $5 billion or more and (ii) the estimated effects of the initial consolidation of certain variable interest entities (FIN 46) and off-balance-sheet vehicles (FAS 166/167). Information about these adjustments is documented in the H.8 Notes in the Data section (http://www.federalreserve.gov/releases/h8/h8notes.htm) of the H.8 Assets and Liabilities of Commercial Banks in the United States release from the Board of Governors. To make the current and past levels comparable, a ratio procedure is used to adjust past levels. For example, if on December 31, 2008, real estate loans at large banks increased by 1 percent because a large bank acquired a nonbank during that week, the levels for real estate loans at large banks for all weeks prior to December 31, 2008, would be increased by 1 percent and then the percent changes would be calculated using those adjusted levels. These quarterly percent changes are calculated from quarterly levels, rounded to the nearest $100 million, based on the average of the three monthly levels in each quarter.

For further information, please refer to the Board of Governors of the Federal Reserve System's H.8 release, online at http://www.federalreserve.gov/releases/h8/.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Real Estate Loans: Commercial Real Estate Loans, All Commercial Banks [CREACBQ158SBOG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CREACBQ158SBOG, May 19, 2024.

RELEASE TABLES

- Selected Assets and Liabilities of Commercial Banks in the United States: Quarterly Rates, Seasonally Adjusted

- Assets and Liabilities of Commercial Banks in the United States: Quarterly Rates, Seasonally Adjusted

- Weekly: Levels, Seasonally Adjusted

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Commercial and Industrial Loans, All Commercial Banks

Monthly, Not Seasonally Adjusted Monthly, Seasonally Adjusted Weekly, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change at Annual Rate, Annual, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Quarterly, Seasonally AdjustedHouseholds and Nonprofit Organizations; One-to-Four-Family Residential Mortgages; Liability, Level

Quarterly, Not Seasonally Adjusted Millions of Dollars, Annual, Not Seasonally Adjusted Millions of Dollars, Annual, Seasonally AdjustedReal Estate Loans: Commercial Real Estate Loans, All Commercial Banks

Billions of U.S. Dollars, Monthly, Not Seasonally Adjusted Billions of U.S. Dollars, Monthly, Seasonally Adjusted Billions of U.S. Dollars, Weekly, Not Seasonally Adjusted Billions of U.S. Dollars, Weekly, Seasonally Adjusted Annual, Seasonally Adjusted Monthly, Seasonally Adjusted