Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

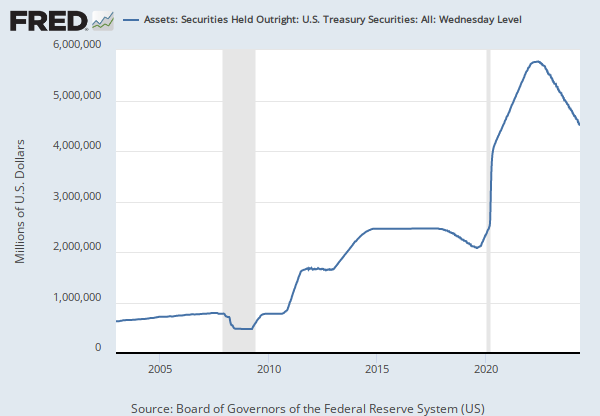

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

This series has been discontinued and will no longer be updated. It was a duplicate of the following series, which will continue to be updated: https://fred.stlouisfed.org/series/WORAL

Repurchase agreements reflect some of the Federal Reserve's temporary open market operations. Repurchase agreements are transactions in which securities are purchased from a primary dealer under an agreement to sell them back to the dealer on a specified date in the future. The difference between the purchase price and the repurchase price reflects an interest payment. The Federal Reserve may enter into repurchase agreements for up to 65 business days, but the typical maturity is between one and 14 days. Federal Reserve repurchase agreements supply reserve balances to the banking system for the length of the agreement. The Federal Reserve employs a naming convention for these transactions based on the perspective of the primary dealers: the dealers receive cash while the Federal Reserve receives the collateral.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Repurchase agreements held by the Federal Reserve: All Maturities (DISCONTINUED) [REPT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/REPT, April 26, 2024.