Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Wilshire Associates

Release: Wilshire Indexes

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the Wilshire 5000 Total Market Full Cap Index represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The total market indexes are total market returns, which do include reinvested dividends. The designation Full Cap for an index signifies a float adjusted market capitalization that includes shares of stock not considered available to "ordinary" investors. Copyright, 2016, Wilshire Associates Incorporated. Reprinted with permission. For more information about the various indexes, visit Wilshire Associates.

Suggested Citation:

Wilshire Associates, Wilshire 5000 Total Market Full Cap Index (DISCONTINUED) [WILL5000INDFC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WILL5000INDFC, May 17, 2024.

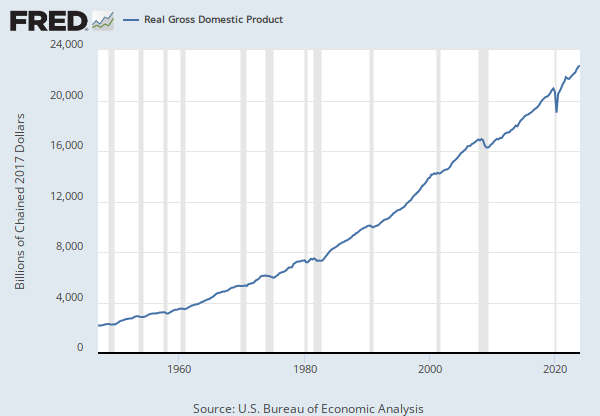

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A191RC

Gross domestic product (GDP), the featured measure of U.S. output, is the market value of the goods and services produced by labor and property located in the United States.For more information, see the Guide to the National Income and Product Accounts of the United States (NIPA) and the Bureau of Economic Analysis.

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP, May 17, 2024.

RELEASE TABLES

- Table 1.1.5. Gross Domestic Product: Quarterly

- Table 1.2.5. Gross Domestic Product by Major Type of Product: Quarterly

- Table 1.3.5. Gross Value Added by Sector: Quarterly

- Table 1.4.5. Relation of Gross Domestic Product, Gross Domestic Purchases, and Final Sales to Domestic Purchasers: Quarterly

- Table 1.5.5. Gross Domestic Product, Expanded Detail: Quarterly

- Table 1.7.5. Relation of Gross Domestic Product, Gross National Product, Net National Product, National Income, and Personal Income: Quarterly

- Table 1.17.5. Gross Domestic Product, Gross Domestic Income, and Other Major NIPA Aggregates: Quarterly