Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

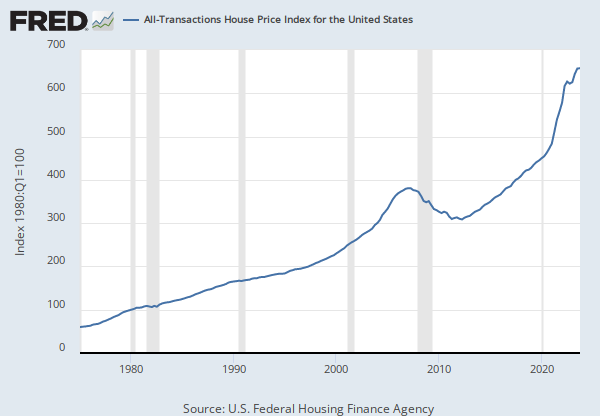

Source: S&P Dow Jones Indices LLC

Release: S&P CoreLogic Case-Shiller Home Price Indices

Units: Index Jan 2000=100, Seasonally Adjusted

Frequency: Monthly

Notes:

For more information regarding the index, please visit Standard & Poor's. There is more information about home price sales pairs in the Methodology section. Copyright, 2016, Standard & Poor's Financial Services LLC. Reprinted with permission.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P CoreLogic Case-Shiller U.S. National Home Price Index [CSUSHPISA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPISA, May 12, 2024.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index 1982-1984=100, Seasonally Adjusted

Frequency: Monthly

Notes:

The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a price index of a basket of goods and services paid by urban consumers. Percent changes in the price index measure the inflation rate between any two time periods. The most common inflation metric is the percent change from one year ago. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.

The CPIs are based on prices for food, clothing, shelter, and fuels; transportation fares; service fees (e.g., water and sewer service); and sales taxes. Prices are collected monthly from about 4,000 housing units and approximately 26,000 retail establishments across 87 urban areas. To calculate the index, price changes are averaged with weights representing their importance in the spending of the particular group. The index measures price changes (as a percent change) from a predetermined reference date. In addition to the original unadjusted index distributed, the Bureau of Labor Statistics also releases a seasonally adjusted index. The unadjusted series reflects all factors that may influence a change in prices. However, it can be very useful to look at the seasonally adjusted CPI, which removes the effects of seasonal changes, such as weather, school year, production cycles, and holidays.

The CPI can be used to recognize periods of inflation and deflation. Significant increases in the CPI within a short time frame might indicate a period of inflation, and significant decreases in CPI within a short time frame might indicate a period of deflation. However, because the CPI includes volatile food and oil prices, it might not be a reliable measure of inflationary and deflationary periods. For a more accurate detection, the core CPI (CPILFESL) is often used. When using the CPI, please note that it is not applicable to all consumers and should not be used to determine relative living costs. Additionally, the CPI is a statistical measure vulnerable to sampling error since it is based on a sample of prices and not the complete average.

For more information on the consumer price indexes, see:

Bureau of Economic Analysis. "CPI Detailed Report." 2013.

Handbook of Methods

Understanding the CPI: Frequently Asked Questions

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPIAUCSL, May 12, 2024.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index 1982-1984=100, Seasonally Adjusted

Frequency: Monthly

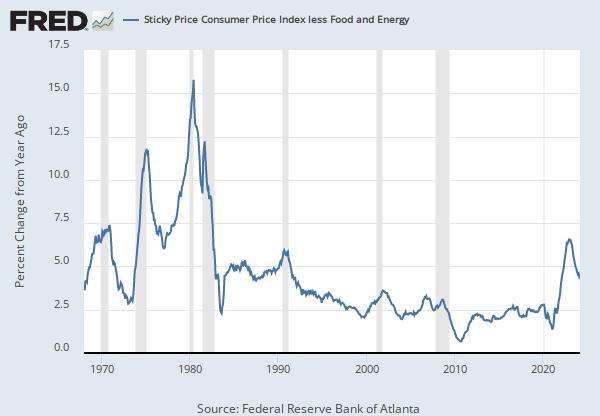

Notes:

The "Consumer Price Index for All Urban Consumers: All Items Less Food & Energy" is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy. This measurement, known as "Core CPI," is widely used by economists because food and energy have very volatile prices. The Bureau of Labor Statistics defines and measures the official CPI, and more information can be found in the FAQ or in this article.

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, May 12, 2024.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index 1982-1984=100, Seasonally Adjusted

Frequency: Monthly

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Shelter in U.S. City Average [CUSR0000SAH1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUSR0000SAH1, May 12, 2024.

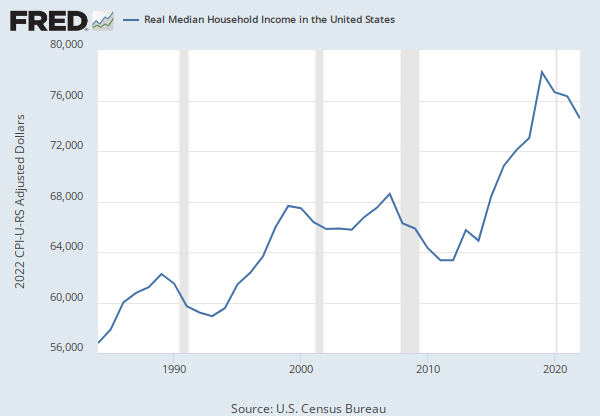

Source: U.S. Census Bureau

Release: Income and Poverty in the United States

Units: Current Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

Household data are collected as of March.

As stated in the Census's "Source and Accuracy of Estimates for Income, Poverty, and Health Insurance Coverage in the United States: 2011" (http://www.census.gov/hhes/www/p60_243sa.pdf):

Estimation of Median Incomes. The Census Bureau has changed the methodology for computing median income over time. The Census Bureau has computed medians using either Pareto interpolation or linear interpolation. Currently, we are using linear interpolation to estimate all medians. Pareto interpolation assumes a decreasing density of population within an income interval, whereas linear interpolation assumes a constant density of population within an income interval. The Census Bureau calculated estimates of median income and associated standard errors for 1979 through 1987 using Pareto interpolation if the estimate was larger than $20,000 for people or $40,000 for families and households. This is because the width of the income interval containing the estimate is greater than $2,500.

We calculated estimates of median income and associated standard errors for 1976, 1977, and 1978 using Pareto interpolation if the estimate was larger than $12,000 for people or $18,000 for families and households. This is because the width of the income interval containing the estimate is greater than $1,000. All other estimates of median income and associated standard errors for 1976 through 2011 (2012 ASEC) and almost all of the estimates of median income and associated standard errors for 1975 and earlier were calculated using linear interpolation.

Thus, use caution when comparing median incomes above $12,000 for people or $18,000 for families and households for different years. Median incomes below those levels are more comparable from year to year since they have always been calculated using linear interpolation. For an indication of the comparability of medians calculated using Pareto interpolation with medians calculated using linear interpolation, see Series P-60, Number 114, Money Income in 1976 of Families and Persons in the United States (www2.census.gov/prod2/popscan/p60-114.pdf).

Suggested Citation:

U.S. Census Bureau, Median Household Income in the United States [MEHOINUSA646N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEHOINUSA646N, May 12, 2024.

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Dollars per Hour, Seasonally Adjusted

Frequency: Monthly

Notes:

Production and related employees include working supervisors and all nonsupervisory employees (including group leaders and trainees) engaged in fabricating, processing, assembling, inspecting, receiving, storing, handling, packing, warehousing, shipping, trucking, hauling, maintenance, repair, janitorial, guard services, product development, auxiliary production for plant's own use (for example, power plant), recordkeeping, and other services closely associated with the above production operations.

#Nonsupervisory employees include those individuals in private, service-providing industries who are not above the working-supervisor level. This group includes individuals such as office and clerical workers, repairers, salespersons, operators, drivers, physicians, lawyers, accountants, nurses, social workers, research aides, teachers, drafters, photographers, beauticians, musicians, restaurant workers, custodial workers, attendants, line installers and repairers, laborers, janitors, guards, and other employees at similar occupational levels whose services are closely associated with those of the employees listed.

The series comes from the 'Current Employment Statistics (Establishment Survey).'

The source code is: CES0500000008

Suggested Citation:

U.S. Bureau of Labor Statistics, Average Hourly Earnings of Production and Nonsupervisory Employees, Total Private [AHETPI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AHETPI, May 12, 2024.

RELEASE TABLES

- CPI for U.S. City Average: Monthly, Seasonally Adjusted

- CPI for U.S. City Average: Monthly, Seasonally Adjusted

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

S&P CoreLogic Case-Shiller U.S. National Home Price Index

Monthly, Not Seasonally AdjustedConsumer Price Index for All Urban Consumers: All Items in U.S. City Average

Monthly, Not Seasonally Adjusted Semiannual, Not Seasonally AdjustedConsumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average

Monthly, Not Seasonally Adjusted Semiannual, Not Seasonally AdjustedConsumer Price Index for All Urban Consumers: Shelter in U.S. City Average

Monthly, Not Seasonally Adjusted Semiannual, Not Seasonally AdjustedAverage Hourly Earnings of Production and Nonsupervisory Employees, Total Private

Monthly, Not Seasonally Adjusted