Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

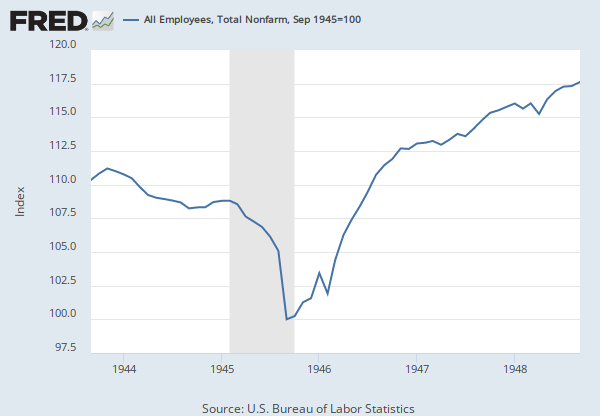

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Thousands of Persons, Seasonally Adjusted

Frequency: Monthly

Notes:

All Employees: Total Nonfarm, commonly known as Total Nonfarm Payroll, is a measure of the number of U.S. workers in the economy that excludes proprietors, private household employees, unpaid volunteers, farm employees, and the unincorporated self-employed. This measure accounts for approximately 80 percent of the workers who contribute to Gross Domestic Product (GDP).

This measure provides useful insights into the current economic situation because it can represent the number of jobs added or lost in an economy. Increases in employment might indicate that businesses are hiring which might also suggest that businesses are growing. Additionally, those who are newly employed have increased their personal incomes, which means (all else constant) their disposable incomes have also increased, thus fostering further economic expansion.

Generally, the U.S. labor force and levels of employment and unemployment are subject to fluctuations due to seasonal changes in weather, major holidays, and the opening and closing of schools. The Bureau of Labor Statistics (BLS) adjusts the data to offset the seasonal effects to show non-seasonal changes: for example, women's participation in the labor force; or a general decline in the number of employees, a possible indication of a downturn in the economy. To closely examine seasonal and non-seasonal changes, the BLS releases two monthly statistical measures: the seasonally adjusted All Employees: Total Nonfarm (PAYEMS) and All Employees: Total Nonfarm (PAYNSA), which is not seasonally adjusted.

The series comes from the 'Current Employment Statistics (Establishment Survey).'

The source code is: CES0000000001

Suggested Citation:

U.S. Bureau of Labor Statistics, All Employees, Total Nonfarm [PAYEMS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PAYEMS, May 18, 2024.

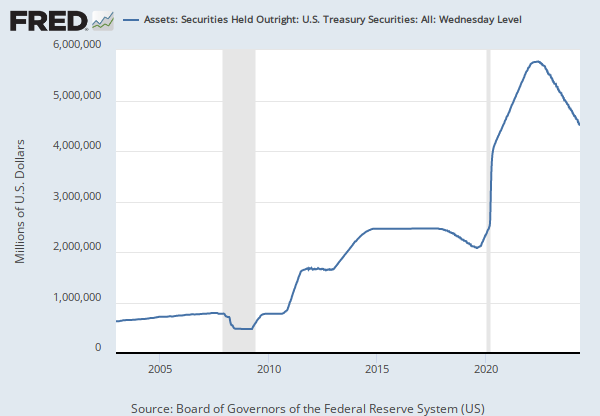

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

The total face value of U.S. Treasury securities held by the Federal Reserve. This total is broken out in the lines below. Purchases or sales of U.S. Treasury securities by the Federal Reserve Bank of New York (FRBNY) are made in the secondary market, or with various foreign official and international organizations that maintain accounts at the Federal Reserve. FRBNY's purchases or sales in the secondary market are conducted only through primary dealers.

Bills: The current face value of the Federal Reserve's outright holdings of Treasury bills.

Notes and bonds, nominal: The current face value of the Federal Reserve's outright holdings of nominal Treasury notes and bonds.

Notes and bonds, inflation-indexed: The current face value of the Federal Reserve's outright holdings of inflation-indexed Treasury notes and bonds.

Inflation compensation: Inflation compensation reflects adjustments for the effects of inflation to the principal of inflation-indexed securities.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: U.S. Treasury Securities: All: Wednesday Level [TREAST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TREAST, May 18, 2024.

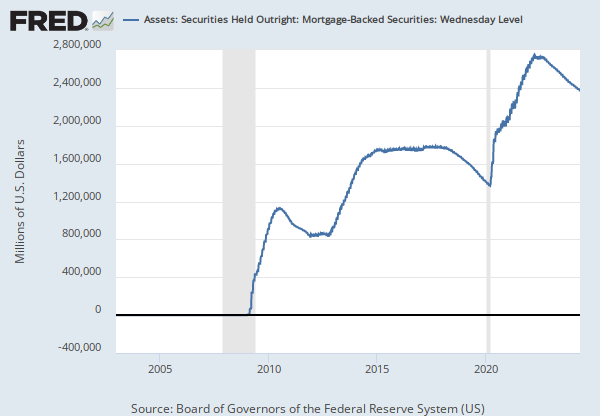

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

This series has been discontinued and will no longer be updated. It was a duplicate of the following series, which will continue to be updated: https://fred.stlouisfed.org/series/WSHOMCB

The current face value of mortgage-backed obligations held by Federal Reserve Banks. These securities are guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Mortgage-backed securities held by the Federal Reserve: All Maturities (DISCONTINUED) [MBST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MBST, May 18, 2024.