Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

This series has been discontinued and will no longer be updated. It has been consolidated under the following series, which will continue to be updated: MDLM.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Components of the monetary aggregates are reported at a total industry level without a breakdown by banks and thrifts. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

The savings deposits component of M2 consists of passbook-type savings deposits as well as MMDAs at banks and thrifts. This item is reported on the FR 2900 and, for institutions that do not file the FR 2900, is estimated using data reported on the Call Reports.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Savings Deposits: Total (DISCONTINUED) [SAVINGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SAVINGS, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

This weekly series is discontinued and will no longer be updated. The non-seasonally adjusted version of this weekly series is WRMFNS, and the seasonally adjusted monthly series is RMFSL.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Weekly average, non-seasonally adjusted data will continue to be made available, while weekly average, seasonally adjusted data will no longer be provided. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

The retail money funds component of M2 is constructed from weekly data collected by the Investment Company Institute (ICI), a trade association for the investment company industry. The retail money funds component of M2 excludes IRA and Keogh balances held at MMMFs, which are reported by ICI on a quarterly basis.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Retail Money Market Funds (DISCONTINUED) [WRMFSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WRMFSL, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

This weekly series is discontinued and will no longer be updated. The non-seasonally adjusted version of this weekly series is WSMTMNS, and the seasonally adjusted monthly series is STDSL.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Weekly average, non-seasonally adjusted data will continue to be made available, while weekly average, seasonally adjusted data will no longer be provided. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

The small-denomination time deposits component of M2 includes time deposits at banks and thrifts with balances less than $100,000. The small-denomination time deposit component of M2 excludes individual retirement account (IRA) and Keogh balances at depository institutions because heavy penalties for pre-retirement withdrawals make them too illiquid to be included in the monetary aggregates. Gross small-denomination time deposits, derived as the difference between total time deposits and time deposits with balances of $100,000 or more, are reported on the FR 2900 and, for institutions that do not file an FR 2900, are estimated using data reported on the Call Reports. IRA and Keogh account balances at depository institutions are estimated using data reported on the Call Reports.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Small-Denomination Time Deposits: Total (DISCONTINUED) [WSMTIME], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WSMTIME, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

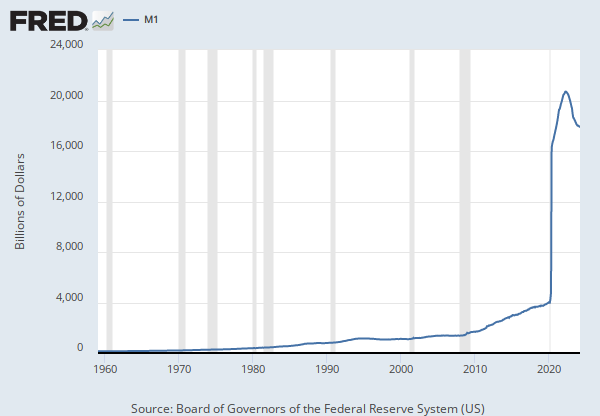

This series has been discontinued and will no longer be updated. It has been consolidated under the following series, which will continue to be updated: MDLM.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Components of the monetary aggregates are reported at a total industry level without a breakdown by banks and thrifts. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

Demand deposits plus other checkable deposits. Calculated by the Federal Reserve Bank of St. Louis.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Total Checkable Deposits (DISCONTINUED) [TCD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TCD, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

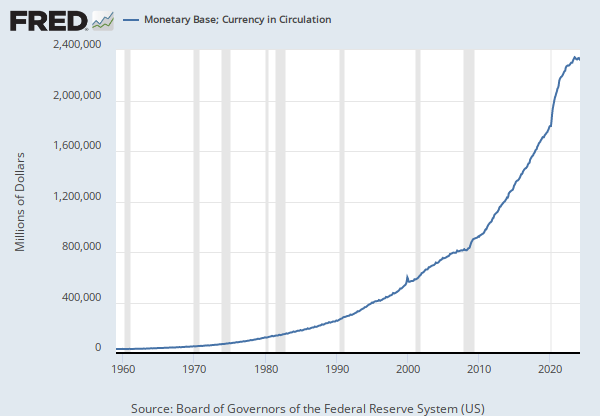

This weekly series is discontinued and will no longer be updated. The non-seasonally adjusted version of this weekly series is WCURRNS, and the seasonally adjusted monthly series is CURRSL.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Weekly average, non-seasonally adjusted data will continue to be made available, while weekly average, seasonally adjusted data will no longer be provided. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

The currency component of M1, sometimes called "money stock currency," is defined as currency in circulation outside the U.S. Treasury and Federal Reserve Banks. Data on total currency in circulation are obtained weekly from balance sheets of the Federal Reserve Banks and from the U.S. Treasury. Weekly currency in circulation data are published each week on the Federal Reserve Board's H.4.1 statistical release "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." Vault cash is reported on the FR 2900 and subtracted from total currency in circulation. For institutions that do not file the FR 2900, vault cash is estimated using data reported on the Call Reports.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Currency Component of M1 (DISCONTINUED) [CURRENCY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CURRENCY, May 15, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

This series has been discontinued and will no longer be updated. Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates, thereby eliminating the release of data on institutional money funds and memorandum items on U.S. government deposits and deposits due to foreign banks and foreign official institutions. For further information about the changes to the H.6 Statistical Release, see the announcements provided by the source.

Institutional money funds are constructed from weekly data collected by the Investment Company Institute (ICI), a trade association for the investment company industry.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Institutional Money Market Funds (DISCONTINUED) [WIMFSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WIMFSL, May 15, 2024.

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Savings Deposits: Total (DISCONTINUED)

Monthly, Not Seasonally Adjusted Monthly, Seasonally Adjusted Weekly, Not Seasonally AdjustedTotal Checkable Deposits (DISCONTINUED)

Monthly, Not Seasonally Adjusted Monthly, Seasonally Adjusted Weekly, Not Seasonally AdjustedInstitutional Money Market Funds (DISCONTINUED)

Monthly, Not Seasonally Adjusted Monthly, Seasonally Adjusted Weekly, Not Seasonally Adjusted