Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

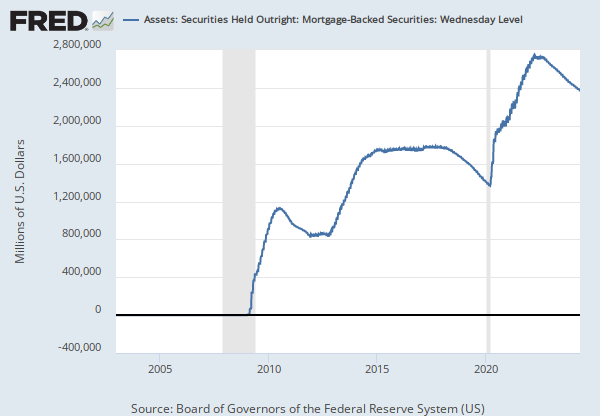

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

This series has been discontinued and will no longer be updated. It was a duplicate of the following series, which will continue to be updated: https://fred.stlouisfed.org/series/WSHOMCB

The current face value of mortgage-backed obligations held by Federal Reserve Banks. These securities are guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Mortgage-backed securities held by the Federal Reserve: All Maturities (DISCONTINUED) [MBST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MBST, May 17, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

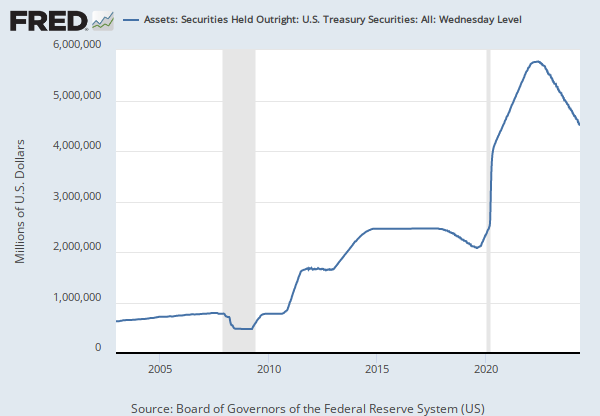

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

The total face value of U.S. Treasury securities held by the Federal Reserve. This total is broken out in the lines below. Purchases or sales of U.S. Treasury securities by the Federal Reserve Bank of New York (FRBNY) are made in the secondary market, or with various foreign official and international organizations that maintain accounts at the Federal Reserve. FRBNY's purchases or sales in the secondary market are conducted only through primary dealers.

Bills: The current face value of the Federal Reserve's outright holdings of Treasury bills.

Notes and bonds, nominal: The current face value of the Federal Reserve's outright holdings of nominal Treasury notes and bonds.

Notes and bonds, inflation-indexed: The current face value of the Federal Reserve's outright holdings of inflation-indexed Treasury notes and bonds.

Inflation compensation: Inflation compensation reflects adjustments for the effects of inflation to the principal of inflation-indexed securities.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: U.S. Treasury Securities: All: Wednesday Level [TREAST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TREAST, May 17, 2024.

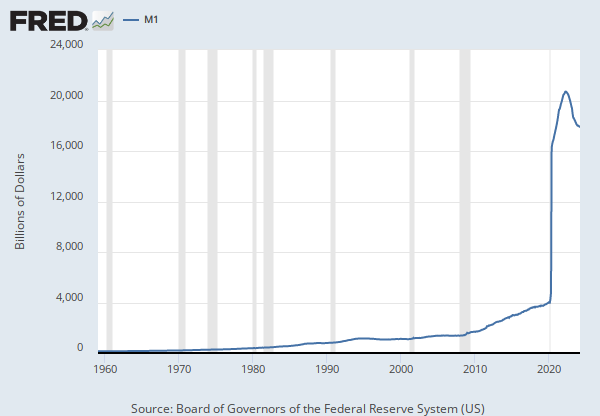

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

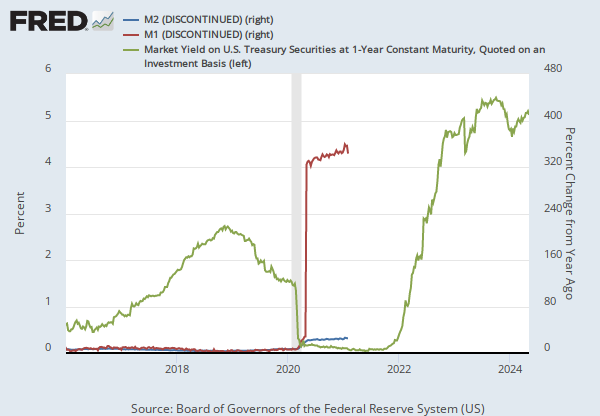

This weekly series is discontinued and will no longer be updated. The non-seasonally adjusted version of this weekly series is WM2NS, and the seasonally adjusted monthly series is M2SL.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Weekly average, non-seasonally adjusted data will continue to be made available, while weekly average, seasonally adjusted data will no longer be provided. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M2 (DISCONTINUED) [M2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2, May 17, 2024.