Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: S&P Dow Jones Indices LLC

Release: Standard & Poors

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the S&P 500 represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The Federal Reserve Bank of St. Louis and S&P Dow Jones Indices LLC have reached a new agreement on the use of Standard & Poors and Dow Jones Averages series in FRED. FRED and its associated services will include 10 years of daily history for Standard & Poors and Dow Jones Averages series.

The S&P 500 is regarded as a gauge of the large cap U.S. equities market. The index includes 500 leading companies in leading industries of the U.S. economy, which are publicly held on either the NYSE or NASDAQ, and covers 75% of U.S. equities. Since this is a price index and not a total return index, the S&P 500 index here does not contain dividends.

Copyright © 2016, S&P Dow Jones Indices LLC. All rights reserved. Reproduction of S&P 500 in any form is prohibited except with the prior written permission of S&P Dow Jones Indices LLC ("S&P"). S&P does not guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be liable for any direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with subscriber's or others' use of S&P 500.

Permission to reproduce S&P 500 can be requested from index_services@spdji.com. More contact details are available here, including phone numbers for all regional offices.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

Source ID: LA154104005.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Households and Nonprofit Organizations; Debt Securities and Loans; Liability, Level [CMDEBT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CMDEBT, May 15, 2024.

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: W068RC

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Government total expenditures [W068RCQ027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W068RCQ027SBEA, May 15, 2024.

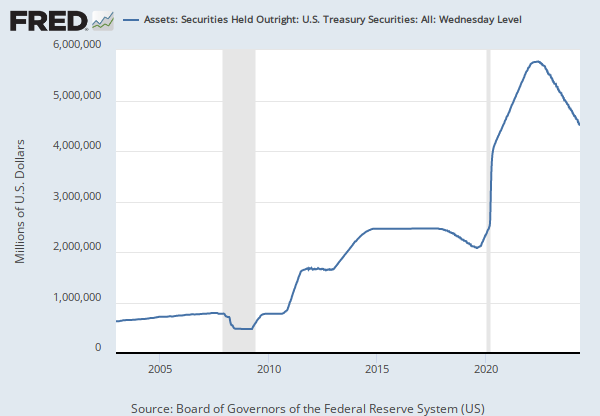

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

The total face value of U.S. Treasury securities held by the Federal Reserve. This total is broken out in the lines below. Purchases or sales of U.S. Treasury securities by the Federal Reserve Bank of New York (FRBNY) are made in the secondary market, or with various foreign official and international organizations that maintain accounts at the Federal Reserve. FRBNY's purchases or sales in the secondary market are conducted only through primary dealers.

Bills: The current face value of the Federal Reserve's outright holdings of Treasury bills.

Notes and bonds, nominal: The current face value of the Federal Reserve's outright holdings of nominal Treasury notes and bonds.

Notes and bonds, inflation-indexed: The current face value of the Federal Reserve's outright holdings of inflation-indexed Treasury notes and bonds.

Inflation compensation: Inflation compensation reflects adjustments for the effects of inflation to the principal of inflation-indexed securities.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: U.S. Treasury Securities: All: Wednesday Level [TREAST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TREAST, May 15, 2024.

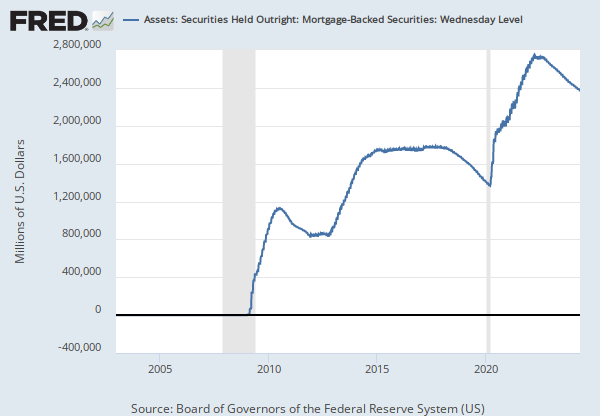

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

This series has been discontinued and will no longer be updated. It was a duplicate of the following series, which will continue to be updated: https://fred.stlouisfed.org/series/WSHOMCB

The current face value of mortgage-backed obligations held by Federal Reserve Banks. These securities are guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Mortgage-backed securities held by the Federal Reserve: All Maturities (DISCONTINUED) [MBST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MBST, May 15, 2024.

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Households and Nonprofit Organizations; Debt Securities and Loans; Liability, Level

Quarterly, Not Seasonally Adjusted Millions of Dollars, Annual, Not Seasonally Adjusted Millions of Dollars, Annual, Seasonally AdjustedGovernment total expenditures

Annual, Not Seasonally Adjusted